Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

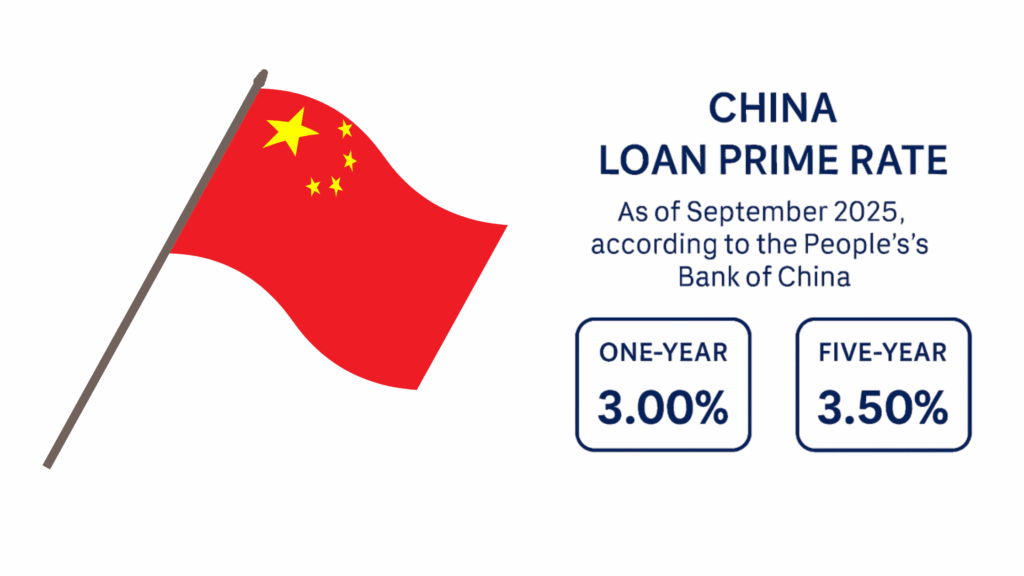

I confirm my intention to proceed and enter this websiteThe People’s Bank of China (PBOC) held its key lending rates steady in September 2025, keeping the one-year Loan Prime Rate (LPR) at 3.00% and the five-year LPR at 3.50%. This marks the fourth consecutive month of unchanged rates, even as the U.S. Federal Reserve recently cut interest rates.

What Is China’s Current Loan Prime Rate (LPR)?

China’s current Loan Prime Rate (LPR) is 3.00% for the one-year term and 3.50% for the five-year term as of September 2025, according to the People’s Bank of China. The one-year LPR is the benchmark for most new and existing loans, while the five-year LPR mainly influences mortgage lending.

The one-year rate is the reference for most new and existing loans, while the five-year rate directly impacts mortgages. By leaving rates unchanged, the PBOC signaled a cautious approach: supporting growth without adding excessive credit risks or asset bubbles.

Why Are There Trade Tensions With China?

Trade tensions involving China (especially with the U.S. and some Western countries) arise from a mix of economic, political, and security factors. Major Causes of Trade Tensions includes:

Intellectual Property (IP) Concerns & Forced Technology Transfer

There are widespread allegations that Chinese firms, sometimes under government pressure or regulation, force foreign companies operating in China to transfer tech or IP as a condition of market access. Cyber-theft or counterfeiting are also issues cited by foreign governments.

Trade Imbalance & Market Access Barriers

The U.S. and others criticize China for implementing tariffs, quotas, or non-tariff barriers (e.g. standards, licensing rules) that make it hard for foreign goods or services to compete. Also, large trade deficits (for example, imports vs exports) are politically sensitive.

State Subsidies & Industrial Policy

China’s government often supports key industries (technology, manufacturing, etc.) via subsidies, state-owned enterprises, preferential financing, or favourable regulation, which some trading partners argue distort competition.

National Security & Strategic Competition

As China advances in critical high technologies (semiconductors, AI, telecommunications), other countries view restrictions (export controls, tariffs) as tools to limit China’s technological lead or risk. There are concerns over supply chains, dependency, and geopolitical influence.

