Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWeak U.S. Jobs Report Triggered Dollar Drop, US Indices Retreat

The U.S. Dollar fell sharply on Friday, giving back more than half of its gains from earlier in the week after a deeply disappointing July labor report reignited expectations for a potential Federal Reserve rate cut. The focus now turns to upcoming U.S. key economic data and ongoing global trade developments, which are likely to shape the market narrative in the week ahead.

July Jobs Report: Weak Headline, Labor Market Momentum Stalls

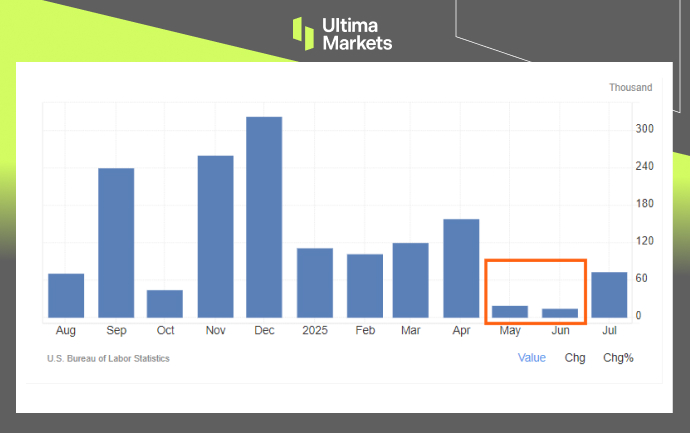

The U.S. economy added just 73,000 jobs in July, falling well short of the consensus estimate of 110,000. Adding to the disappointment, May and June job gains were significantly revised downward to just 19,000 and 14,000, respectively—a combined reduction of 258,000 jobs. This brings the three-month average job gain down to 35,000, marking the weakest stretch outside of the pandemic period.

The unemployment rate ticked up slightly to 4.2%, from 4.1% previously, while average hourly earnings grew 3.9% year-over-year, a modest uptick from June’s 3.8%, suggesting that wage pressures remain elevated despite soft job creation.

Key July Jobs Data:

- Non-Farm Payrolls: +73,000 (vs. +110,000 expected)

- May & June Revisions: Revised to +19,000 and +14,000 respectively

- Unemployment Rate: 4.2% (vs. 4.1% prior)

- Average Hourly Earnings (YoY): +3.9% (vs. 3.8% prior)

May and June Revised Non-Farm Payroll | Source: US BLS, Chart: TradingEconomics

“The three-month average job gain has dropped to the lowest level in non-pandemic history. This definitely raises red flags about the resilience of the U.S. economy, particularly in light of ongoing trade-related headwinds,” said Shawn Lee, Senior Analyst at Ultima Market.

“If we see further deterioration in U.S.–China trade negotiations or any downside surprise in this week’s key economic data, both the U.S. Dollar and equity markets could face renewed selling pressure,” he added.

Market Reaction: U.S. Dollar Slips, Equities Retreat

Following the release of key labor data, U.S. markets experienced notable volatility. The U.S. Dollar gave up more than half of its weekly gains, while major equity indices posted their largest single-week losses in nearly five months.

S&P500 Index (SP500), Day-Chart | Source: Ultima Market MT5

On the technical front, the S&P 500 recently broke below a rising wedge pattern—often considered a bearish signal—which could indicate the start of a near-term pullback within the broader uptrend.

Given the current backdrop, a deeper correction in the S&P 500 is possible, particularly if investor risk appetite continues to shift toward aversion.

USDX Dollar Index, Day-Chart | Source: Ultima Market MT5

Turning to the U.S. Dollar, the greenback pulled back sharply after failing to break above the key 100.00 resistance level, placing renewed pressure on the currency.

From a technical perspective, however, the broader reversal pattern remains intact as long as the 99.00–98.50 support zone holds. If this area provides a solid floor, the U.S. Dollar may still have room to rebound. Conversely, a decisive break below this zone could trigger a continuation of the bearish momentum.

What’s Next for the Market?

Looking ahead, market sentiment will hinge on whether upcoming developments reinforce the softening economic outlook. Any further setbacks in U.S.–China trade negotiations could amplify concerns over global growth and trigger additional risk-off moves across assets.

This week’s release of the U.S. ISM Services PMI will also be closely watched as a key gauge of the health of the broader economy.

A weaker-than-expected reading could reinforce expectations for a Fed rate cut and weigh further on the U.S. Dollar, while a surprise to the upside may help stabilize market sentiment—at least temporarily.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server