Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhy Oman Currency Is So Strong?

The Omani rial (OMR) remains strong due to a combination of factors such as a fixed exchange rate pegged to the US dollar, substantial oil revenues, prudent fiscal and monetary policies, and ongoing economic diversification. These measures ensure stability, investor confidence, and the currency’s long-term strength.

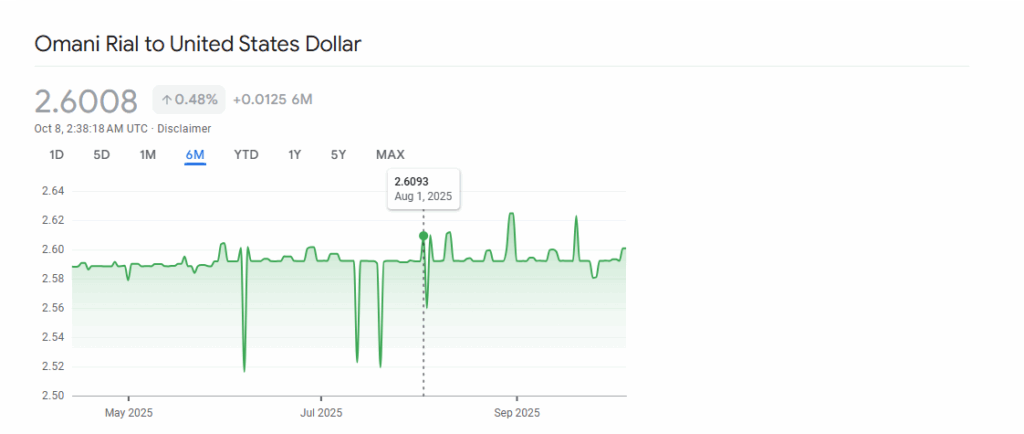

The Omani rial (OMR) consistently ranks among the world’s strongest currencies, often behind only the Kuwaiti dinar and Bahraini dinar. As of mid-2025, 1 OMR equals approximately 2.60 USD, supported by a fixed US dollar peg, strong oil revenues, prudent fiscal policies, and economic diversification, all of which ensure long-term stability and investor confidence.

Oil Revenues Support the Omani Rial

Oman’s economy relies heavily on its oil sector, which directly strengthens the Omani rial (OMR). Revenue from oil exports provides foreign currency inflows, helping the Central Bank of Oman maintain the rial’s fixed peg to the US dollar.

- Stable Foreign Reserves – Oman holds significant foreign currency reserves, allowing the central bank to intervene in currency markets and maintain OMR stability even during global market fluctuations.

- Export Revenue Consistency – In 2025, Oman produces around 363 million barrels of oil per year, with exports accounting for the majority of national revenue. This steady inflow of USD strengthens the rial and ensures fiscal balance.

- Oil Price Influence – Higher global oil prices increase government revenue, allowing Oman to prepay foreign debt, fund economic diversification, and maintain low inflation, all of which reinforce currency strength.

- Investor Confidence – Consistent oil income signals economic stability to international investors, further supporting the rial’s strength in the global market.

- Strategic Reserves Management – The government uses oil windfalls to maintain a buffer against external shocks, making the OMR one of the most resilient currencies in the region.

Oil revenues provide the financial backbone that allows Oman to keep the rial strong, stable, and attractive to investors, complementing other measures like fiscal discipline and monetary policy.

Fiscal Discipline Enhances Currency Strength

Oman’s government relies on prudent fiscal management to maintain currency stability. By managing debt carefully and prepaying foreign loans, the government reduces vulnerability to external shocks. Maintaining balanced budgets, even during periods of volatile oil prices, ensures that the country does not run large deficits that could weaken investor confidence.

- Investor Confidence: Credit rating agencies such as Moody’s upgraded Oman to Baa3 in 2025, citing improved fiscal metrics, lower debt-to-GDP ratios, and responsible budgeting.

- Economic Resilience: Fiscal discipline allows Oman to fund strategic projects, maintain foreign reserves, and provide stability to the OMR, even if oil revenues temporarily dip.

Monetary Policy Maintains Inflation Control

The Central Bank of Oman (CBO) plays a crucial role in protecting the rial’s purchasing power. Its key tools include:

- Interest Rate Management: By adjusting interest rates in line with global market conditions, the CBO can attract foreign investment, supporting demand for OMR.

- Inflation Control: Targeted monetary measures keep inflation low and predictable, ensuring that consumer prices remain stable and the OMR retains value.

Stable monetary policy not only reassures residents but also strengthens international investor confidence, reducing currency volatility.

Economic Diversification Reduces Oil Dependence

Oman’s Vision 2040 strategy aims to lessen reliance on oil by developing alternative sectors:

- Tourism: Expanding luxury, cultural, and eco-tourism to attract foreign spending.

- Logistics and Ports: Leveraging Oman’s strategic location along the Arabian Sea for trade hubs.

- Manufacturing and Technology: Promoting local production and tech-driven industries.

Diversification reduces vulnerability to oil price shocks, creating multiple revenue streams that sustain the rial’s strength over the long term.

Global Trade and Investment Attract Demand

Oman’s strategic geographic location and open trade policies enhance demand for the OMR:

- Geopolitical Stability: A secure environment attracts multinational companies and foreign investors.

- Trade Networks: Expanding import-export networks increases the need for OMR in international transactions.

- Investor-Friendly Policies: Reforms and incentives encourage foreign direct investment (FDI), which supports currency demand.

Higher global demand for OMR helps maintain its exchange rate and supports long-term stability.

Central Bank Oversight Ensures Stability

The Central Bank of Oman safeguards financial and currency stability through:

- Regulation of Banks: Ensuring that financial institutions operate safely and meet liquidity requirements.

- Market Intervention: Buying or selling foreign reserves to maintain the rial’s peg.

- Transparent Communication: Keeping markets informed to prevent speculative attacks or panic selling.

Active oversight strengthens confidence among international investors and domestic participants, keeping the OMR stable during periods of volatility.

Credit Ratings Reflect Economic Health

Investment-grade credit ratings signal economic stability and attract capital:

- Moody’s Baa3 Upgrade (2025): Indicates reduced fiscal risk and better debt metrics.

- Investor Confidence: Strong ratings make Oman more attractive to global investors seeking stable currencies.

Improved creditworthiness directly supports demand for the OMR and enhances its strength in global markets.

Inflation Control Preserves Currency Value

Stable inflation is critical for maintaining the rial’s purchasing power:

- Low Inflation: Prevents erosion of consumer savings and stabilizes living costs.

- Predictable Prices: Helps businesses plan investments and operations effectively.

- Complementary to Monetary Policy: Reinforces the fixed USD peg, keeping the OMR reliable for international trade.

Effective inflation management ensures that Oman’s currency remains one of the strongest in the world, both for residents and investors.

Conclusion

The Omani rial (OMR) remains one of the strongest currencies in the world thanks to a combination of a fixed USD peg, robust oil revenues, fiscal discipline, monetary stability, economic diversification, and investor-friendly policies.

For traders and investors, understanding the factors behind Oman currency strength is essential when engaging in commodities trading, particularly in oil and gas markets. Oman’s substantial oil exports directly influence the rial’s value, making OMR-linked positions more predictable. A strong and stable currency allows commodities traders to better manage foreign exchange risk and plan investments with confidence. By monitoring Oman’s fiscal policies, oil production, and global oil prices, traders can anticipate currency movements that may impact commodities pricing and returns. In essence, Oman currency strength provides a reliable foundation for strategic trading and investment in energy and commodities markets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.