Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is The Triple Bottom Pattern?

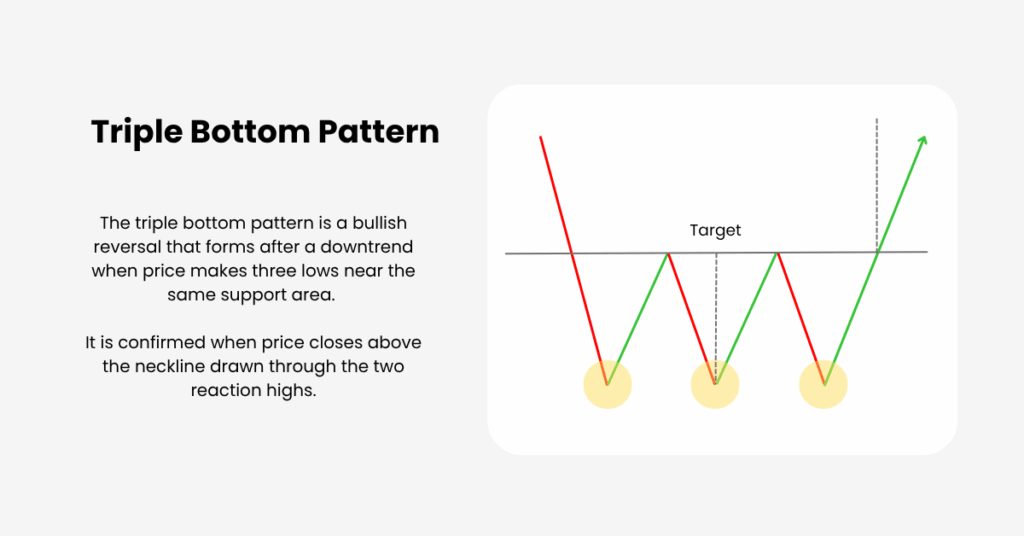

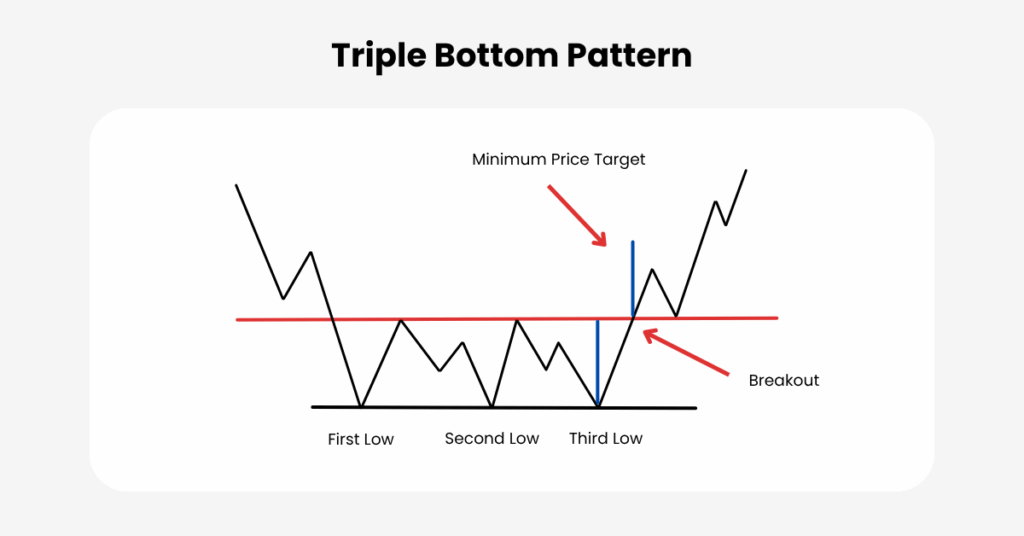

The triple bottom pattern is a bullish reversal setup that forms after a downtrend. Price tests the same support zone three times, fails to break lower, and then closes above neckline resistance. That breakout signals a shift in control from sellers to buyers and sets up a new uptrend.

This article will show you how to identify the triple bottom pattern, confirm it with volume and indicators, and manage entries, stops, and targets with confidence.

How The Triple Bottom Pattern Forms

Understanding the sequence helps you recognise quality from noise.

