Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomDead Cat Bounce Explained for Traders

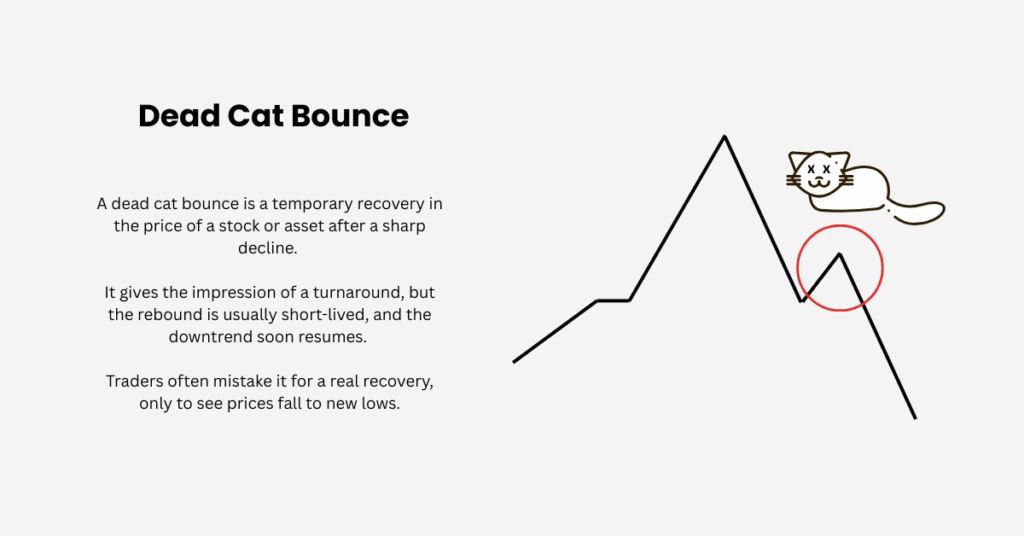

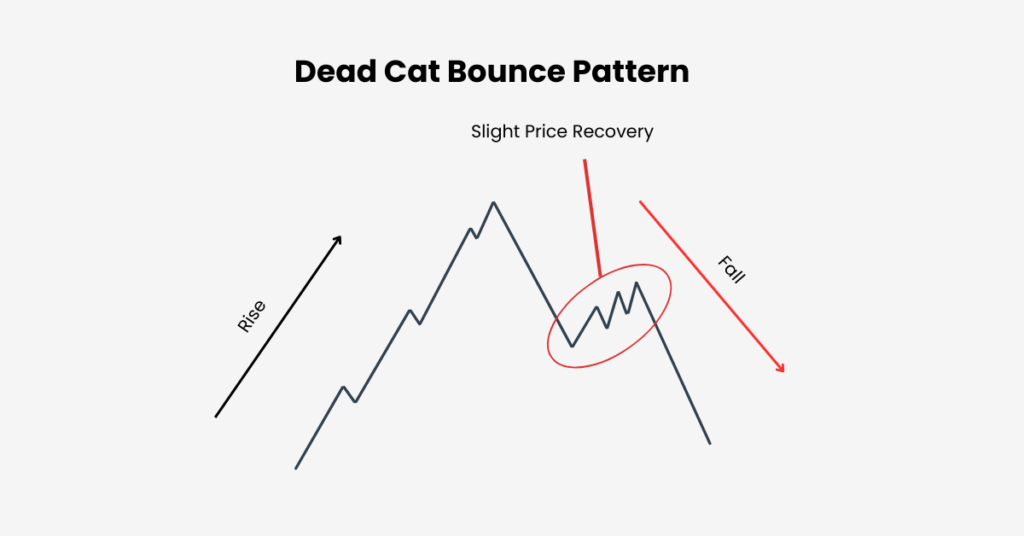

When markets fall sharply, traders often look for signs that the worst is over. Broader declines are usually tied to economic conditions, as macro factors drive investor sentiment. But not every rebound signals recovery. One of the most deceptive moves is the dead cat bounce — a short-lived rally that looks like a turnaround but usually ends with prices sliding even lower.

A dead cat bounce occurs when an asset that has dropped significantly stages a brief recovery before resuming its downtrend. The phrase comes from the saying that even a dead cat will bounce if it falls from high enough. In trading, it means that after a stock falls 20, 30, or even 40 percent, it can still jump back temporarily. But this bounce rarely lasts, and more often than not, it simply marks a pause before the decline continues.

Why the Dead Cat Bounce Happens

Two main forces drive this pattern. The first is short covering. After a steep drop, traders who bet against the stock often lock in profits by buying it back, sparking a temporary surge in demand. The second is investor psychology. When a stock has been beaten down, bargain hunters jump in, convinced the fall is overdone and that the company won’t go to zero. They hope to profit from a quick rebound.

Together, these factors create the illusion of a turnaround. But without fundamental strength to support the rally, the gains fade and latecomers end up trapped as the downtrend resumes. Identifying whether a bounce is real or just temporary is notoriously difficult, which is why so many investors get caught.

Volatility and the Risk of False Signals

Periods of high market volatility make dead cat bounces even harder to spot. Prices swing wildly, sometimes climbing 10 or 20 percent in a matter of days, only to reverse just as quickly. Technical analysts look for clues in trading volume, moving averages, and resistance levels, but even with the best tools, it’s easy to misread a false rally as a recovery.

The danger for investors is obvious. Buying into a stock during one of these rebounds can lead to losses when prices break new lows. That’s why discipline and risk management are critical, especially in bear markets where sharp rallies are common.

A Real Example of a Dead Cat Bounce: Yes Bank

The story of Yes Bank illustrates the trap perfectly. The stock plunged from around 350 rupees to a fraction of its value, but along the way it staged multiple rebounds. At one point, the price doubled from 150 back to nearly 300, giving the impression of a turnaround. Yet each rally proved temporary. The stock eventually collapsed further, leaving many investors stuck at far higher entry points.

This case highlights how convincing a dead cat bounce can look in real time. Only in hindsight does it become clear that the rebound was temporary and that the downtrend was far from over.

How to Tell the Difference

The real challenge is distinguishing between a dead cat bounce and a genuine buying opportunity. A useful test is to ask why the stock is falling. Is the decline due to a one-off shock that temporarily hurts an otherwise strong company, or is it the result of deeper structural problems? If the issue is temporary, the drop might offer value. But if the fundamentals are deteriorating, the rebound is likely just a trap.

Final Thoughts

Dead cat bounces are part of every market cycle. From the dot-com bust to the global financial crisis and modern crypto crashes, they appear again and again. They remind us that not every rally is worth chasing. More often than not, when a stock has already fallen 40 or 50 percent, mid-trend rebounds are temporary and dangerous to mistake for recovery.

For traders and investors, the takeaway is clear: don’t confuse short covering or bargain hunting with true strength. Analyse the fundamentals, apply strict risk controls, and remember that many signals only reveal their true meaning in hindsight. Patience and discipline are often the best protection when volatility strikes.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.