Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhy the Stubhub IPO was Oversubscribed

StubHub’s IPO was more than 20 times oversubscribed, showing extremely high investor demand.

Strong brand recognition and market share

StubHub is one of the most recognizable names in online ticket resale. In the U.S. and globally, it competes directly with Ticketmaster and Vivid Seats. Investors often favor brands with established network effects: the more buyers and sellers use StubHub, the stronger the platform’s moat becomes. That recognition translated into heavy institutional demand during the IPO book-building.

Investor appetite for consumer-tech IPOs in 2025

After a slower IPO market in 2022–2023, 2025 has seen renewed enthusiasm for high-profile listings. Strong debuts from other consumer and tech names have made institutions eager to secure allocations in anything with growth potential. This “pent-up demand” added fuel to StubHub’s order book.

Limited float creates scarcity

StubHub offered about 34 million shares out of a much larger outstanding total. This limited float less than 10% of the company, meant supply was tight relative to demand. Scarcity almost always drives oversubscription.

Underwriter strategy

Lead banks (J.P. Morgan, Goldman Sachs) are experienced at pricing IPOs to maximize demand. They marketed shares in a range of $22–$25, ultimately pricing at $23.50. Setting the range slightly conservative helps generate a “fear of missing out” (FOMO) effect, leading to more institutional orders.

What Oversubscription Signals

- Positive signal: It shows broad institutional interest and confidence in StubHub’s brand and long-term potential. High oversubscription also improves liquidity on day one and creates buzz that can attract retail investors.

- Cautionary note: Oversubscription does not guarantee price gains. If priced aggressively, or if fundamentals disappoint, shares can still fall post-IPO. For example, heavily oversubscribed IPOs like Deliveroo (2021) struggled after listing because profitability wasn’t clear. Investors need to separate demand hype from financial reality.

Implications For Different Investors

- Institutions: Likely received smaller-than-requested allocations. Many will turn to the open market to top up holdings, potentially pushing early trading higher.

- Retail investors: With limited primary access, most must buy in the secondary market. Here, timing is critical, entering at a high opening price carries risk if momentum fades.

- Long-term holders: Oversubscription indicates interest, but the real driver of performance will be revenue growth, profitability, and the ability to defend market share against rivals.

Financials & Risks

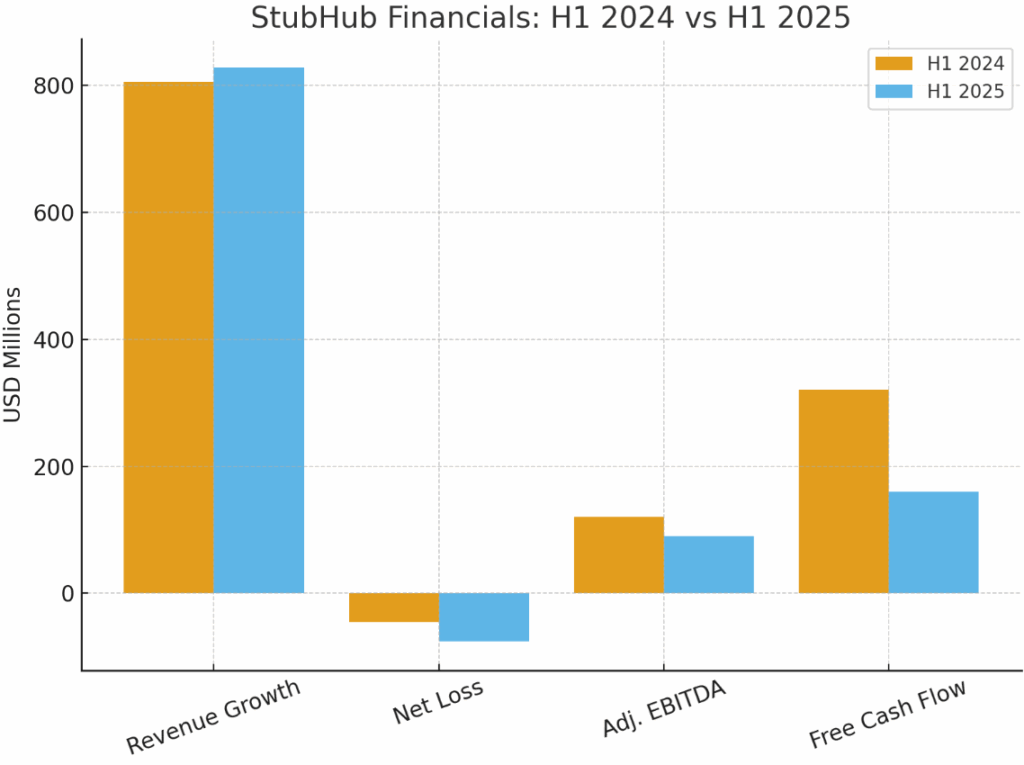

Revenue growth is slowing

StubHub reported revenue of ~$828 million in the first half of 2025, up only about 3% year-on-year. For a company valued at $8.6 billion, that modest growth rate is concerning. Investors generally expect newly public growth companies to deliver double-digit expansion. The slowdown raises questions about whether StubHub’s business has matured or whether it can re-accelerate through new products and geographies.

