Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

When is Nvidia Stock Split?

Nvidia’s explosive growth in AI has turned the company into a market powerhouse. Many investors are asking: when is Nvidia stock split and what does it mean for my position? The last Nvidia stock split occurred on June 10, 2024, marking the sixth time the company has done this since going public in 1999.

As Nvidia continues to dominate the AI infrastructure market with record revenue growth and partnerships across the tech sector, understanding the timing and mechanics of stock splits is crucial for both new and experienced investors. This guide breaks down everything you need to know about Nvidia stock splits—from the most recent 10-for-1 split to historical patterns and future outlook.

Key Takeaways

- Last Nvidia stock split: June 10, 2024 (10-for-1)

- Record date: June 7, 2024

- Sixth split since IPO in 1999

- Share price adjusted from ~$1,208.88 to ~$120.88

- No plans announced for another split in 2025–2026

Nvidia’s June 2024 Stock Split: Full Timeline

The June 2024 stock split was a major event reflecting Nvidia’s immense growth:

| Event | Date |

| Record Date | 7 June 2024 |

| Split Execution | 10 June 2024 |

| Split Ratio | 10-for-1 |

| Pre-split Price | ~$1,208.88 |

| Post-split Price | ~$120.88 |

If you owned 100 shares before the split, you now own 1,000 shares after—with the total value unchanged. It made the stock more affordable and boosted liquidity.

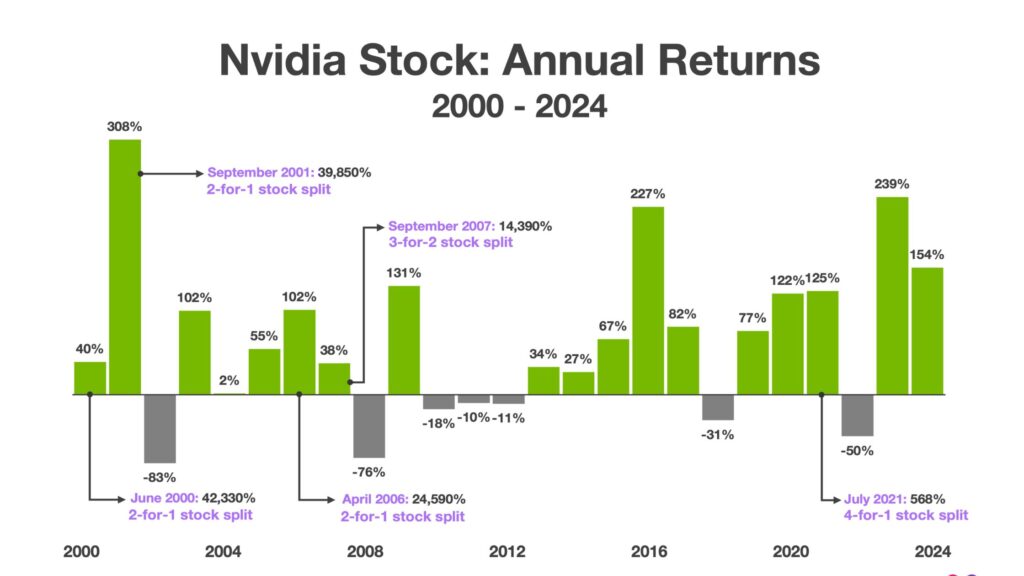

Complete History of Nvidia Stock Splits

Nvidia has completed six stock splits since going public:

| Date | Split Ratio | Market Context |

| June 2000 | 2-for-1 | Dot-com boom, strong GPU demand |

| September 2001 | 2-for-1 | Growth despite tech sector volatility |

| April 2006 | 3-for-2 | Rise of professional visualization markets |

| September 2007 | 2-for-1 | Data center and graphics growth |

| July 2021 | 4-for-1 | AI and crypto demand surge |

| June 2024 | 10-for-1 | AI infrastructure and data center explosion |

If you held 1 share before June 2000, you’d own 480 shares today.

Why Nvidia Did the 2024 Stock Split

Nvidia’s decision to split its stock wasn’t just symbolic—it was a strategic move to attract a broader base of investors, increase market participation, and align with its long-term growth trajectory in AI and high-performance computing. As the company evolves into a foundational player in the global tech ecosystem, accessibility and confidence remain key pillars of its investor strategy.

- Improve Retail Accessibility: High share prices can deter small investors. The split lowered the entry barrier.

- Signal of Confidence: A 10-for-1 split reflects management’s belief in Nvidia’s long-term growth.

- Explosive Growth: Data center revenue jumped from $4.3B to $39B in just two years.

- Enhanced Liquidity: More shares in circulation means easier trading and tighter bid-ask spreads.

What Traders Need to Know

The 2024 split brought a wave of renewed interest from traders, both retail and institutional. It increased the number of shares available, made options trading more flexible with additional strike prices, and boosted daily trading volume.

While the total investment value stayed the same, the lower price point made Nvidia more appealing to smaller investors looking to enter the AI megatrend. Additionally, portfolio rebalancing and fractional share buying became easier, enhancing Nvidia’s role in diversified strategies.

- Dividend Policy: Nvidia pays a small dividend post-split, unchanged in total value.

- Options Market: The split increased liquidity in Nvidia options, offering finer strike price increments.

- Trading Activity: Splits often drive short-term volume spikes as new investors enter the market.

- Institutional Ownership: Nvidia remains heavily weighted in the S&P 500 and Nasdaq 100.

- Valuation Post-Split: While the price dropped, valuation metrics like P/E remained unchanged.

- Comparison: Similar to Apple’s 2020 (4-for-1) and Tesla’s 2022 (3-for-1) splits, Nvidia’s move made shares more accessible and widened investor interest.

Conclusion

Nvidia’s 2024 stock split was more than a technical adjustment—it reflected the company’s transformation into the backbone of global AI infrastructure. While no split is expected in 2025–2026, its market dominance suggests future splits are possible if the stock continues to outperform.

For traders and investors alike, Nvidia’s stock split history reinforces the importance of corporate actions in portfolio planning. As technology stocks remain volatile, understanding mechanics like splits, valuations, and long-term growth drivers is critical.

At Ultima Markets, we help traders stay ahead of key market moves with timely insights, strategy tools, and expert guidance. Whether you’re trading Nvidia, gold, or other high-potential assets, our platform equips you with the knowledge you need to make smarter decisions in fast-moving markets.

FAQ

When was the last Nvidia stock split?

June 10, 2024 (10-for-1 split).

How many times has Nvidia split its stock?

Six times since going public in 1999.

Does a stock split change my investment value?

No, total investment value remains the same—just more shares at a lower price.

How are options affected by a split?

Contracts are adjusted automatically to reflect the new share count and price.

What triggered Nvidia’s 2024 stock split?

Massive AI-driven growth, rising stock price, and a desire to broaden shareholder access.

Does Nvidia pay dividends?

Yes, a small quarterly dividend that adjusts proportionally after a split.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.