Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomQuad Witching Explained with 2025 Dates

Every so often, financial markets experience days that don’t look like business as usual. One of the most important is quadruple witching, or more commonly known as quad witching. These quarterly events bring higher trading volumes, sudden swings, and unique opportunities for those who know what to expect.

What Is Quad Witching?

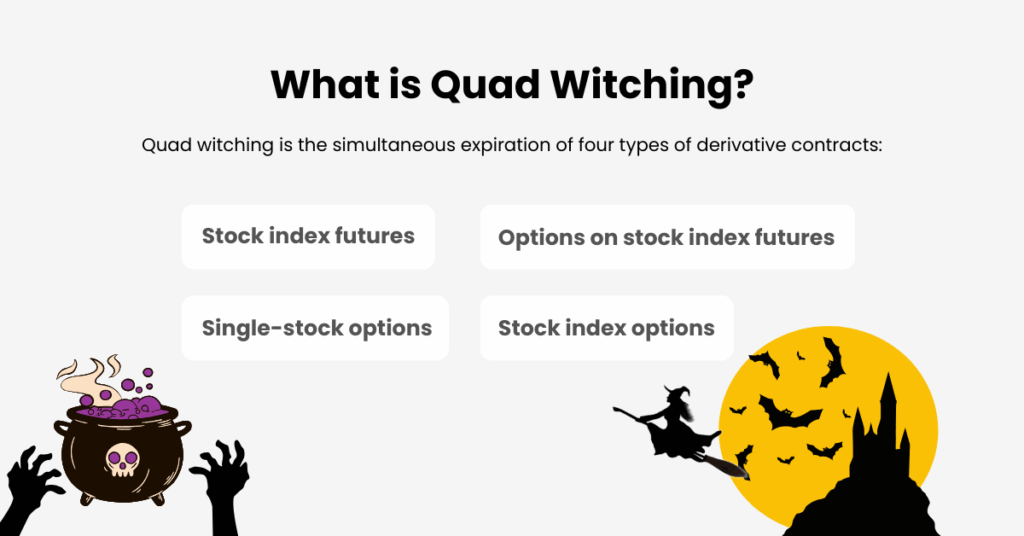

Quad witching is the simultaneous expiration of four types of derivative contracts: stock index futures, options on stock index futures, single-stock options, and stock index options. Some sources also include single-stock futures, though these are now relatively small and have limited market impact.

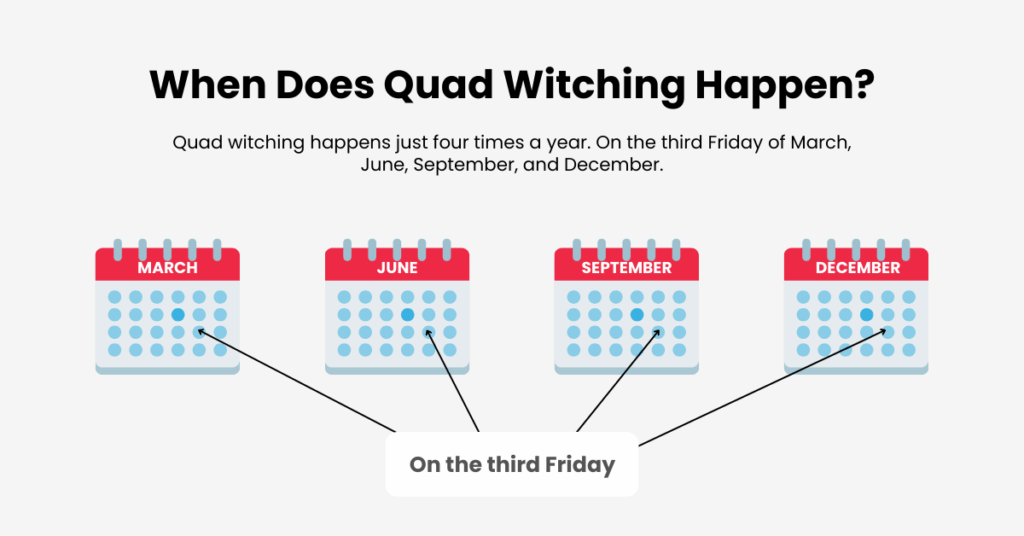

This convergence happens just four times a year. On the third Friday of March, June, September, and December. In 2025, the quad witching days are:

- March 21

- June 20

- September 19

- December 19

On these days, expirations line up across different markets, forcing traders to close, adjust, or roll over positions. The result is a surge of activity unlike a normal trading session.

From Double to Quadruple Witching

The terminology has evolved over time. Double witching occurs monthly when two derivatives expire together, though it has little effect on markets. Triple witching was the standard term until single-stock futures and more index options were introduced. Today, most traders refer to these events as quad witching, though you may still hear the older term used interchangeably.