Losses are widening

Despite higher revenues, StubHub’s net loss expanded to ~$76 million in H1 2025, compared with a smaller loss in the prior year. This widening suggests that operating costs including marketing, platform investment, and transaction support are outpacing revenue growth. Consistent losses can limit flexibility and weigh on investor confidence, particularly if interest rates remain high and capital is more expensive.

Declining profitability metrics

Adjusted EBITDA, a common metric investors use to gauge underlying profitability, fell more than 25% in H1 2025 compared with the same period in 2024. That signals declining efficiency. Even more worrying, free cash flow dropped by around 50% to about $160 million, meaning StubHub is generating less cash to reinvest in growth or reduce debt.

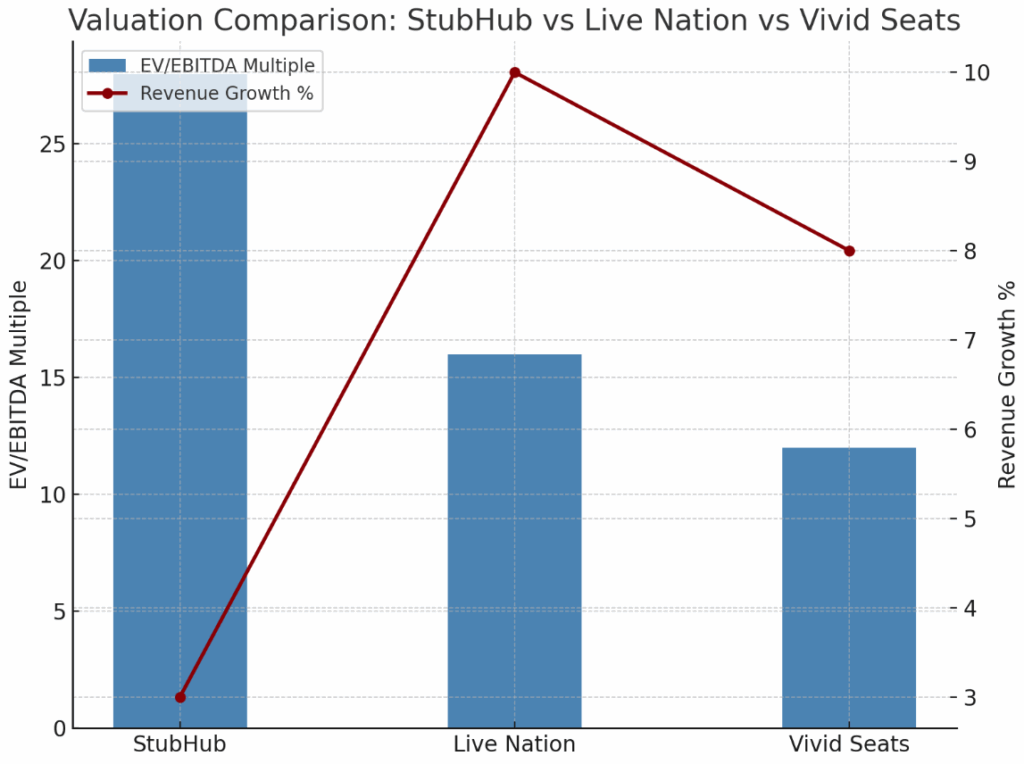

Valuation is rich compared with peers

At its IPO price, StubHub’s enterprise value relative to EBITDA is significantly higher than established peers like Live Nation or even platform companies like Airbnb. This premium implies investors are paying up for growth that has yet to materialize. Unless StubHub can demonstrate faster revenue gains or a turnaround in profitability, the multiple could compress, pressuring the stock price.

Market and regulatory risks

StubHub’s business model depends heavily on the live events industry, concerts, sports, theater. Demand is cyclical and sensitive to macro conditions. Any downturn in discretionary spending or event attendance could hit ticket volumes. In addition, regulators in several countries are examining ticket resale practices, with potential rules on price caps or disclosure requirements. Such measures could limit StubHub’s margins.

