Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat Exactly Is a Cross Currency Swap?

A cross currency swap (CCS) is a financial derivative where two parties in different countries agree to exchange currencies that they have borrowed from their domestic markets. The parties swap their debt based on an agreed exchange rate, exchanging principal amounts and making periodic interest payments in different currencies.

These swaps are commonly used to hedge currency risk, access lower borrowing costs, or speculate on currency movements. By entering into a swap, businesses and financial institutions can effectively manage their exposure to foreign currency fluctuations and take advantage of favorable lending conditions in different markets. For example, a European company might borrow euros at a lower rate and swap them with a U.S. company’s U.S. dollars at a better rate, thus managing their debt more efficiently in both currencies.

How Does a Cross Currency Swap Work?

In a typical cross currency swap, there are three main stages. First, the two parties exchange principal amounts in their respective currencies. For instance, a European company may swap euros for U.S. dollars with a U.S.-based company. This initial exchange sets the stage for the following interest payments.

During the life of the swap, both parties make periodic interest payments to each other based on the terms of their agreement. The interest rates can be either fixed (fixed interest rate) or floating, depending on the specifics of the swap. A fixed interest rate is a predetermined, unchanging rate that helps reduce interest rate risk and ensures predictable payments throughout the contract duration. These payments are made in the respective currencies agreed upon at the start.

At the end of the swap term, both parties will swap their principal amounts back, usually at the same exchange rate as initially agreed upon. If the exchange rate is not predetermined, the principal amounts may be exchanged at the spot rate, which is the current exchange rate at the time of settlement. This final exchange is what “settles” the swap.

Real-World Example

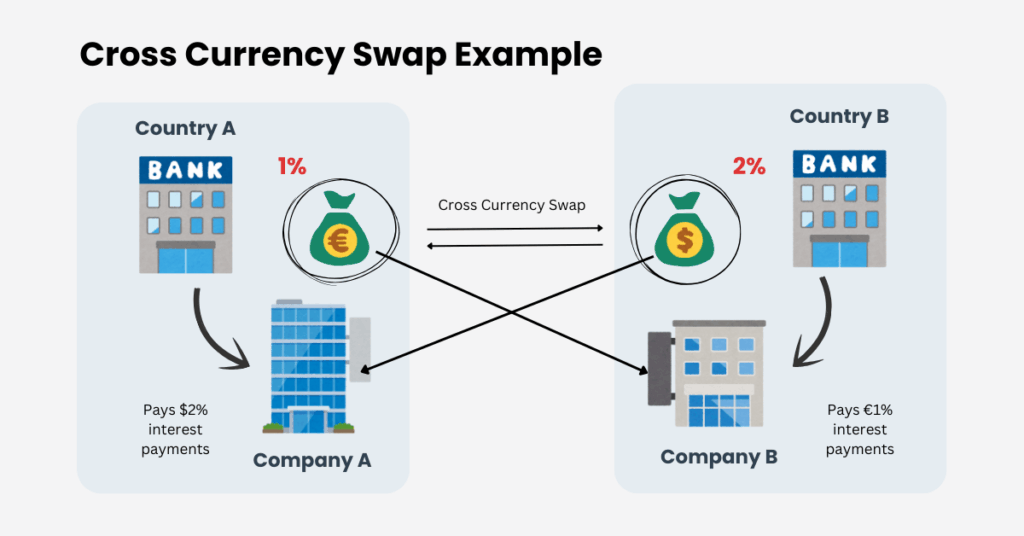

Let’s break it down with a simple example. Imagine Company A is based in Europe and has borrowed €100 million at 1% interest from a local bank. Meanwhile, Company B in the U.S. has borrowed $120 million at 2% interest from a U.S. bank. They decide to enter a cross currency swap.

- Company A agrees to pay 2% interest in U.S. dollars to Company B.

- Company B agrees to pay 1% interest in euros to Company A.

This swap helps both companies get access to the currency they need at a better interest rate than they would have paid by borrowing directly from the foreign market. After the agreed period, both companies exchange the principal amounts back, completing the swap.

Why Use a Cross Currency Swap?

Cross currency swaps offer businesses several advantages, especially for those operating internationally. These swaps provide effective solutions for managing currency risk, borrowing costs, and even speculation. Here are the key reasons why companies and investors choose cross currency swaps:

Hedging Currency Risk: For multinational corporations, exposure to currency fluctuations can significantly impact profits and costs. Cross currency swaps provide a way to lock in exchange rates and interest payments, reducing the uncertainty caused by these fluctuations.

Lower Borrowing Costs: Cross currency swaps allow companies to borrow at more favorable rates in their domestic market, which may be lower than borrowing in the foreign market. By swapping the borrowed amount into the desired currency, companies can save on interest expenses.

Speculation on Exchange Rates: Investors may also use swaps to speculate on future movements in exchange rates, betting on which currency will appreciate or depreciate relative to another.

The Benefits and Risks of Cross Currency Swaps

While cross currency swaps offer numerous benefits, they also come with inherent risks.

| Benefit | Risk |

| Lower borrowing costs via favorable exchange rates | Counterparty Risk: Default could lead to losses |

| Effective currency risk management | Market Risk: Exchange rate fluctuations affect value |

| Flexible and customizable terms | Liquidity Risk: Hard to exit swap early |

| Provides access to foreign capital at lower rates | Interest Rate Risk: Changes in rates can affect payments |

Cross currency swaps offer several benefits for businesses, including the ability to lower borrowing costs by accessing more favorable interest rates in foreign markets. This can be especially valuable when borrowing in a foreign currency is less expensive than in the domestic market.

Additionally, they also provide a way to manage currency risk by locking in exchange rates and interest payments, offering companies more predictable financial outcomes. The flexibility of these swaps is another key advantage, as the terms can be tailored to meet the specific needs of both parties, whether it’s the principal amount, interest rates, or maturity dates.

However, cross currency swaps come with their own set of risks. Counterparty risk is a significant concern, as either party may default on their obligations, leading to potential losses for the other.

Market risk is another factor, as changes in exchange rates or interest rates during the life of the swap can impact its value, resulting in unexpected costs.

Lastly, liquidity risk can arise, as cross currency swaps are typically less liquid than other financial instruments, making it difficult to unwind or adjust the swap before maturity. Despite these risks, swap banks play a crucial role in assessing creditworthiness and ensuring the swap is executed securely.

The Role of Swap Banks

Swap banks are intermediaries that facilitate cross currency swaps. They help companies find suitable counterparties for their swaps, and also assess the creditworthiness of both parties involved. By doing this, swap banks reduce the risk of default and ensure the swap goes smoothly.

They charge fees for their services, but these fees are usually lower than the quality spread differential (QSD), which is the difference between borrowing rates in domestic and foreign markets.

Conclusion

Cross currency swaps are powerful tools that allow businesses to exchange principal and interest payments in different currencies, helping them manage currency exposure and secure better borrowing rates. While these swaps are primarily used by large institutions, individual traders can still benefit from understanding how they influence exchange rates and interest rates in the forex market. Recognizing the effects of these swaps can provide valuable insights when speculating on currency movements.

For businesses looking to optimize financial strategies and manage currency exposure, Ultima Markets offers a range of tools and support to help you navigate global markets. Explore how our platform can empower your decisions and enhance your trading strategies.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.