Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat is A50 futures and how to profit from China’s trends

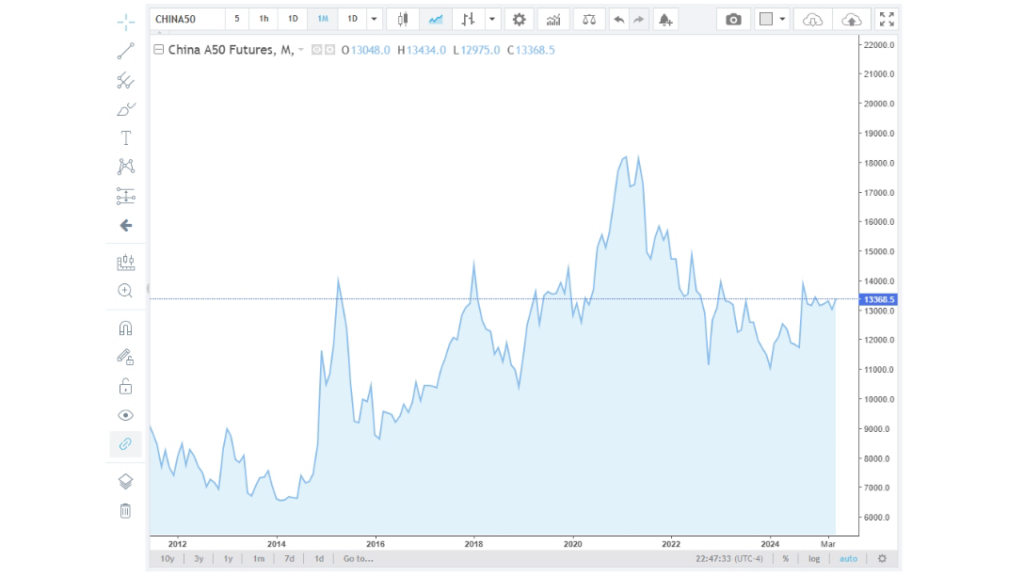

In today’s rapidly evolving global economy, China’s market trends undoubtedly influence global capital flows. According to data from the Singapore Exchange (SGX), the FTSE China A50 Index futures see an average daily trading volume of over 360,000 contracts, making it a top choice for investors positioning themselves in the Chinese market. For Taiwanese investors seeking to track the Chinese stock market and deepen their investment exposure, A50 futures have become an essential tool. This article will help you understand what A50 futures are, how they work, the key factors affecting their price, and how to choose a secure and efficient platform for trading.

What Are A50 Futures? A Quick Guide to the Basics

A50 futures are derivative financial products based on the FTSE China A50 Index, which was developed by FTSE Russell and officially launched in January 2004. The index tracks the performance of the 50 most representative A-share stocks in China, covering key sectors such as finance, technology, energy, and consumer goods. These futures are primarily listed and traded on the Singapore Exchange (SGX), allowing global investors to gain exposure to China’s core equity market without using domestic Chinese brokers.

Key Features Include:

- Currency: Renminbi (RMB)

- Trading Hours: Nearly 24 hours, including night session

- Leverage: Enables amplified exposure and capital efficiency

- Bi-directional Trading: Go long or short depending on market conditions

With China’s 2025 policy stance expected to remain moderately accommodative and domestic demand strengthening, A50 futures have become a crucial instrument for both institutional and retail investors to monitor and participate in China’s capital market.

A50 Futures Contract Specifications

| Item | Specification |

| Futures Name | FTSE China A50 Index Futures |

| Exchange | Singapore Exchange (SGX) |

| Contract Code | CN |

| Contract Multiplier | USD 1 × Index Points |

| Quotation Currency | USD (on SGX) / RMB or USD (on CFD platforms) |

| Minimum Tick Size | 1 point = USD 1 |

| Tick Value | USD 1 (1 point × USD 1) |

| Trading Hours (SGX) | 09:00–16:35 and 17:00–05:15 (next day), Taiwan time |

| Final Trading Day | Second-to-last business day of the contract month (trading ends at 16:35) |

| Contract Months | The next two consecutive months + quarterly months (March, June, September, December) |

A50 Index Constituents and Sector Coverage

The FTSE China A50 Index, which underpins A50 futures, consists of 50 of the largest and most liquid A-share companies in China’s stock market. Below are the main sectors and representative companies included:

- Financials: Ping An Insurance, China Merchants Bank, Industrial and Commercial Bank of China (ICBC)

- Technology & Manufacturing: CATL, LONGi Green Energy, CRRC

- Consumer & Healthcare: Kweichow Moutai, Haitian Flavoring, Jiangsu Hengrui Medicine

- Energy & Infrastructure: PetroChina, China Shenhua, Sany Heavy Industry

These companies play a vital role in China’s economy, making A50 futures a powerful tool to reflect the country’s macroeconomic trends.

Top 10 Constituents of the A50 Index

| Rank | Stock Code | Company Name | Weight (%) |

| 1 | 600519 | Kweichow Moutai | 11.87 |

| 2 | 300750 | CATL | 6.78 |

| 3 | 600036 | China Merchants Bank | 5.55 |

| 4 | 002594 | BYD | 4.06 |

| 5 | 600900 | Yangtze Power | 4.04 |

| 6 | 601318 | Ping An Insurance | 3.35 |

| 7 | 601398 | ICBC | 3.13 |

| 8 | 000858 | Wuliangye Yibin | 3.11 |

| 9 | 601166 | Industrial Bank | 2.71 |

| 10 | 601288 | Agricultural Bank | 2.64 |

A50 index components are subject to change. The above data is for reference only and is current as of March 25, 2025.