Execution challenges

StubHub has announced partnerships (e.g., with Major League Baseball) and expansion into merchandise and sponsorship. These initiatives could support growth but also require execution discipline. If integration or scaling costs rise faster than revenue contribution, profitability could deteriorate further.

When is StubHub IPO

StubHub’s IPO priced on September 16, 2025, and the company began trading on the New York Stock Exchange under ticker STUB on September 17, 2025.

Key timeline:

- IPO pricing date: September 16, 2025 (U.S. time)

- First trading day: September 17, 2025 (NYSE: STUB)

- Ticker symbol: STUB

- Lead underwriters: J.P. Morgan, Goldman Sachs

If you’re in Asia (GMT+8), StubHub’s trading debut occurred late evening September 17 or early September 18, depending on market hours.

How to Buy StubHub IPO Shares

Since the IPO has been priced and shares are now trading, here are ways and tips:

Primary allocation (if still open):

If your brokerage or IPO platform had access to the offering before pricing, you could have applied for shares. But with 20× oversubscription, many allocations (especially for small/retail investors) are likely scaled back.

Secondary market purchase:

After trading opens on Sept 17, 2025, buy via any brokerage that offers U.S. stock trading. Look for ticker STUB on NYSE.

Watch for lock-up expiration / insider sell-off:

IPOs often have a lock-up period (e.g., 90‐180 days) for insiders. Once that ends, supply increases, potentially affecting price. Check the prospectus for lock-up duration.

Evaluate risk vs reward carefully:

Given high valuation, weak profitability, and competition, consider setting a limit order or waiting for post-IPO earnings to assess performance.

StubHub vs Other Recent IPOs

Valuation multiples

At its IPO price of $23.50 per share, StubHub was valued at about $8.6 billion. That translates into a much higher enterprise value-to-EBITDA multiple compared to peers:

- StubHub: trading at a premium based on estimated 2025 EBITDA (multiple significantly above industry averages).

- Live Nation (LYV): valued lower on an EV/EBITDA basis despite being a larger, vertically integrated ticketing and events powerhouse.

- Airbnb (ABNB): also enjoys network effects, but its multiple is supported by higher revenue growth and improving profitability.

This premium pricing signals investor optimism, but it leaves StubHub with a narrow margin for error if financial results don’t improve.

Revenue and growth trajectory

- StubHub: H1 2025 revenue growth was only ~3% year-on-year, while losses widened.

- Vivid Seats (SEAT): showed stronger top-line momentum in 2024–2025, though from a smaller base.

- Airbnb and Uber: other recent platform IPOs/post-IPO stories demonstrate that investors will tolerate losses if growth is fast. StubHub’s slower growth puts it under heavier scrutiny.

Oversubscription vs performance

Many IPOs are oversubscribed, but oversubscription does not guarantee sustained gains. Examples:

- Arm Holdings (2023): heavily oversubscribed, traded up initially, but later pulled back as valuation concerns resurfaced.

- Deliveroo (2021): oversubscribed but struggled post-IPO due to profitability doubts. StubHub’s 20× oversubscription may drive a strong opening, but history suggests fundamentals must back up the hype.

Market positioning

- StubHub: strength lies in brand and user base in ticket resale, but faces regulatory risk and competition from Ticketmaster, Live Nation, and Vivid Seats.

- Peers: Companies like Airbnb and Uber diversified revenue streams beyond their initial core. StubHub still leans heavily on event ticketing, which is cyclical and discretionary.

Conclusion

StubHub’s IPO tells a two-sided story. On one hand, demand was extraordinary, the deal was 20× oversubscribed, raising nearly $800 million at a valuation of $8.6 billion. This reflects the strong appetite for high-profile consumer platforms as the IPO market reawakens.

On the other hand, the financials raise caution. Revenue growth has slowed to just a few percent, losses are widening, and cash flow has halved. Against competitors like Live Nation or Airbnb, StubHub is trading at a premium multiple. Oversubscription shows enthusiasm, but sustained performance will depend on whether StubHub can prove that growth and profitability are back on track.

For traders and investors, the key lesson is balance: enthusiasm should be measured against fundamentals. Short-term volatility is likely, and long-term outcomes hinge on execution, regulation, and the resilience of the live events sector.

At Ultima Markets, we believe knowledge is the foundation of smart trading. By staying informed about events like the StubHub IPO, you can approach opportunities with clarity, manage risks responsibly, and make decisions that align with your goals. Markets move fast but with the right insights, you trade with purpose.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.