Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteAs the global capital market continues to mature, more and more investors regard securities as the core of wealth management. For most investors, “securities” have become an essential main path on the road to financial planning.

This article, from the perspective of a “beginner’s guide to securities investment,” will analyze the latest market trends and provide platform selection recommendations, opening a new starting point for your assets.

What Are “Securities”?

Definition

In financial markets, “securities” are valuable financial instruments representing equity, debt, or other financial rights, which can be bought, sold, or transferred in the market. Simply put, when you purchase shares issued by a company, you become a shareholder of that company and own part of its equity.

The existence of securities allows capital to flow efficiently between investors and enterprises, enabling individuals to invest in various assets through the market and participate in economic growth.

Types of Securities

Securities can be classified into various types based on their nature and function, with the most common being stocks, bonds, ETFs (exchange-traded funds), and derivative financial instruments such as options and futures.

In recent years, the rise of ETFs has opened a convenient gateway for ordinary investors. Dividend-paying ETFs and industry-themed ETFs not only have low investment thresholds but can also be easily purchased through global brokerage platforms, offering small investors more opportunities to participate in the market.

Comparison Between Securities and Other Assets

Compared with other investment assets, the greatest difference in securities lies in their liquidity and investment flexibility.

Unlike real estate, securities can be bought and sold quickly in the market, offering high capital conversion efficiency. Compared to conservative products such as fixed deposits and insurance, securities investment provides higher return potential but also carries higher risks.

In addition, compared to highly volatile assets like forex or cryptocurrencies, securities offer greater transparency, with corporate financial reports and investor conferences helping investors make rational decisions.

Therefore, securities are often regarded as core assets in a stable investment portfolio.

How Can Taiwanese Investors Start Investing in Securities?

To start investing in securities in Taiwan, the first step is to open an account with a suitable brokerage. In recent years, the rise of digital finance driven by the pandemic and the younger generation’s preference for online operations have led more people to choose online securities platforms.

The general process is as follows:

- Apply for an account online and provide copies of your ID and a secondary identification document.

- Complete KYC (identity verification) and link your bank account.

- Deposit funds to start trading.

1. What Should Prepare Before Opening an Account?

- ID card, secondary identification document, and bank account.

- You can choose to open an account with a traditional securities company or an overseas online broker.

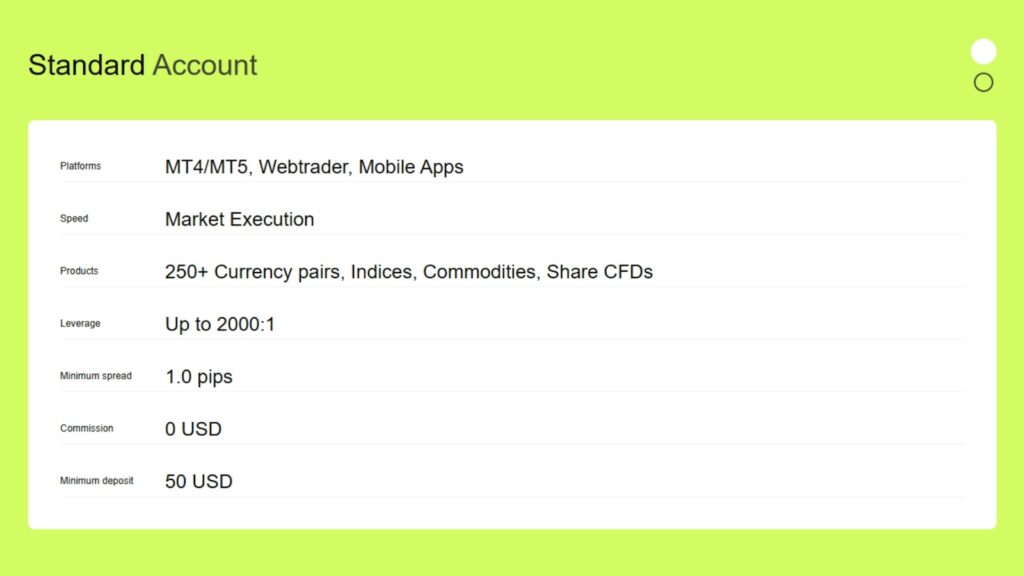

Traditional brokers such as Yuanta, KGI, and Fubon have a high market share, but their fees are relatively higher and their interfaces more standardized. In contrast, some overseas brokers or new platforms like Ultima Markets offer greater flexibility in fees, user experience, and product variety. They also support registration in Taiwan, making them particularly suitable for investors who wish to trade international securities and CFDs.

Four Key Indicators for Choosing a Securities Platform

When selecting a platform, most people focus first on fees, but that’s just the tip of the iceberg. The following points are equally important for comparison:

1. Trading Costs and Fees

Local Taiwanese brokers charge around 0.1425% in fees, while some online platforms offer fixed low-cost fees or even commission-free trading. If you trade frequently, the cost savings can be significant.

2. Diversity of Investable Products

Does the platform only offer Taiwan stocks, or can you also invest in US stocks, ETFs, gold, bonds, and digital currencies? Platforms like Ultima Markets provide global securities CFD trading, allowing more flexible asset allocation.

3. User Interface and Chinese Language Support

A Chinese interface and Taiwan-based customer service are especially important for beginners. Check whether the platform also offers a demo trading account, so you can practice without “paying tuition” to learn operations.

4. Educational Resources and Tools

Does the platform provide technical analysis charts, financial report interpretation, or online seminars? A good platform should not only “let you trade” but also “help you understand trading.”

