Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website2025 Top 5 High Risk High Reward Stock

Looking to supercharge your portfolio in 2025? A high risk high reward stock is capable of soaring 200% or dropping 80% in months. For bold investors and tactical traders, they represent rare opportunities to outperform the market.

In this article, we spotlight 5 high risk high reward stocks poised for potential breakouts in 2025 based on real catalysts, sector momentum, and speculative buzz.

Introduction to Investing in High Risk Stocks

Investing in high risk stocks can feel intimidating, but for many investors, the potential for outsized gains is too compelling to ignore. High risk stocks (often referred to as growth stocks) are known for their high volatility and the possibility of rapid capital appreciation. These stocks are frequently found in fast-evolving sectors like artificial intelligence, where innovation and demand can drive dramatic price swings.

When adding high risk stocks to your investment portfolio, it’s crucial to remember that only a small portion should be allocated to these positions to help manage potential losses. Many investors follow a portfolio split, such as the 70/20/10 rule, to balance their investments between low, medium, and high risk categories. By keeping high risk stocks as a smaller part of your overall portfolio, you can pursue growth while protecting your capital from excessive volatility.

What Makes a Stock High Risk and High Reward?

- Extreme volatility and unpredictable earnings

- Speculative catalysts like FDA approvals, tech breakthroughs, or hype cycles

- Often small or mid-cap companies in fast-moving industries

- May attract traders due to momentum or narrative appeal, rather than solid fundamentals

- This type of stock is considered high risk because it often operates in an emerging or disruptive industry, lacks a safe and stable value, and does not offer the reliability of traditional value stocks.

For example, a biotech startup awaiting FDA approval is considered a high risk high reward stock due to its unproven product and the volatile nature of the industry.

Top 5 High Risk High Reward Stocks for 2025

*Disclaimer: This list of top 5 stocks is speculative and based on research and analysts’ opinions for the period ending in Aug 2025. The stocks are ranked according to their high risk high reward potential. Always perform your own due diligence.

1. Palantir Technologies (NYSE: PLTR)

Sector: AI & Big Data

Why Watch:

Palantir has delivered outstanding growth in 2025, with Q2 revenue surpassing US$1 billion—up ~48% year-over-year. Palantir’s services in AI and data analytics have positioned it as a leader in providing comprehensive solutions to both government and enterprise clients. The company is riding the AI boom with lucrative U.S. government contracts, reported with a potential $10 billion U.S. Army deal by The Guardian.

Over the past several years, Palantir has achieved strong performance, consistently setting new revenue benchmarks and reaching a number of key financial milestones. Significant capital invested in Palantir has helped the company achieve its ambitious growth targets by the end of each period. Analysts have given Palantir a strong buy or buy rating based on its recent performance, often comparing its results to major benchmark indices.

While bulls are excited about Palantir’s growing enterprise presence, skeptics point to its sky-high valuation. With a beta around 1.8, this stock is nearly twice as volatile as the S&P 500—making it a textbook high-risk, high-reward play.

2. Tonix Pharmaceuticals (NASDAQ: TNXP)

Sector: Biotech

Why Watch:

Tonix is a micro-cap biotech with multiple drugs in the pipeline, including TNX‑102 SL for fibromyalgia—currently awaiting a key FDA decision in mid-August 2025. Approval would make it the first new fibromyalgia drug in over 15 years, as sourced from Nasdaq.

This binary event could make or break the stock. Tonix has experienced a massive YTD drop (~98%) and underwent a 1-for-32 reverse split earlier this year. As seen in the chart, the stock sharply declined around 10 June, reflecting investor caution ahead of the decision. It’s a classic biotech moonshot—high volatility, uncertain outcome, but huge potential return if the FDA gives a green light.

3. SoundHound AI (NASDAQ: SOUN)

Sector: Voice AI

Why Watch:

SoundHound is a small-cap AI stock that develops voice recognition solutions. It signed a 7-year partnership with Hyundai in 2022 and in 2025 has expanded into the restaurant sector via a deal with Acrelec, enhancing drive-thru ordering systems.