Why Quad Witching Matters

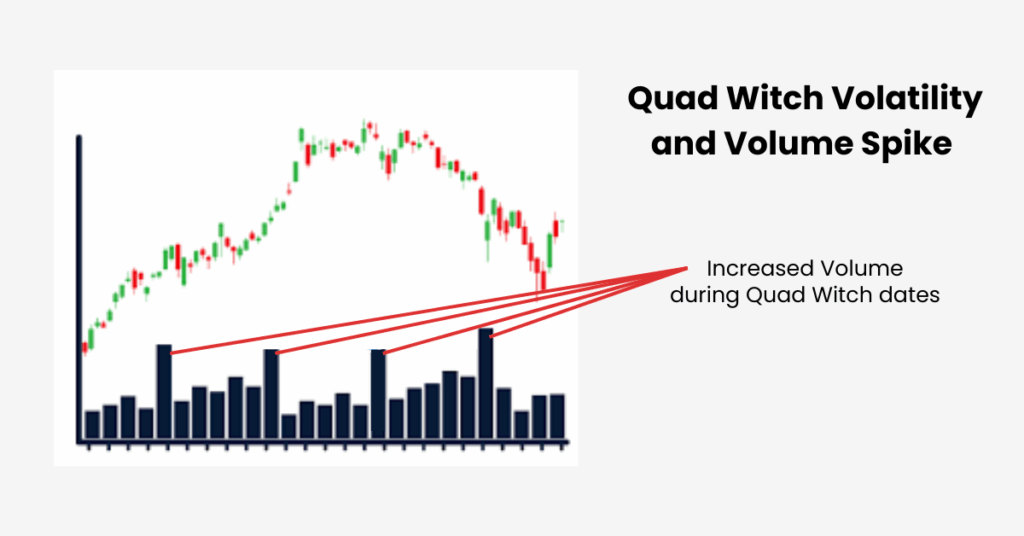

Quad witching matters because of the sheer scale of repositioning it triggers. Institutional investors, hedge funds, and market makers all need to rebalance portfolios, roll over futures contracts, and adjust hedges. This rush of activity drives trading volumes to spike, often 50 to 100 percent above normal levels.

For example, the quad witching session on December 20, 2024, produced the highest trading volume of the year in the S&P 500. This kind of market-wide surge shows why traders watch these dates closely.

Options mechanics add another layer. In-the-money contracts often exercise automatically, forcing additional share buying or selling. Combined with index futures rolling into the next quarter, this creates waves of order flow that ripple through the market.

The impact is most visible involatility and spreads. Quad witching can temporarily widen bid-ask spreads, making execution more co stly for retail traders. Hedge funds and sophisticated investors may even find arbitrage opportunities when short-lived price distortions appear.

Market Impact in Numbers

Historical trends highlight how quad witching shapes market behaviour:

- In the five days before quad witching, the S&P 500 shows a higher chance of positive returns.

- On the day itself, the index has a slight negative bias, averaging a dip of about –0.38 percent.

- In the five days after, performance typically turns positive again, with stronger gains offsetting frequent small declines.

The VIX, Wall Street’s “fear index,” often drifts lower in the days leading up to quad witching. Even on the day itself, when the S&P sometimes dips, the VIX has a tendency to contract, reflecting an orderly but busy trading environment rather than outright panic.

The Witching Hour

The final hour of trading on quad witching days, often nicknamed the witching hour, is notorious for its intensity. As traders scramble to close or roll positions before the bell, volumes surge and price swings can be sharp. For retail traders, this period can feel chaotic. For experienced day traders, it sometimes presents short-lived opportunities.

How Traders Handle Quad Witching

Institutional players typically prepare weeks in advance, gradually shifting positions to avoid bottlenecks on the day itself. Hedge funds may actively hunt for arbitrage between related contracts, while market makers focus on hedging to keep books balanced.

Retail traders usually take one of two approaches: some step aside completely to avoid the noise, while others participate cautiously with smaller positions and tight risk controls. A few attempt to trade intraday volatility, but success depends heavily on discipline and execution speed.

Practical Tips for Quad Witching Days

For those who do trade during quad witching, preparation is key. Expect the heaviest activity around the open and close, when volumes are most concentrated. Stick to highly liquid instruments such as index ETFs or large-cap stocks, where spreads are tighter. Use clear stop-losses and conservative position sizing to manage risk.

If you’re managing a portfolio rather than trading actively, consider protective strategies such as hedging with options or inverse ETFs. And remember, the witching hour can magnify moves, so treat it with extra caution.

Conclusion

Quad witching only happens four times a year, but its impact is felt across global markets. The surge in trading volume, the unusual volatility patterns, and the intense final hour all combine to make it a unique event on the financial calendar.

For most long-term investors, quad witching isn’t something to fear, but it is something to respect. For active traders, it offers both challenges and opportunities. By knowing the dates, understanding the mechanics, and approaching the day with a plan, you can navigate quad witching with more confidence and less surprise.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.