Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What Is an Order Block in Trading?

An order block is a market concept used by price action traders to identify significant areas where institutional buying and selling occur. These blocks represent zones where large orders have been executed, often leading to price movements that create support or resistance. Recognizing these blocks helps traders anticipate potential market reversals or breakouts, providing a competitive edge in their trading strategies.

How Do Order Blocks Influence Market Movements?

Order blocks are the result of large institutional orders that create market imbalances, leading to sharp price moves. These imbalances create areas where price action is likely to reverse or stall, making them key for traders who want to follow institutional market activity.

How to Identify Order Blocks

- Look for a Consolidation Phase: Order blocks typically form during periods of sideways price action, signaling balance between buyers and sellers.

- Sharp Price Movement: A significant price move following the consolidation indicates that large institutional orders have been executed.

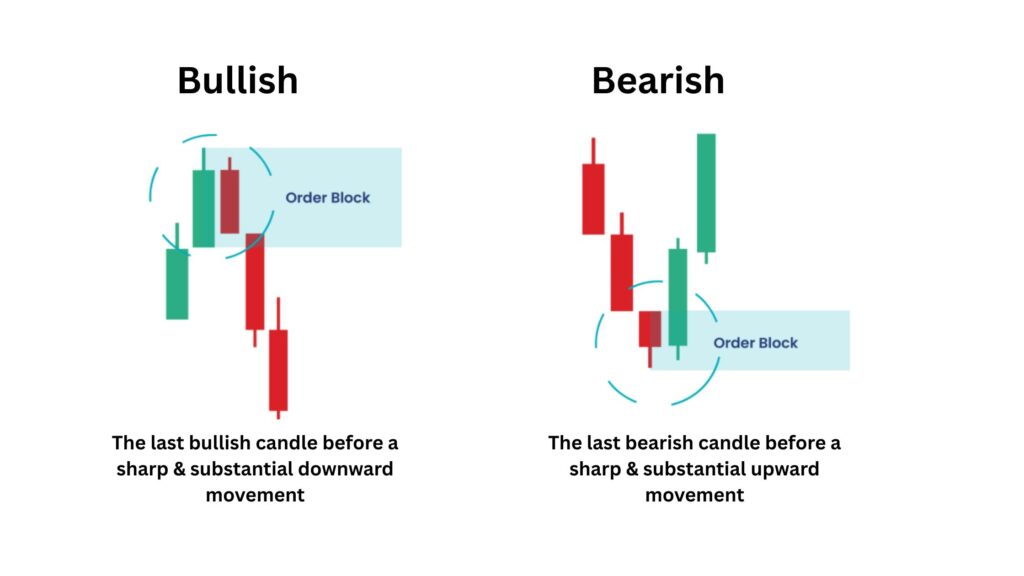

- Key Candlestick Patterns: The last bullish candle before a downtrend (for bearish order blocks) or the last bearish candle before an uptrend (for bullish order blocks) often marks the order block zone.

Identifying these order blocks allows traders to pinpoint key price levels where market direction may change, providing valuable entry points for trades.

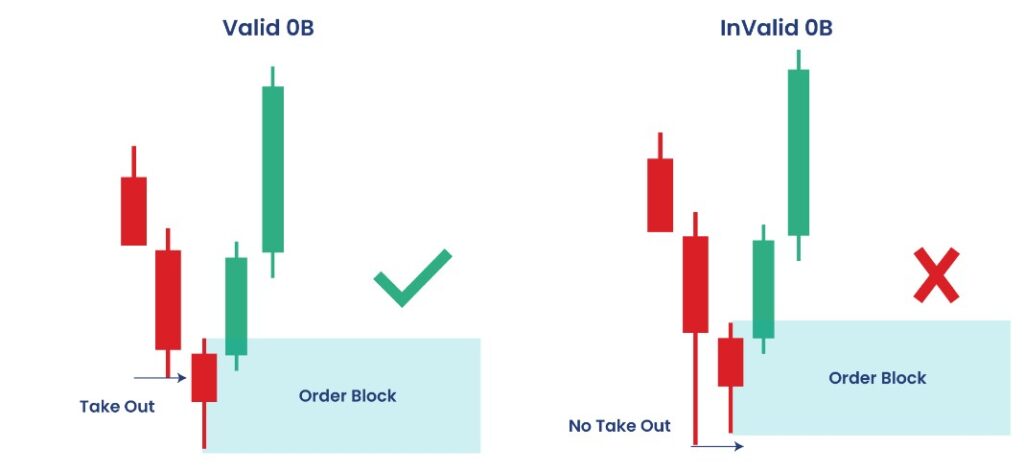

Valid vs. Invalid Order Blocks

Understanding this distinction helps traders avoid false signals, ensuring they stay aligned with institutional market movements.

