Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHow to Position in the Gold Stock Market for Inflation Hedge

Gold stock market refers to the market for investing in gold-related stocks or gold ETFs, allowing investors to allocate assets in gold through the stock market. This form of investment does not require direct ownership of physical gold, making it suitable for investors seeking flexible and low-cost options.

Differences Between Gold Stock Market and Physical Gold Investment

| Category | Gold Stock Market | Physical Gold |

| Investment Threshold | Low, suitable for beginners with limited capital | High, requires one-time purchase of gold bars or jewelry |

| Liquidity | High, can be traded anytime in the stock market | Low, buy/sell procedures are slower |

| Transaction Costs | Low, only involves trading fees | High, includes manufacturing and storage costs |

| Trading Convenience | Operated online, no geographical restrictions | Requires physical delivery or in-person transactions |

| Return and Risk Characteristics | Flexible return-risk profile with leverage options | Stable value retention, slower price appreciation |

| Investment Channels | ETFs, concept stocks, funds, etc. | Gold shops, bullion exchanges, physical dealers |

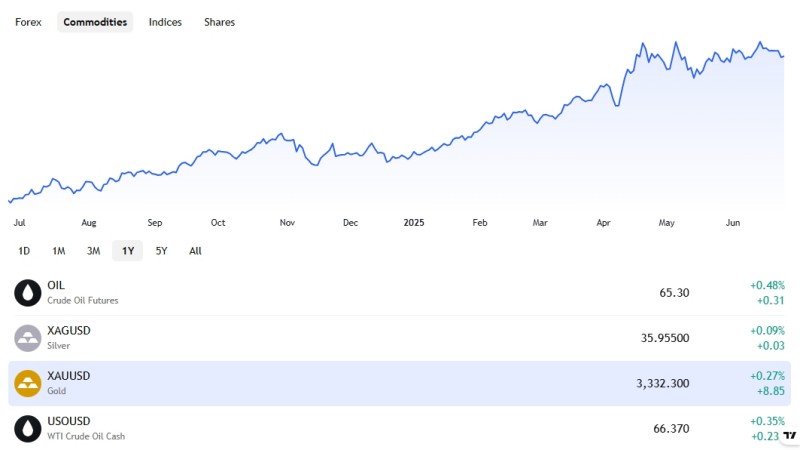

Current Gold Stock Market Outlook

In the first half of 2025, gold prices performed strongly, driving up related gold concept stocks and ETFs. According to Bloomberg data, international gold prices once surged past USD 2,350 per ounce in April, hitting a historic high and reflecting the market’s continued demand for inflation hedging and safe-haven assets.

In the Asia-Pacific market, particularly among Taiwanese investors, interest in the gold stock market continues to rise amid slowing U.S. rate hikes and ongoing geopolitical instability. Most investors participate via ETFs or gold mining stocks, using these highly liquid market instruments to implement a balanced strategy that combines capital defense and growth.

How Does the Gold Stock Market Affect Hedging Strategies?

The gold stock market plays a key role as a hedge asset. During times of heightened market uncertainty—such as inflation or geopolitical tensions—gold prices often perform strongly. As a result, investing in the gold stock market can effectively diversify risk.

Since 2023, with persistently high inflation and multiple rate hikes by the Federal Reserve, the gold stock market has become increasingly favored in asset allocation. Many Taiwanese investors have begun using gold-related equities to preserve the value of their assets.

What Are the Investment Strategies for Gold-Related Stocks?

Investment strategies for gold-related stocks revolve around two main pillars: fundamental analysis and technical trading. On the fundamental side, investors should assess factors like the company’s correlation with gold prices, production cost management, debt structure, and price-to-earnings ratio. On the technical side, tools such as candlestick patterns, RSI, and MACD help determine optimal entry and exit points to improve strategy precision.

Building a successful strategy requires a stable and flexible trading platform. Ultima Markets offers one-stop access to gold-related trading instruments including gold-related stocks, gold ETFs, and gold futures CFDs, meeting both short-term and long-term allocation needs. The UM platform supports both MT4 and MT5, enabling users with different preferences to easily get started.

Additionally, UM’s demo account provides real-time market quotes and the same operational environment as a trading account, allowing investors to practice strategies and test risk control logic. Once the strategy is validated, switching to a trading account for live trading can significantly reduce risk.

UM also offers dedicated charting tools, daily gold market reports, and professional customer support—empowering users to capture market momentum and strategic opportunities more quickly. For Taiwanese investors, this comprehensive support structure is a strong foundation for improving performance and success in the gold stock market.