It’s still not profitable and faces strong competition—but strong enterprise adoption news can send the stock flying.

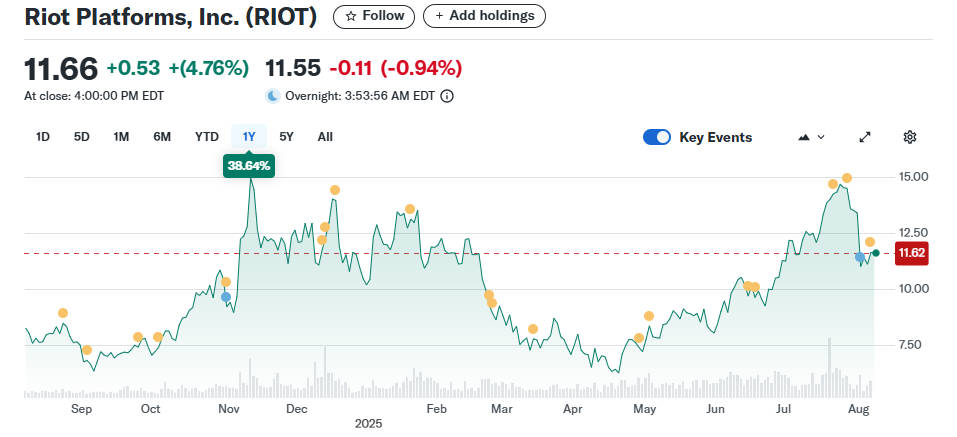

4. Riot Platforms (NASDAQ: RIOT)

Sector: Crypto Mining

Why Watch:

Riot Platforms remains a textbook example of a high-risk, high-reward stock, closely tied to the fortunes of Bitcoin. While the company reported a strong Q2 2025, with revenue surging 118% YoY to $153 million and net income hitting $219 million; its stock recently plunged over 17% in a single day, extending a six-day losing streak.

The sharp drop was largely triggered by a combination of two external shocks: a pullback in Bitcoin prices and renewed market fears following former President Donald Trump’s announcement of tariffs on U.S. imports. Given Riot’s core exposure to the crypto ecosystem, particularly mining operations, its share price remains highly sensitive to macro-driven sentiment shifts and Bitcoin volatility.

Despite the recent dip, Riot’s long-term potential remains tied to the 2024 Bitcoin halving event, increased institutional crypto interest in 2025, and its ability to capitalise on rising mining demand. This makes it a highly speculative but potentially rewarding play for investors with a strong risk appetite.

5. IonQ Inc. (NYSE: IONQ)

Sector: Quantum Computing

Why Watch:

IonQ leads the charge in quantum hardware, backed by strategic partnerships with major cloud platforms and U.S. government agencies. Though still in the early stages with limited revenue, its position at the forefront of commercial quantum computing gives it significant upside potential. The promise of breakthroughs in quantum performance or new enterprise applications could send the stock soaring.

In 2025, IonQ remains one of the most speculative tech bets. Its share price is highly sensitive to news around R&D milestones, research collaborations, or government funding announcements. For example, even small advancements in trapped-ion quantum computing or long-term federal contracts can spark double-digit percentage spikes within days. This high beta behaviour makes IonQ both a volatile and potentially explosive play—perfectly suited for investors chasing innovation-driven gains.

Risk vs Reward: Trade Smart in 2025

While the upside on these stocks can be jaw-dropping, the risk is real. Some of these companies are burning cash fast, others are at the mercy of market hype or unpredictable catalysts.

Top tips to manage risk:

- Limit your position size per trade

- Use stop-losses and defined exits

- Don’t chase pumps, trade with a plan

- Stay updated on earnings, clinical trials, or tech demos

- Diversify within your speculative basket

Final Thoughts

High risk high reward stocks aren’t about safety, they’re about strategy, timing, and conviction. In 2025, the right pick at the right time could outpace the market by 10x.

At Ultima Markets, we help traders seize opportunities with expert market insights, tools, and real-time analysis.

Ready to explore your next moonshot?

Start building your high risk watchlist today, because we trade smarter, not just harder.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.