Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteList of Top 10 Weakest Currencies in Africa

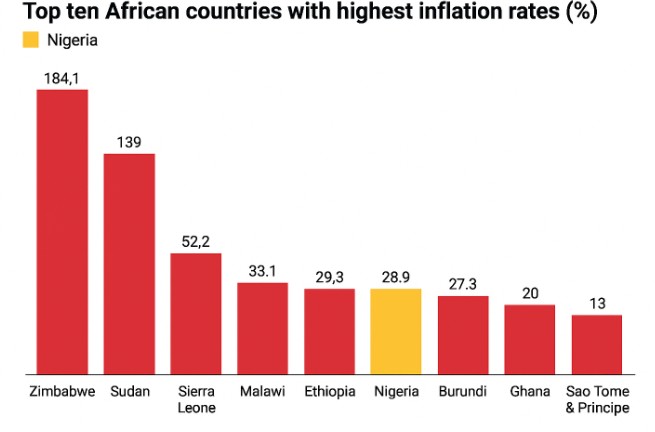

Here is the updated ranking of the weakest African currencies in 2025, based on official and parallel market exchange rates:

| Rank | Currency | Country | Exchange Rate (1USD =) |

| 1 | São Tomé and Príncipe Dobra (STN) | São Tomé and Príncipe | ~22,282 STN |

| 2 | Sierra Leonean Leone (SLL) | Sierra Leone | ~20,970 SLL |

| 3 | Guinean Franc (GNF) | Guinea | ~8,657 GNF |

| 4 | Ugandan Shilling (UGX) | Uganda | ~3,606 UGX |

| 5 | Burundian Franc (BIF) | Burundi | ~2,976 BIF |

| 6 | Congolese Franc (CDF) | DR Congo | ~2,905 CDF |

| 7 | Tanzanian Shilling (TZS) | Tanzania | ~2,653 TZS |

| 8 | Malawian Kwacha (MWK) | Malawi | ~1,733 MWK |

| 9 | Nigerian Naira (NGN) | Nigeria | ~1,554 NGN |

| 10 | Ethiopian Birr (ETB) | Ethiopia | ~137 ETB |

What Are the Weakest Currencies in Africa?

The weakest currencies in Africa are those with the highest exchange rates relative to the USD, meaning it takes more local currency units to equal one US dollar. These currencies often suffer from long-term depreciation, macroeconomic instability, and high inflation.

Countries like São Tomé and Príncipe, Sierra Leone, and Guinea top the list due to fragile economies and limited access to foreign reserves.

What Determines a Weak Currency?

A weak currency is typically the result of poor economic fundamentals. Factors that lead to currency weakness include:

- High Inflation: Erodes purchasing power and lowers investor confidence.

- Current Account Deficits: More imports than exports weaken demand for the local currency.

- Political Instability: Uncertainty deters investment and fuels capital flight.

- Low Foreign Reserves: Limits central bank’s ability to stabilize currency.

- Debt Overload: External debt obligations can lead to IMF intervention and devaluation.

- Uncontrolled Monetary Policy: Excessive printing of money without asset backing.

What Factors Make These African Currencies Weak?

Let’s break down why these currencies rank among the weakest in Africa in 2025:

São Tomé and Príncipe Dobra (STN)

Despite its peg to the euro in theory, the dobra trades at ~22,000 STN/USD in practice. The economy is small, reliant on cocoa exports and aid, with low trade volume and high external dependency.

Sierra Leonean Leone (SLL)

After a currency redenomination in 2022, the Leone has lost value rapidly due to inflation over 30%, a weak fiscal base, and growing trade imbalances.

Guinean Franc (GNF)

The GNF continues to weaken despite Guinea’s mineral wealth. Political unrest and low forex reserves have dragged its value down significantly.

Ugandan Shilling (UGX)

Although considered relatively stable, the UGX still trades at ~3,600 per USD due to low industrial output and reliance on commodity exports.

Burundian Franc (BIF)

Burundi faces extreme poverty, low investor confidence, and aid dependence, all contributing to its currency’s weakness.

Congolese Franc (CDF)

The DRC’s economic dependence on copper and cobalt exports creates volatility. Weak governance and corruption risk further pressure the CDF.

Tanzanian Shilling (TZS)

TZS depreciation is driven by current account deficits and declining tourism post-pandemic. The exchange rate hovers around 2,600 TZS/USD.

Malawian Kwacha (MWK)

The MWK has seen significant depreciation due to forex shortages, drought impacts on agriculture, and IMF-influenced policy shifts.

Nigerian Naira (NGN)

Following FX liberalization in 2024, the NGN has depreciated from 750 to ~1,550/USD in 2025. Inflation and dwindling reserves contribute to its weakness.

Ethiopian Birr (ETB)

Despite GDP growth, the birr continues to depreciate due to war-related spending, trade deficits, and inflation above 20%.

Weakest vs Strongest African Currencies

Let’s compare the weakest African currencies with the strongest:

| Category | Currency Example | Exchange Rate (1 USD =) | Key Reason |

| Weakest | STN, SLL, GNF | 8,000–22,000 | Inflation, aid reliance, poor FX reserves |

| Strongest | Libyan Dinar (LYD), Tunisian Dinar (TND), Moroccan Dirham (MAD) | 1.4–10 | Low inflation, stronger reserves, commodity surplus |

Libya’s Dinar (LYD) remains Africa’s strongest currency, supported by oil surpluses and low imports.

How Do Traders View These Weak Currencies?

From a trader’s perspective, the 10 weakest currencies in Africa are considered:

- Non-tradeable on major FX platforms

- High-risk for carry trade or hedging

- Indicators of macroeconomic stress in respective regions

Traders monitor these currencies not for speculation, but to assess risks in sovereign debt, foreign direct investment, and currency mismatch exposures in African markets.

Conclusion

The 10 weakest currencies in Africa in 2025 highlight the ongoing economic challenges many African nations face from inflation and low foreign reserves to political instability and heavy reliance on imports. As traders and investors assess risks across the continent, understanding these currencies becomes critical in evaluating macroeconomic stability, foreign exchange exposure, and capital flows.

At Ultima Markets, we provide in-depth market analysis and real-time data to help traders navigate volatile currency environments. Whether you’re monitoring African FX trends, global currency shifts, or cross-border investment risks, our platform gives you the insights and tools you need to make informed decisions.

Stay ahead of the market with Ultima Markets, your trusted partner in forex and macroeconomic analysis.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.