Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteFutu Stock Forecast 2030: What Can Investors Expect?

Futu’s stock price in 2030 could fall anywhere between $250-$450, depending on factors like global market expansion, technology adoption, and the regulatory landscape. Investors should keep a close eye on these factors when making investment decisions.

While stock price projections for 2030 can be challenging due to the volatility and unpredictability of global markets, analysts are generally optimistic about Futu’s growth potential given its strong positioning in the global fintech market.

Growth Based on Global Expansion

As Futu expands its services in international markets like the United States, Southeast Asia, and Europe, its revenue base could increase substantially. If Futu can successfully increase its market share, we could see a steady rise in stock price. Depending on the success of its expansion, Futu’s stock could hit $300-$400 per share by 2030. This assumes the company continues to attract a growing number of users and generate stable revenue streams from both trading commissions and wealth management services.

Technological Growth

Futu’s continued investment in AI and machine learning could provide it with a competitive edge in offering more advanced and personalized trading tools. If Futu successfully capitalizes on technological trends and attracts a significant user base, analysts might project the stock to rise to a target range of $350-$450 by 2030. However, this depends on successful execution and adoption of these technologies.

Regulatory and Market Challenges

Chinese regulations and global market volatility remain risks to Futu’s stock price. If the company faces regulatory hurdles or market downturns, stock price growth could be subdued. However, if Futu can navigate these challenges and maintain its growth trajectory, the stock could still achieve moderate growth, staying within the $250-$300 range.

Several financial analysts have a positive outlook for Futu, forecasting steady long-term growth based on the company’s innovative business model and global expansion strategy. However, the Chinese regulatory environment and competition in fintech could create volatility in the short term, making precise price predictions difficult.

What is Futu Stock?

Futu Holdings Limited (NASDAQ: FUTU) is an innovative online brokerage firm founded in 2012, providing a suite of investment services including commission-free trading of stocks, options, ETFs, and more. Based in Hong Kong, Futu is making waves in the fintech sector, offering a robust trading platform known as moomoo, which combines advanced tools, social networking, and education to attract a growing user base globally.

As of today, Futu operates in multiple countries, including the United States, Singapore, and China, and continues to expand its reach. As an early mover in the digital brokerage sector, Futu has carved a niche in providing low-cost, technology-driven services.

Is Futu a Chinese Company?

Yes, Futu is based in China, though it operates from Hong Kong. It primarily serves Chinese investors, but its service offerings extend to U.S. and international markets. The company is part of the fintech revolution that has transformed the brokerage landscape, especially within China’s growing middle class and the global millennial investor market.

Key Takeaway: Although Futu is a Chinese-origin company, its global expansion strategy is clear, as it competes on a global scale with other fintech giants like Robinhood and Charles Schwab.

Futu Stock Price

Futu Stock Price has experienced significant fluctuations since its IPO in 2019. However, the stock has been heavily influenced by the shifting market sentiments in both China’s regulatory environment and global fintech trends.

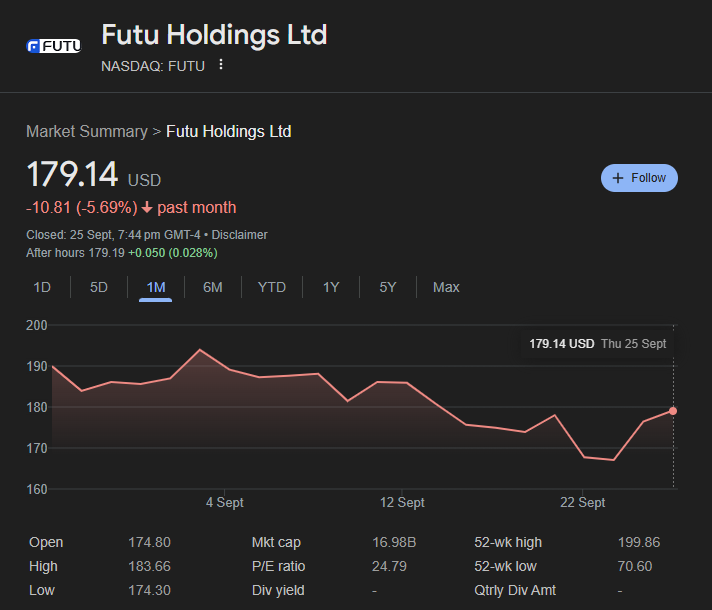

As of the latest available data on Friday, September 26, 2025, Futu Holdings Ltd (NASDAQ: FUTU) is trading at $179.14, reflecting a 1.32% increase from the previous close. This uptick is part of a broader positive trend for Futu, with the stock up over 120% year-to-date and 134% from its April low, driven by strong earnings, global expansion, and favorable analyst sentiment.

How Does Futu Earn Money?

Futu’s revenue model is multi-faceted, including a combination of transaction fees, subscription-based services, and margin trading. Here’s a detailed breakdown:

- Trading Commissions: Futu generates revenue through transaction fees on stock, ETF, and options trades. While commissions are low (or nonexistent in some regions), the volume of trades helps boost revenue.

- Margin Lending: Just like its competitors, Futu earns interest on loans provided to margin traders. This accounts for a significant portion of its earnings.

- Wealth Management and Financial Advisory Services: Futu offers a premium wealth management service to its clients, which generates subscription-based revenue.

- Premium Subscriptions for Moomoo: Futu’s trading app moomoo offers premium subscriptions for advanced charting tools, real-time market data, and additional research services.

Is Futu a Good Stock to Buy?

Futu (NASDAQ: FUTU) can be a good stock to buy for investors seeking exposure to the growing fintech and online brokerage sectors. The company has shown strong growth potential, especially with its global expansion, technological innovations, and mobile-first platform (moomoo). However, Futu also faces risks, including regulatory challenges in China and competition from other brokerage firms.

Pros:

- Strong growth prospects from international market expansion.

- Cutting-edge AI-driven tools for investors, giving it a competitive edge.

- Low-cost trading model attracting a large, tech-savvy user base.

Cons:

- Regulatory pressures in China could create volatility.

- Intense competition in the global brokerage space.

Overall, Futu may be a good investment for long-term growth if the company successfully navigates its challenges and capitalizes on its technological advancements. Investors should monitor market conditions and regulatory developments before making a decision.

Conclusion

For investors with an eye on global fintech trends, Futu (NASDAQ: FUTU) offers significant growth potential, particularly through its international expansion and technological innovations. Its AI-powered trading tools and moomoo platform position the company as a strong competitor in the online brokerage space. However, potential investors must weigh this growth against the regulatory challenges in China and the competitive landscape in the fintech sector.

For Ultima Markets investors, the key takeaway is that Futu represents an intriguing opportunity in the tech-driven brokerage space, but the stock may also be volatile. As Ultima Markets continues to expand its footprint and innovate, keeping an eye on companies like Futu can provide valuable insights into the evolving fintech ecosystem. Still, thorough research and monitoring of regulatory changes and global market trends are crucial to making informed investment decisions in this space.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.