If you are searching for a recommended online securities trading platform with full Chinese support and demo account options, Ultima Markets is worth considering. It supports a traditional Chinese interface, Taiwan user registration, and is equipped with Trading Central analysis tools and market trend reports, ensuring you are not alone on your investment journey.

What to Expect from the Securities Market in 2025?

In 2024, Taiwan’s stock market performed strongly, with the TAIEX surpassing 20,000 points and achieving an annual gain of 28.5%. According to TWSE statistics, the average daily trading value in Q1 2025 was approximately NT$401.7 billion, indicating robust capital momentum. Meanwhile, forecasts from institutions such as Fidelity International and Bloomberg suggest that while global stock market returns may slow in 2025, sectors like technology, energy, and high-dividend stocks remain promising.

Against this macro backdrop, investors may consider diversifying into high-dividend Taiwan ETFs (such as 0056), leading US tech stocks (such as GOOGL and TSLA), and bond ETFs to maintain a stable asset structure. All of these can be flexibly deployed through Ultima Markets’ CFD trading, capturing rotation opportunities across different regions and industries.

Why Recommend Using Ultima Markets for Securities Investment?

1. Flexible Products and Leverage Options

UM offers CFD trading for securities, forex, ETFs, and cryptocurrencies, supporting both long and short positions with adjustable leverage. This is suitable for advanced trading or short-term strategic deployment.

2. 24-Hour Trading Environment

Whether during Asian market hours or US stock trading sessions, UM provides stable liquidity and low-latency execution, making it especially suitable for working professionals who trade part-time.

3. Security and Compliance

The platform is regulated by multiple authorities, including CySEC, ASIC, and FSC, with client funds segregated and held at Australia’s WESTPAC Bank to ensure they are not misused. In addition, there is financial commission compensation protection of up to 20,000 euros, giving you greater peace of mind when investing.

4. Free Demo Account for Stress-Free Practice

Beginners can start with a demo account to practice, familiarize themselves with the trading interface and risk control, and only invest real funds once their strategy becomes stable.

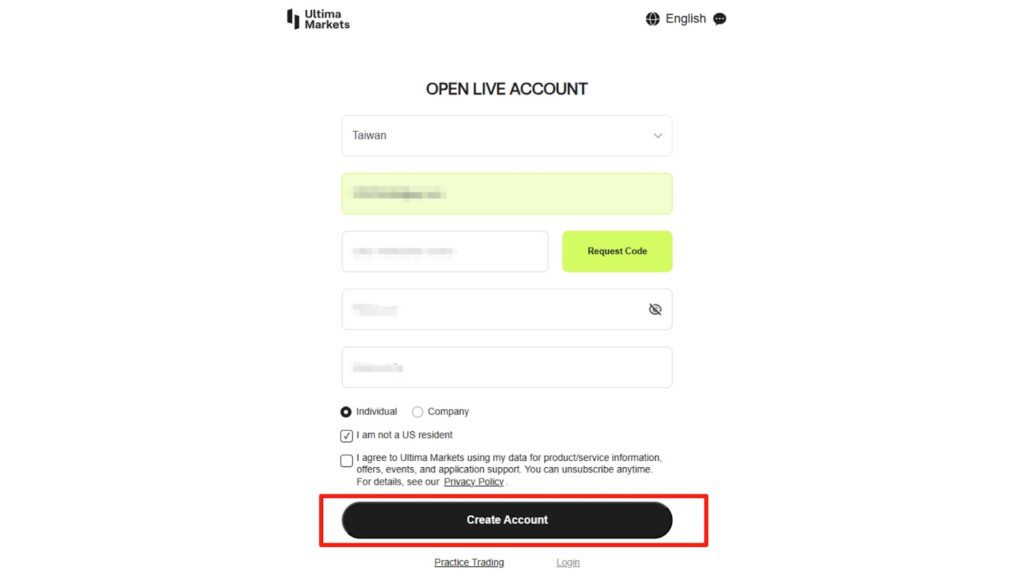

How to Start Securities Investment on Ultima Markets

Step 1: Free Registration

- Click “Open an Account Now”, fill in basic information, and complete identity verification quickly.

Step 2: Practice with a Demo Account

- Use UM’s demo environment with a “demo trading account” to test strategies, ensuring a smoother transition to real trading.

Step 3: Select Products and Place Orders

- For example, apply dividend ETF comparison and recommended strategies, placing orders for US stock ETFs or CFDs on UM.

Step 4: Continuous Learning and Optimization

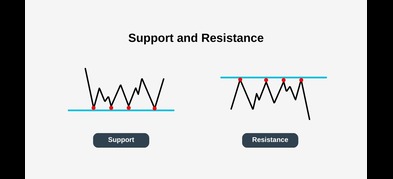

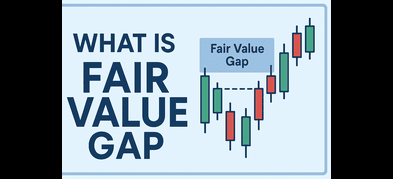

- Utilize UM’s market tools and educational resources for technical analysis and financial report evaluation.

Conclusion

The year 2025 is a golden opportunity for securities investment. With Taiwan stocks continuing to reach new highs and global equities maintaining steady growth, investors still have the chance to enjoy asset appreciation by applying proper strategies and tools.

Rather than hesitating over stock selection or fearing to take action, start with simple ETFs or well-known corporate securities. Using platforms like Ultima Markets can make investing easier and safer.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.