- Valid Order Block: A valid order block occurs when price revisits the zone and reacts as expected, either reversing or continuing in the predicted direction. This confirms that institutional orders still hold sway at the area.

- Invalid Order Block: If price breaks through the zone without any significant reaction, it signals a weak market structure and may indicate a shift in the market’s trend.

Types of Order Blocks

- Bullish Order Block: A bullish order block occurs after a downtrend, suggesting strong buying interest from institutions and signaling potential upward price movement.

- Bearish Order Block: A bearish order block occurs after an uptrend, indicating strong selling pressure from institutional players and signaling potential downward price movement.

- Breaker Block: A breaker block occurs when a previous order block is invalidated, signaling a potential shift in market direction.

- Rejection Block: A rejection block happens when price fails to breach a significant level, indicating a reversal in market direction.

- Vacuum Block: A vacuum block refers to a price gap where liquidity is missing, often causing rapid price movements as the market seeks equilibrium.

Rejection Block vs. Order Block

While both order blocks and rejection blocks indicate key price levels, they serve different purposes:

- Order Block: Reflects areas where institutional orders drive price action, leading to either price reversals or continuations.

- Rejection Block: Represents a failed attempt to breach a key level, indicating that price will likely reverse.

Understanding the difference between these blocks helps traders identify potential market turning points more effectively.

Order Block Trading Strategy

By following this strategy, traders can increase their chances of entering the market at optimal levels influenced by institutional orders.

- Identify the Order Block: Use price action and candlestick patterns to locate key order block zones on your chart.

- Wait for Price to Return: Allow price to retrace to the order block zone.

- Confirm with Additional Indicators: Look for candlestick patterns, volume spikes, or other supporting indicators to confirm the market direction.

- Enter the Trade: Once confirmation is received, enter your trade with a well-placed stop loss to manage risk effectively.

How to Combine Order Blocks with Other Technical Indicators

To enhance the accuracy of your trades, consider combining order blocks with other popular technical indicators:

- RSI (Relative Strength Index): Helps identify overbought or oversold conditions at or near an order block, signaling potential reversals.

- Moving Averages: Use moving averages to confirm the overall trend direction in relation to an order block.

- Fibonacci Retracement: Combine order blocks with Fibonacci levels to spot confluence zones where price is likely to reverse or continue.

- MACD (Moving Average Convergence Divergence): Use MACD to confirm momentum at or near an order block, helping you gauge the strength of a potential price move.

By integrating these indicators, traders can make more informed decisions, improving the reliability of their entry and exit points at order blocks.

How to Use Order Blocks in Forex & Crypto Trading

In Forex trading, order blocks are essential tools for understanding price action driven by institutional activity. By analyzing order blocks in currency pairs, traders can identify key support and resistance levels, as well as anticipate trend reversals or continuation patterns.

How to Use Order Blocks in Forex:

- Bullish Order Block: Look for bullish order blocks after a downtrend in currency pairs, signaling buying interest and potential upward movement.

- Bearish Order Block: Look for bearish order blocks after an uptrend, indicating selling pressure and potential downward movement.

By mastering the use of order blocks in Forex, traders can better align their trades with institutional flows, increasing the probability of success.

Order blocks are also incredibly useful for cryptocurrency trading, especially given the growing institutional interest in the crypto market. Recognizing order blocks in crypto pairs allows traders to spot key levels of support and resistance that can indicate significant market moves.

How to Use Order Blocks in Crypto:

- Bullish Order Block: After a downtrend, a bullish order block indicates potential buying interest from institutional players in the crypto market, leading to upward price movement.

- Bearish Order Block: A bearish order block after an uptrend signals strong selling pressure and the potential for a downward move in cryptocurrencies.

Using order blocks in conjunction with other indicators can help crypto traders make more accurate predictions and improve their trade entries.

Order Block Trading Mistakes to Avoid

Even experienced traders can make mistakes when using order blocks. Here are some common pitfalls to avoid:

- Entering Too Early: Entering trades before price confirms the order block level can lead to false signals and losses.

- Ignoring Market Context: Not considering the broader market trend or other supporting indicators can result in missed opportunities or invalid trades.

- Not Using Proper Risk Management: Failing to place appropriate stop loss or take profit levels can lead to unnecessary risk.

Avoiding these mistakes will help traders successfully incorporate order blocks into their trading strategy.

Conclusion

Understanding order blocks and integrating them into your trading strategy can significantly enhance your ability to identify high-probability entry and exit points. Whether you’re trading Forex or Crypto, mastering this powerful concept can give you a deeper understanding of institutional market movements and improve your overall trading performance.

At Ultima Markets, we offer advanced trading tools and resources to help you stay ahead of the market. Join us today and start trading with purpose, leveraging the power of order block analysis and other innovative strategies to boost your success.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.