Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomHow Does ADP Jobs Report Impact Forex Trading?

In the forex and macroeconomic markets, the ADP jobs report serves as a crucial leading indicator of the US labor market. Its data not only shapes market expectations for the nonfarm payroll report but also triggers short-term exchange rate volatility.

This article provides an in-depth analysis of the latest ADP jobs report from May 2025 and explains how to develop tailored trading strategies using Ultima Markets to enhance decision-making.

What Is the ADP Jobs Report?

The ADP (Automatic Data Processing) jobs report is published by the US payroll services giant ADP, based on over 25 million payroll records, and developed in collaboration with the Stanford Digital Economy Lab.

Released two days before the nonfarm payroll report each month, the ADP report provides fast insights into private-sector employment. It includes job creation numbers, industry breakdowns, and wage growth rates—thus often referred to as the “mini-NFP.” The data offers an early signal of labor market trends and impacts the US dollar and overall market volatility.

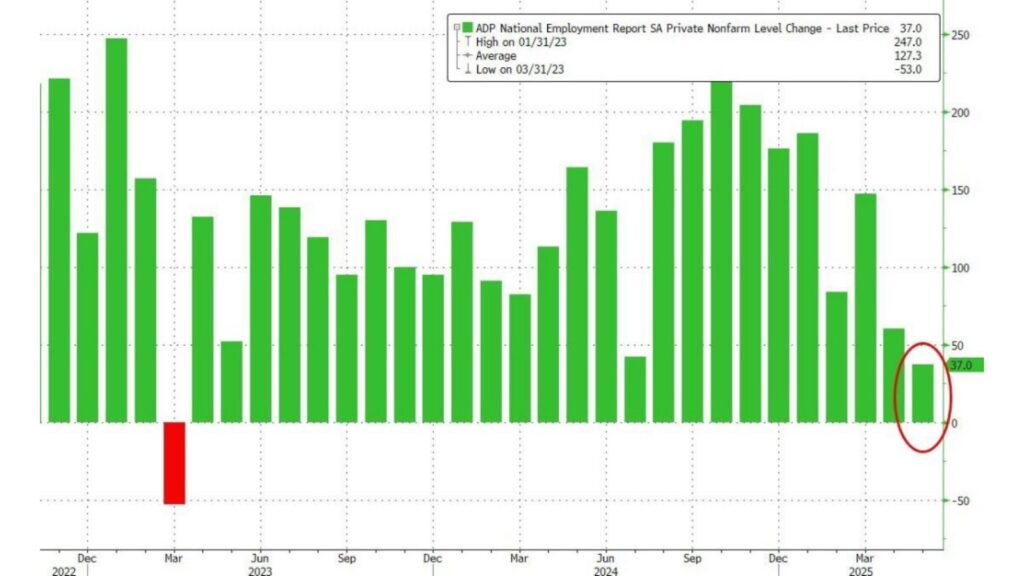

In May 2025, the ADP report showed only 37,000 new private-sector jobs—marking the lowest level since March 2023.

Key Figures from May 2025 ADP Jobs Report

- Private sector added 37,000 jobs, down from 60,000 in April.

- Compared to the same month last year, job creation fell by approximately 77%, with the annual gain declining from 164,000 to 37,000.

- Sector performance varied: leisure and hospitality added 38,000 jobs, finance added 20,000, while manufacturing and professional services saw declines.

- Wage growth remained strong: 4.5% year-over-year for job stayers, and 7% for job changers.

These real-time indicators show that while the US labor market is cooling, wage pressure persists—offering critical directional cues for forex traders.

Impact of the ADP Jobs Report on the Forex Market

When the ADP jobs report is released, markets often react immediately—particularly in USD-related currency pairs. Stronger-than-expected data tends to boost the dollar, while weaker data increases the likelihood of depreciation.

The weak 37K reading in May 2025 triggered a nearly 1% short-term decline in the US Dollar Index (DXY), dropping it to around 104.5. This sparked USD carry trade inflows and led to a sharp intraday dip in EUR/USD and GBP/USD.

How to Develop an ADP Trading Strategy with Ultima Markets

Using Ultima Markets’ ADP report trading strategy as a foundation, the following outlines a sample strategy workflow:

Interpreting the Gap Between Forecast and Actual

Compare market consensus (e.g., 110K) with the actual figure (e.g., 37K) to assess deviation from expectations. If the actual number falls significantly short, it may trigger a USD pullback, presenting short opportunities in EUR/USD or GBP/USD.

Combining Technical and Fundamental Analysis

Integrating technical and fundamental perspectives allows traders to define breakout or breakdown levels. Use indicators from Ultima Markets’ Trading Central alongside ADP report–based forex strategy insights to reduce risk exposure.

Risk Control and Stop-Loss Design

As recommended in Ultima Markets’ ADP strategy framework, adjust leverage to 1:200 before and after the data release (automatically from 15 minutes before to 5 minutes after). Implement strict stop-loss orders to avoid liquidation.

Stop-loss levels should be set 10–20 pips above or below distorted data thresholds. In the event of a false breakout, exit positions quickly.

Practice with a Demo Account

Beginners can open a demo account with Ultima Markets to simulate ADP-based strategies in real time, allowing for stress-free testing of entry, exit, and risk control techniques.

Comparing ADP and Nonfarm Payroll Data

Investors often compare ADP employment data with the nonfarm payroll (NFP) report to gauge overall labor market momentum. This comparative approach gives global traders a broader view of monthly employment trends.

Summary of Key Differences

| Category | ADP Report | Nonfarm Payroll Report (NFP) |

| Publishing Agency | ADP Research Institute | U.S. Department of Labor |

| Coverage | Private sector employment | All nonfarm employment (including government) |

| Release Timing | First Wednesday of each month | First Friday of each month |

| Market Sensitivity | High, early indicator but volatile | Official and stable but lagging |

| Market Impact Strength | Immediate and sharp movements | Mid-term and more stable in stock/FX |

Combined Strategy Recommendation

Traders are advised to establish an initial position after the ADP report, then validate direction based on NFP data before making adjustments. Combine Ultima Markets’ platform tools with its economic calendar to align trade plans with key events.

Professional Support from Ultima Markets

Integrated Technology and Information Tools

- Real-time ADP report alerts and insights: Stay updated with live push notifications and market commentary on ADP data through the platform, allowing early positioning of your trading strategy.

- Economic calendar + Trading Central technical analysis: Integrate macroeconomic schedules with technical indicators to generate automated entry and exit signals, enhancing trading accuracy.

- Multi-platform execution via MT4/MT5 with automation support: Flexibly manage diverse trading instruments and implement EA (Expert Advisor) automated strategies, suitable for all levels of traders.

Demo Account and Educational Resources

Beginners can open a demo account and access exclusive educational content tailored to ADP employment report strategies, helping to build a personalized trading system.

Brand Value and Security Commitment

Ultima Markets offers a streamlined trading environment and robust regulatory compliance. Client funds are insured through Willis Towers Watson and regulated by the FSC, making it a reliable platform for learning and live trading of ADP reports.

Conclusion

The ADP employment report offers forward-looking guidance for the forex market. The May 2025 figure of 37,000 new jobs indicates growing volatility in the U.S. labor market. It is recommended to utilize Ultima Markets’ real-time alerts, technical tools, and demo account features. Whether you’re a beginner or experienced trader, the ADP-specific learning materials and simulated trading environment will help enhance your decision-making quality.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.