Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteMarket Clearing Price: Why It Matters

In finance and trading, few concepts are as essential as the market clearing price. It represents the price at which supply perfectly matches demand, allowing all buyers and sellers to transact without leftover inventory or unmet orders.

But how does this work in practice, and why should traders, investors, and businesses care?

Let’s explore how understanding the market clearing price can give you a strategic edge.

What Is the Market Clearing Price?

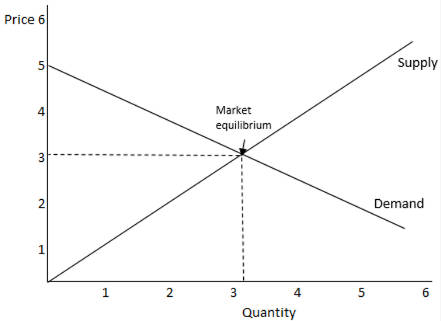

The market clearing price (also known as equilibrium price) is the price at which the quantity of a good or service offered matches exactly with the quantity demanded. This is the point of market equilibrium, where the quantity supplied is equal to the quantity demanded. The market clearing price is a specific price at which this balance occurs.

The demand curve is typically downward sloping, reflecting that higher prices lead to lower quantities demanded.

In simpler terms:

- Too much supply? Prices drop until buyers return.

- Too much demand? Prices rise until sellers catch up.

- At market clearing price, the same amount of goods is supplied and demanded—supply equals demand—so everything gets sold, and no one is left waiting.

This price is dynamic and constantly adjusts based on market forces—especially in real-time markets like stocks, commodities, and forex.

How Is the Market Clearing Price Determined?

In theory, the clearing price is found at the intersection of the supply and demand curves. These curves reflect buyer preferences and seller costs. In real-world markets, especially financial ones, clearing prices are determined through auction processes, order books, and pricing algorithms that match bids and offers in real time.

For example, on a stock exchange, buyers place bids and sellers set ask prices. The market matches these orders at a mutually acceptable price—the clearing price. In liquid markets, this matching occurs almost instantly. In less liquid markets, it may take longer for a clearing price to emerge.

Why Is the Market Clearing Price Important?

Understanding the market clearing price has real-world benefits for everyone from casual traders to institutional investors and consumers. Here’s why it matters:

Fair Pricing

The clearing price reflects the consensus value between buyers and sellers at any given moment.

Efficient Allocation

It ensures resources (stocks, goods, commodities) are allocated efficiently—minimising waste and shortages.

Trading Opportunities

Rapid deviations from the clearing price can indicate market inefficiencies, which savvy traders can capitalise on these gaps.

Example: If a stock’s clearing price is $100, but panic selling pushes it to $98, informed investors may buy at a discount and profit when it rebounds.

Better Decision Making

Whether pricing an IPO, trading futures, or selling property, knowing the clearing price helps avoid overpricing or undervaluing.

Price Stickiness and Its Effects

Although economic theory suggests prices adjust quickly, in reality, this adjustment is often delayed—a phenomenon known as price stickiness. This occurs when prices resist movement despite changes in supply or demand, often due to contracts (i.e wage agreements), menu costs (cost of changing prices), or behavioural factors (resistance to price change).

For example, if demand for a product surges but the price remains unchanged, a temporary shortage may develop. Likewise, if demand drops but prices stay high, suppliers may be left with excess inventory. These mismatches mean the market is not at equilibrium and the clearing price is not yet reached.

Labour markets often experience this. Even if demand for workers falls, wages may not drop immediately due to contractual or legal constraints, consequently leading to unemployment.

A Real-World Example of Market Clearing

Imagine an online auction for a rare collectible.

- 10 buyers want it.

- Sellers list 5 units.

- Bids range from $100 to $200.

- The 5 highest bids are accepted at $180.

Here, $180 becomes the market clearing price. It’s the price at which the market “clears” all the available units without excess. If more buyers were willing to pay a higher price, the highest price accepted would increase, and the market clearing price would rise. Conversely, if fewer buyers bid, the market clearing price would be a lower price. If demand drops, the price falls or sellers may decrease their prices to clear the market.

In stock trading, the opening auction price often acts as the clearing price, especially after pre-market order matching. This is the point where the price reaches equilibrium for that trading session.

Market Clearing Price vs Market Price

Although they sound similar, the market clearing price isn’t always the same as the current market price:

| Market Clearing Price | Market Price |

| Based on supply = demand | Based on most recent trade |

| May require adjustment | Updates continuously |

| Can be theoretical | Always actual and real-time |

Smart traders monitor both to detect momentum shifts, potential reversals, or liquidity gaps.

Government interventions, such as setting a maximum price (price ceiling), are often used to prevent high prices from making goods or services unaffordable. However, these price ceilings can lead to shortages when the legal cap is set below the market equilibrium. Conversely, price floors are used to prevent lower prices, but this can result in surpluses when prices are kept above the equilibrium level.

Can the Market Fail to Clear?

Yes, markets don’t always clear perfectly. This can occur due to external factors such as:

- Government price controls

- Lack of information or transparency

- Imperfect competition (e.g. monopolies)

- Sudden economic shocks or disruptions

A common example is the housing market under rent control policies. While well-intentioned, such controls often prevent the market from reaching its natural clearing point, leading to a shortage of rental properties and reduced investment in housing.

Understanding these limitations helps market participants make informed decisions and adapt to inefficiencies.

Final Thoughts

Whether you’re trading forex, flipping NFTs, or setting product prices, understanding the market clearing price helps you:

- Recognise fair value

- Spot opportunities before others do

- Make more informed pricing decisions

Master this concept and you’ll move from guessing to strategising in every trade.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.