Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteMarket Risk Premium Explained: What Is It?

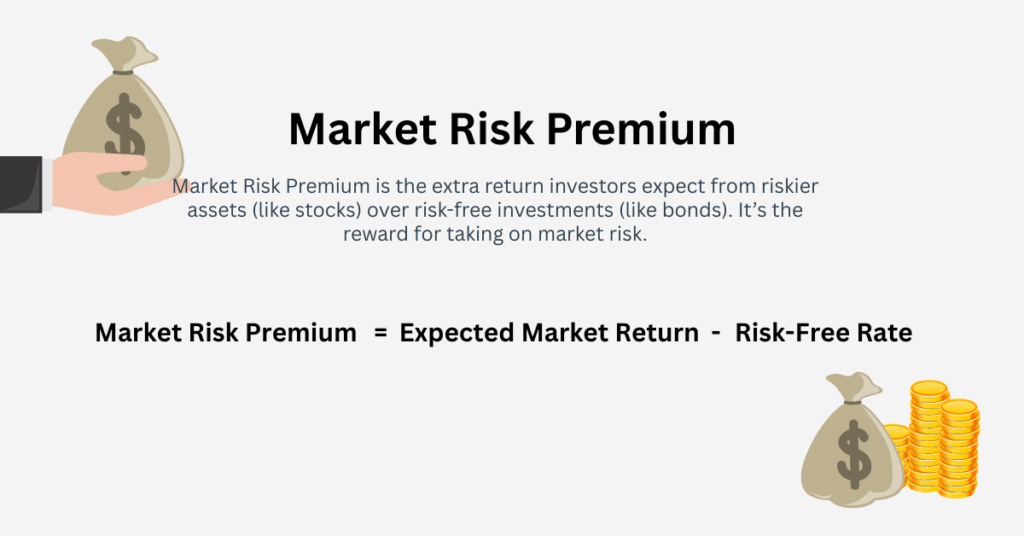

The market risk premium is a critical concept for traders who want to understand the relationship between risk and return in their investment decisions. It represents the additional return an investor demands for taking on the extra risk associated with investing in the stock market, compared to a risk-free investment such as government bonds.

For traders, understanding the market risk premium is important because it helps in evaluating whether the expected returns from stocks or other riskier assets justify the risks involved. It plays a crucial role in portfolio management, helping investors balance potential rewards with risks. In this article, we’ll explore the concept of the market risk premium, why it matters, and how it can impact your trading strategy.

What Is Market Risk Premium?

The market risk premium is the difference between the expected return on the market portfolio (e.g., the overall stock market) and the risk-free rate (such as U.S. Treasury bonds). Simply put, it’s the extra return that investors expect for taking on the additional risk of investing in the stock market compared to a risk-free asset.

- Expected Market Return: The average return expected from the market as a whole.

- Risk-Free Rate: The return on a completely risk-free asset, typically represented by government bonds.

Example:

Think of the market risk premium as the “extra reward” for taking on more risk. For example, you might estimate the expected market return by looking at the average return of the stock market in the previous year. The market risk premium can be historically created by analysing returns over time, and many investors use historical risk premiums as a benchmark for current calculations.

Let’s say you invest in stocks, which are considered a risky investment compared to low risk assets like government bonds (which are risk free investments or risk free assets). If the expected market return on stocks is 8%, and the risk-free rate (from government bonds) is 2%, then the market risk premium is 6%. This is the additional return you can expect from stocks as compensation for the added risk.

When evaluating a particular investment, you compare the investment’s rate of return to the market risk premium to see if it is worthwhile. Higher risk investments generally require a higher premium, and investors in risky investments seek compensation for the extra uncertainty. The premium may differ for one investor compared to another, depending on their risk tolerance and what each expects as a return. Ultimately, the goal is to earn more money by choosing investments that exceed the market risk premium.

Why Market Risk Premium Matters for Traders

1. It Guides Investment Decisions

The market risk premium helps traders assess whether the potential returns from a risky asset (such as stocks) are worth the risks involved. A higher market risk premium means that investors expect higher returns to compensate for the increased risk of market volatility.

2. It Impacts Portfolio Allocation

Understanding the market risk premium helps traders decide how much capital to allocate to riskier assets. If the premium is higher, traders might choose to allocate more funds to stocks or growth-oriented investments. Conversely, if the premium is lower, they may opt for more conservative investments like bonds or cash.

3. It Reflects Economic Conditions

The market risk premium changes in response to shifts in economic conditions. For example, in times of economic uncertainty, the market risk premium tends to increase as investors demand higher returns for taking on risk. On the other hand, in bull markets, the premium may decrease as market conditions stabilise and investor confidence grows.

Factors Influencing the Market Risk Premium

The size of the market risk premium can change depending on various economic and market conditions. Below is a table summarising the key factors that influence the market risk premium.

| Factor | Impact on Market Risk Premium |

| Economic Growth | Slower growth increases the premium as investors demand higher returns for increased uncertainty. |

| Inflation | Rising inflation typically leads to a higher market risk premium as investors seek greater returns to offset inflationary pressures. |

| Market Volatility | High volatility increases the premium, as more risk is involved in the market, requiring higher compensation for risk-taking. |

| Interest Rates | Low interest rates often increase the market risk premium as stocks become more attractive relative to low-yielding bonds. Conversely, higher rates can decrease the premium. |

These factors can impact how much return investors expect for taking on the risk of investing in the stock market compared to risk-free investments. Economic growth and inflation typically lead to an increase in the market risk premium because of the greater uncertainty involved.

Similarly, market volatility and interest rates play a significant role. When markets are volatile, or when interest rates are low, the premium tends to rise as investors demand greater returns for the perceived risks.

Now that we’ve discussed the key factors influencing the market risk premium, let’s take a look at how it impacts your trading strategy.

How Market Risk Premium Affects Your Trading Strategy

The market risk premium plays a key role in shaping a trader’s approach to risk management and asset allocation. Here’s how it can affect your strategy:

1. Risk and Reward Trade-Off

The market risk premium directly reflects the risk-return trade-off. If the market risk premium is high, traders might be more inclined to take on riskier investments for higher potential returns. However, if the premium is low, traders may decide to reduce their exposure to riskier assets and increase their holdings in safer, more stable investments.

2. Long-Term Investment Outlook

For traders with a longer-term perspective, the market risk premium can help guide their approach to portfolio construction. In a high-risk environment, they might focus on diversifying into safer assets like bonds, while in a lower-risk environment, they may seek growth opportunities in equities.

3. Adaptation to Changing Market Conditions

Traders who track the market risk premium can adjust their strategies to reflect shifting market conditions. For example, during periods of high market risk premiums, it might make sense to allocate more capital into bonds or other less volatile assets. Alternatively, when the premium is low, traders might consider increasing their exposure to stocks or growth assets.

Conclusion

To wrap it up, the market risk premium is a vital concept for understanding the risk-return trade-off in financial markets. For semi-professional traders, this premium helps in evaluating whether the returns on stocks justify their inherent risks and provides insights into overall market conditions. As market conditions change, so does the market risk premium, making it a valuable tool in portfolio management and trading strategies.

By understanding what the market risk premium is, how it’s influenced, and how it impacts your investments, you can make more informed decisions and tailor your strategies to changing market conditions. Always keep an eye on this key metric to ensure your portfolio is aligned with both your risk tolerance and long-term financial goals.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.