A Guide to Investing in Gold ETFs

Gold ETFs track the price of gold and provide investors with a convenient way to gain exposure to the gold market. A prominent example is SPDR Gold Shares (GLD), which offers high liquidity and transparency, making it a major benchmark among global gold ETFs.

Investing in ETFs not only helps reduce the risk of single-stock exposure but also facilitates leverage strategies, enhancing capital efficiency through gold ETF products.

What Are the Advantages and Risks of Investing in the Gold Stock Market?

‧ High Liquidity and Transaction Convenience: The gold stock market is part of the broader stock market, allowing investors to buy and sell quickly via online platforms without geographic or time constraints, enhancing trading efficiency.

‧ Diverse Investment Tools: The gold stock market includes gold-related stocks, gold ETFs, futures, etc., meeting various investor profiles and strategy needs for a more flexible portfolio.

‧ Flexible Leverage Options: Certain gold stock market instruments support leverage, enabling amplified returns in clear trends. However, appropriate risk control is necessary to mitigate potential losses.

‧ Risk Exposure to Market Volatility: As gold-related equities are still stock-based assets, they are susceptible to macroeconomic data, interest rate policies, and geopolitical events, often resulting in significant price fluctuations.

‧ Leverage Risks May Amplify Losses: In unfavorable market conditions, insufficient stop-loss settings or poor capital management in leveraged trades can lead to amplified losses—caution is essential.

New investors in the gold stock market often lack awareness of price volatility and may mistakenly view gold as a guaranteed safe haven, ignoring its equity characteristics and associated leverage risks. Before executing real trades, it is recommended to develop the following three core competencies:

‧ Understanding Asset Types: Although gold-related stocks correlate closely with gold prices, they are essentially company equities. Investors should consider financials like earnings reports, mineral reserves, and business models—not just gold price trends.

‧ Position Sizing and Risk Control Modeling: A common beginner mistake is going all-in without setting stop-losses or allocating capital wisely. A general rule is to limit each trade to no more than 5% of total capital and use trailing stops to secure profits/losses.

‧ Choosing the Right Trading Cycle and Matching Strategy: Short-term trading requires quick indicators like MACD crossovers or candlestick patterns, while mid-to-long-term positions should be based on fundamentals and trend analysis. Different trading cycles demand different mindsets and strategies. Use demo accounts to identify your trading habits and optimal strategies.

Investing in the gold stock market is not as simple as copying others or buying and holding. It requires a clearly structured and disciplined strategy framework. Building such a framework is the first step toward stable profits for any beginner.

3 Key Reminders for Gold Stock Investing

- Stay informed on global market developments and central bank policy shifts.

- Use a demo account to test strategies and reduce operational risks.

- Apply leverage appropriately to enhance capital efficiency, but always enforce strict risk controls.

Real-World Case Study: Investing in the Gold Stock Market

In 2024, during the Federal Reserve’s rate-hiking cycle, the gold stock market outperformed most asset classes. Many investors gained over 20% annual returns by investing in gold-related stocks and ETFs.

For example, SPDR Gold Shares (GLD) saw a return of over 15% in 2024, significantly exceeding the average performance of broader stock indices, making it a popular anti-inflation choice among Taiwanese investors.

FAQ About the Gold Stock Market

How Are Returns from the Gold Stock Market Calculated?

Returns are calculated based on price appreciation and dividends. For instance, buying a gold-related stock at $20 and selling it at $25 yields a $5 profit per share, plus any dividend income.

Are There Gold Stock Market Investment Methods Suitable for Small Investors?

Yes. Small investors can invest in gold ETFs via a regular investment plan, contributing small amounts monthly. Over time, this helps reduce the impact of volatility and supports long-term wealth building.

Is the Gold Stock Market Affected by Global Events?

Yes. The gold stock market is highly sensitive to international developments. Geopolitical tensions in the Middle East, U.S. Federal Reserve interest rate hikes, or global economic downturns can all push gold prices higher and impact related equities.

Conclusion

Investing in the gold stock market has become a vital option for modern investors, offering both capital preservation and growth potential. By understanding market trends and using a demo account to refine trading skills, investors can confidently navigate volatility.

Though the road to gold stock investing has its challenges, support from a professional platform can significantly enhance results. Taiwanese investors are encouraged to explore this promising sector in greater depth.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.