Key Factors Affecting A50 Futures Prices

A variety of factors influence A50 futures price fluctuations. Understanding the following elements can help investors identify entry points and manage risk effectively:

1. China’s Macroeconomic Data

For example, China’s GDP growth reached 5.4% in Q1 2025, slightly exceeding expectations, boosting market confidence and pushing A50 futures higher. Other indicators such as the Purchasing Managers’ Index (PMI), trade data, and inflation metrics like CPI and PPI also directly influence market sentiment and capital flows.

2. Monetary and Interest Rate Policies

If the People’s Bank of China implements interest rate cuts or reserve requirement ratio (RRR) reductions, it typically boosts capital markets and supports A50 futures. Conversely, tightening measures may lead to price corrections.

3. RMB Exchange Rate Volatility

Since A50 futures are denominated in RMB, a stronger yuan often attracts foreign capital into China’s A-share market, supporting futures prices. Since early 2025, the RMB/USD exchange rate has fluctuated between 7.08 and 7.33, becoming a key indicator for foreign investment decisions in A-shares.

4. Policy and Regulatory Risk

Policy shifts in sectors like technology or education can directly affect relevant index constituents. For instance, the regulatory crackdown on internet platforms that concluded in 2024 had a significant impact on A-share tech stocks.

5. Global Capital Flows and Geopolitical Risk

U.S. interest rate policy, and cross-strait tensions all influence global investor positioning and risk appetite in A50 futures.

Investment Advantages of A50 Futures

Trading A50 futures offers several clear advantages, making them especially suitable for investors aiming to capture trends in China’s markets:

1. Low Entry Barrier and Flexible Capital Allocation

Participating in A50 futures via CFDs (Contracts for Difference) allows investors to avoid the high margin requirements of traditional futures contracts.

2. Support for Two-Way Trading in Any Market

A50 futures can be traded both long and short, offering opportunities in both bullish and volatile market conditions.

3. Leverage to Amplify Return Potential

Prudent use of leverage improves capital efficiency and increases flexibility for short-term trading strategies.

4. Access to China’s Blue-Chip Momentum

Compared to individual stocks, A50 futures offer a more comprehensive view of China’s economic trajectory through exposure to top blue-chip companies.

Risks and Challenges of A50 Futures

Despite the many advantages of A50 futures, investors should remain aware of the following risks:

- Leverage Risk: High market volatility can amplify losses when using leverage.

- Currency Fluctuations: If the trading platform is USD-denominated, RMB depreciation may erode returns.

- Frequent Policy Intervention: Sudden changes in policy or regulation may quickly alter market dynamics.

- High Operational Skill Requirement: Successful trading requires sound technical analysis and effective risk management tools.

How to Trade A50 Futures? A Beginner-Friendly Guide

There are currently two main ways to participate in the A50 futures market:

Traditional Futures Method

This requires opening a futures account, involves a higher entry barrier, large margin requirements, and prior knowledge of futures trading.

CFD (Contract for Difference) Method – Recommended

More flexible and beginner-friendly, CFD trading allows 24-hour access with no need for physical delivery, making it the preferred choice for most retail and advanced traders.

CFDs allow you to trade A50 futures with small capital outlays. You can also integrate them with technical analysis and EA (Expert Advisor) automated systems for quantitative strategy deployment.

Why Trade A50 Futures with Ultima Markets?

As a globally regulated and professional forex and CFD broker, Ultima Markets offers an exceptional trading experience for A50 futures CFDs:

- Spreads starting from 0.0, with highly competitive trading costs

- Leverage up to 1:2000 for flexible capital usage

- Full support for MT4, MT5, and mobile app trading—seamless on-the-go access

- Demo account to test strategies without financial pressure

- Integrated Trading Central tools for real-time technical analysis and trend tracking

- Segregated funds and Financial Commission protection up to €20,000 for financial security

- 24/7 Chinese-speaking customer support for instant assistance

With UM’s all-in-one platform and risk control tools, you can confidently capture opportunities in the Chinese market through A50 futures.

Who Should Consider Investing in A50 Futures?

- Global investors seeking exposure to China’s growth potential

- Investors with experience in Taiwan or Hong Kong stocks looking to expand into the Chinese market

- Traders who favor swing trading and flexible risk and capital management

- Advanced traders who can interpret short-term volatility and apply disciplined risk management

Conclusion

In 2025, China continues to advance digital transformation, green energy development, and domestic demand stimulus. The momentum of the A-share market remains worth watching, and A50 futures are one of the most direct instruments reflecting the performance of China’s core assets. By using flexible CFD trading methods and a professional platform like Ultima Markets, you can confidently participate in this convergence of policy, corporate performance, and market direction.

FAQ

- What are the trading hours for A50 futures?

On the Singapore Exchange (SGX), A50 futures trade from 09:00 to 16:35 (QUEST) and from 17:00 to 05:15 the next day (T+1), Taiwan time.

- How are A50 futures related to China A-shares?

The price of A50 futures closely tracks the performance of the top 50 largest-cap A-share companies, offering international investors an efficient way to follow the Chinese stock market.

- How can I trade A50 futures?

You can open an account with a licensed international futures broker or opt for a forex platform like Ultima Markets that offers A50 CFDs, enabling flexible long and short trading.

- Can I trade A50 futures in TWD?

Traditional futures are settled in USD. However, when trading A50 CFDs on platforms like Ultima Markets, you can deposit funds in TWD, which will be automatically converted into the required trading currency, offering greater capital flexibility.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.