Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomIs QQQ a Good Investment For You?

If you’re asking is qqq a good investment, you’re really weighing whether a focused tilt toward U.S. mega-cap innovation fits your goals and risk tolerance. Invesco QQQ (QQQ) tracks the Nasdaq-100 Index, giving you simple, liquid exposure to companies shaping the future of AI, semiconductors, cloud, cybersecurity, digital advertising, and e-commerce. The upside is powerful growth potential; the trade-off is higher volatility and concentration in a handful of giants.

What QQQ Actually Owns

QQQ represents a cap-weighted basket of the Nasdaq-100. It is an ownership slice of the 100 largest non-financial companies listed on Nasdaq so you hold tiny pieces of each constituent in proportion to its market value.

Before deciding is qqq a good investment for you, it helps to know what’s under the hood. QQQ follows the Nasdaq-100 (the 100 largest non-financial companies listed on Nasdaq) rebalanced quarterly and reconstituted annually. That rules-based design keeps the lineup current while letting winners carry meaningful weight. It’s also why QQQ is intentionally tech-tilted and excludes traditional financials, so it won’t diversify your portfolio the way a broad market fund does.

- Expense ratio: 0.20%.

- Income profile: Yield is modest. Think growth, not income.

- Holdings feel familiar: Nvidia (AI hardware), Amazon (e-commerce and cloud), Tesla (autonomy) and other innovation leaders often sit near the top.

QQQ’s Track Record: Resilience with Real Whipsaws

When people ask “is qqq a good investment over the long run?”, they’re often looking at these numbers: over 15 years to June 30, 2025, QQQ posted an annualized total return near 19.6% and ranked in the top percentile of large-cap growth peer funds.

It outperformed the S&P 500 in most of the past decade and delivered a ~456% cumulative 10-year return (USD 10,000 → ~USD 55,600). However, the flip side is the style’s cyclicality, QQQ fell about −32.6% in 2022 during rapid rate hikes and macro shocks.

Why Investors Like QQQ

If your answer to is qqq a good investment leans yes, these are the typical reasons:

- Innovation in one ticker. QQQ captures secular themes. AI, chips, cloud, cybersecurity, digital ads, and platforms without stock-picking.

- Simplicity and liquidity. It’s one of the most actively traded ETFs, making entries and exits straightforward.

- Rules and refresh. Regular rebalancing and an annual refresh help phase out laggards and include rising leaders.

Risks You Should Consider

- Concentration risk. A handful of mega-caps drives a large share of returns, so single-stock headlines can sway performance.

- Higher volatility. Growth styles can de-rate quickly when rates rise or sentiment turns. 2022 is a recent example.

- Sector skew. With no banks and a heavy tech/consumer-tech tilt, QQQ offers less diversification than broad market funds.

- Low yield. Income seekers may find the payout underwhelming.

Is QQQ a Good Investment For Your Portfolio?

Who QQQ Suits

Thinking in “fit” terms helps you decide is qqq a good investment for your situation.

- Best for:

Investors with multi-year horizons who want a growth tilt; core-plus builders who hold a broad index at the core and use QQQ as a 10–30% satellite; tactically minded investors who value deep liquidity. - Not ideal for:

Income-focused investors; diversification-first investors who insist on sector balance (financials, energy, small/mid caps) within a single fund; anyone who loses sleep during sharp drawdowns.

QQQ vs Alternatives

Another way to test if qqq a good investment is to compare it with common options:

- S&P 500 trackers (e.g., SPY, VOO).

Broader sector mix and typically lower volatility; often the better core. QQQ can then be layered on top for a growth tilt. - Large-cap growth ETFs.

Overlap with many of QQQ’s leaders, but QQQ’s no-financials rule creates a purer growth/tech posture. - Single-sector tech ETFs.

Even more concentrated than QQQ. QQQ remains tech-heavy, but still adds some dispersion via consumer discretionary and healthcare allocations. - QQQM (sister fund).

Tracks the same index with a lower fee. Popular for buy-and-hold, while QQQ typically retains the edge on intraday trading liquidity.

How to Use QQQ Without Overdoing It

Positioning matters as much as selection. A few practical habits make the ride easier, especially if your answer to is qqq a good investment is “yes, with guardrails.”

- Size it as a satellite. Many investors cap QQQ at 10–30% of equities to keep portfolio risk in check.

- Phase in with DCA. Dollar-cost averaging spreads timing risk in a volatile style.

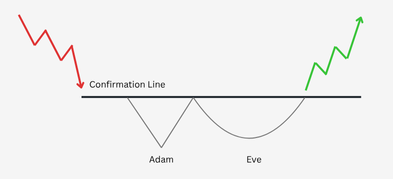

- Rebalance on rules. Use calendar (e.g., semi-annual) or band triggers to trim after big runs and add after pullbacks.

- Mind taxes and account type. If your market offers tax-advantaged accounts, consider holding growth-tilted funds there.

So, Is QQQ a Good Investment?

It can be. If you want a liquid, rules-based way to lean into U.S. mega-cap innovation and you’re comfortable with bigger drawdowns. Treat QQQ as a growth-tilt satellite, pair it with a broad-market core, size it prudently, and rebalance with discipline. If you need steadier diversification or income, look to broader or dividend-tilted ETFs and keep QQQ as an add-on, not the whole plan.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.