Intellectual Property Rights Enforcement & Legal Frameworks

Even where laws exist in China relating to IP, enforcement is often seen by foreign entities as weak or inconsistent.

Why Did the People’s Bank of China Hold Rates Steady?

Beijing is walking a fine line. On one side, economic growth has shown signs of slowing, especially in real estate and manufacturing. On the other, China’s stock market and currency have been relatively stable in recent months.

Holding the LPR steady allows policymakers to:

- Maintain financial stability amid global uncertainty.

- Avoid widening the gap between Chinese and U.S. interest rates too aggressively.

- Support the yuan (CNY), which remains sensitive to capital flows.

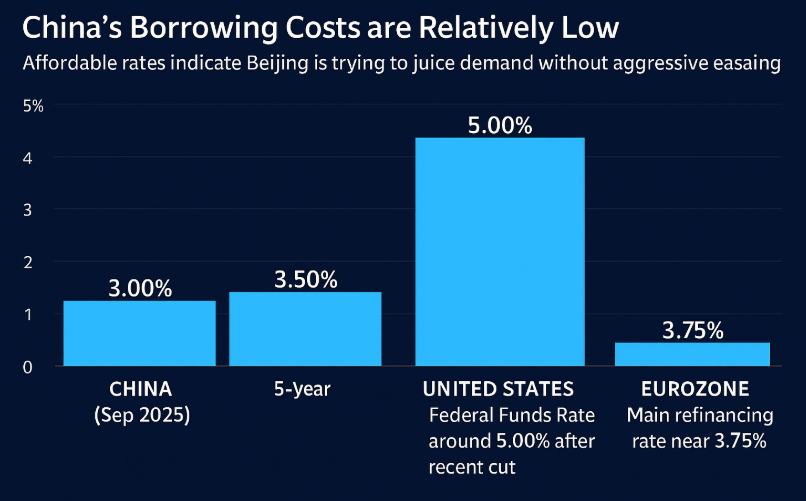

How Do China’s Lending Rates Compare to the U.S. and Europe?

Compared globally, China’s borrowing costs are relatively low, reflecting its efforts to stimulate lending and encourage domestic demand without over-relying on aggressive monetary easing.

- China (Sep 2025): 1-year at 3.00%, 5-year at 3.50%

- United States: Federal Funds Rate around 5.00% after the recent cut

- Eurozone: Main refinancing rate near 3.75%

Which Country Has the Highest Lending Rate?

Interest rates vary significantly around the world.

- Venezuela currently records one of the highest central bank policy rates, at nearly 60%, as the country battles runaway inflation.

- Zimbabwe has reported even higher commercial lending rates, sometimes exceeding 170%, due to chronic economic instability.

- In comparison, most developed economies such as the United States (5.00% range) or the Eurozone (3.75% range) have much lower benchmarks.

These extreme examples highlight why global investors closely monitor lending rates: they reflect both inflation risks and credit stability.

What Does This Mean for Traders and Investors?

For global traders, China’s decision carries several implications:

- Forex: A stable LPR helps support the yuan (CNY), but trade headlines remain a key driver.

- Equities: Rate stability may ease pressure on China’s stock market but growth concerns linger.

- Commodities: China’s borrowing costs influence demand for energy and metals, shaping global commodity prices.

Conclusion

China’s decision to keep lending rates unchanged in September 2025 highlights how central banks balance growth, stability, and global pressures. While the U.S. Federal Reserve and other economies shift policy, China’s cautious stance reinforces the importance of monitoring both domestic lending conditions and international trade developments.

For traders, these factors directly influence forex, equities, and commodities markets where every percentage point and headline can spark volatility.

At Ultima Markets, we provide traders with the tools, insights, and regulated environment needed to make informed decisions in today’s complex landscape. By combining trusted analysis with advanced trading technology, we help you stay ahead of rate moves and market shifts so you can trade with confidence and purpose.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.