- Preceding Downtrend

The pattern carries meaning only after a genuine decline, which creates the conditions for reversal. - Three Distinct Lows In One Support Area

The first low attracts bargain interest, the second low validates demand, and the third low shows supply is fading. Think of a support band rather than a single price. - Two Reaction Highs Create The Neckline

The bounces between lows draw a horizontal or gently sloped neckline. This line becomes the confirmation level. - Breakout And Optional Retest

A close above the neckline confirms the pattern. A controlled pullback that holds near the neckline often offers a secondary entry.

With the structure set, the next question is why this sequence implies a shift in control.

Market Psychology In One Pass

The psychology explains the edge.

At the first low, buyers appear but bears still dominate. The second low shows sellers cannot extend the trend, which strengthens confidence in support. By the third low, short sellers lose conviction and fresh buyers step in. When price closes above the neckline, trapped shorts cover and momentum flips. This narrative sets up the rules for entries, stops, and targets.

Indicator Confirmations That Improve Quality

We now connect price structure to objective tools that confirm strength.

- Volume, OBV, VWAP

Breakouts with expanding volume are higher quality. Rising On-Balance Volume during the right side of the base signals accumulation. On intraday charts, holding above VWAP after breakout supports buyer control. - MACD

A bullish line crossover around the third low or on the breakout aligns momentum with the pattern. A rising histogram from negative toward zero strengthens the case. - RSI

A move back above 50 after the breakout is constructive. Bullish RSI divergence at the third low (price equal or lower low while RSI prints a higher low) shows waning downside pressure. - Fibonacci Retracements

Map 38.2 percent to 61.8 percent zones inside the base and near the neckline. After breakout, pullbacks into these levels help frame secondary entries and stop placement.

With structure and confirms aligned, you can formalise execution.

Trading Rules And Risk Plan

Rules translate the pattern into repeatable decisions.

Entry

- Conservative entry on a closing break above the neckline.

- Aggressive entry on a successful neckline retest that forms a higher low.

Stop Loss

- Classic placement just below the lowest of the three bottoms, with a small buffer such as one ATR.

- Tighter variant inside the structure under the most recent swing low to improve reward to risk, accepting a higher chance of being stopped.

Profit Targets

- Measured move: distance from the lowest bottom to the neckline projected upward from the breakout.

- Consider scaling out at one times risk, then trail below higher swing lows or a rising short-term moving average.

Invalidation

- A decisive close back below the neckline after confirmation, or a fresh lower low beneath the third bottom, voids the setup.

Before placing orders, compare the triple bottom to similar patterns to avoid mislabels.

Triple Bottom Versus Similar Patterns

Differentiation avoids false assumptions and keeps your rules consistent.

- Double Bottom

Two lows rather than three. Triple bottoms usually imply stronger base building but occur less frequently. - Inverse Head And Shoulders

Three swing lows as well, but the middle low is deeper. Both rely on a neckline break; the choice depends on which geometry the chart truly displays. - Triple Top

The bearish mirror image with three highs at resistance and a breakdown trigger. Knowing the opposite helps you read failed reversals faster.

With the distinctions clear, the next step is a practical workflow you can apply on any market.

Practical Workflow You Can Repeat

Here is a simple sequence investors can follow to connect scanning, confirmation, and execution.

- Scan

Look for three separated troughs after a clear downtrend, with a flat or gently sloped neckline that is easy to draw through the two reaction highs. - Validate

Confirm accumulation with volume expansion on rallies, rising OBV, MACD turning up or crossing bullish, and RSI back above 50 or showing bullish divergence at the third low. - Plan Risk

Set position size, choose a stop just below the lowest trough with a small buffer, and define a measured move target before you place any order. - Execute

Enter on a closing breakout above the neckline or on a controlled retest that holds as new support, and place your stop immediately. - Manage

Take partial profits around 1R, trail the stop under higher swing lows or a short moving average, and avoid stacking correlated longs that move together.

Conclusion

The triple bottom pattern links a clear price structure to a shift in market psychology. Three tests of support prepare the ground, the neckline defines the moment of confirmation, and indicator evidence helps filter stronger opportunities.

When you combine disciplined entry tactics, protective stops, and measured targets with strict risk control, the pattern becomes a practical framework rather than a chart curiosity. Use the workflow, avoid the common traps, and let only the best-formed bases through your checklist.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.