Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteUSDJPY Breaks Higher on Fed Support, BOJ Policy Uncertainty

The U.S. dollar advanced sharply on Wednesday, supported by cautious remarks from Federal Reserve officials. The Dollar Index climbed notably, while USD/JPY surged past 148 to trade just shy of 149, marking a significant move against the Japanese yen.

The yen came under further pressure despite the release of the Bank of Japan’s July meeting minutes, which revealed that some policymakers had discussed the possibility of future rate hikes.

BOJ Minutes Reveal Hawkish Lean

The recently released July BOJ meeting minutes showed that several board members flagged the possibility of future rate hikes, even though the policy rate was left unchanged at 0.5%.

While the board still leaned toward maintaining current rates, the internal debate over inflation, price pressures, and timing of normalization has become more visible.

Some policymakers view inflation as approaching—or already at—the BOJ’s 2% target, arguing for more proactive tightening if conditions permit. But others remain cautious, citing global uncertainties and downside risks as reasons to wait.

The minutes also reinforced that policy moves remain data-dependent, and that any shift must be gradual to avoid market disruptions.

Yen Reaction & FX Implications

The yen showed some strength in early Thursday trading following the release of the BOJ’s July meeting minutes, which revealed a more hawkish internal debate and raised speculation about potential rate hikes ahead.

This comes after USD/JPY had already surged near 149.00 on Wednesday, driven by a stronger U.S. dollar amid cautious Fed commentary.

Despite the hawkish undertone from the BOJ, the yen’s upside remains limited by lingering political uncertainty, particularly the upcoming Liberal Democratic Party leadership contest, as well as global trade risks tied to U.S. tariff policies.

USDJPY Technical Outlook

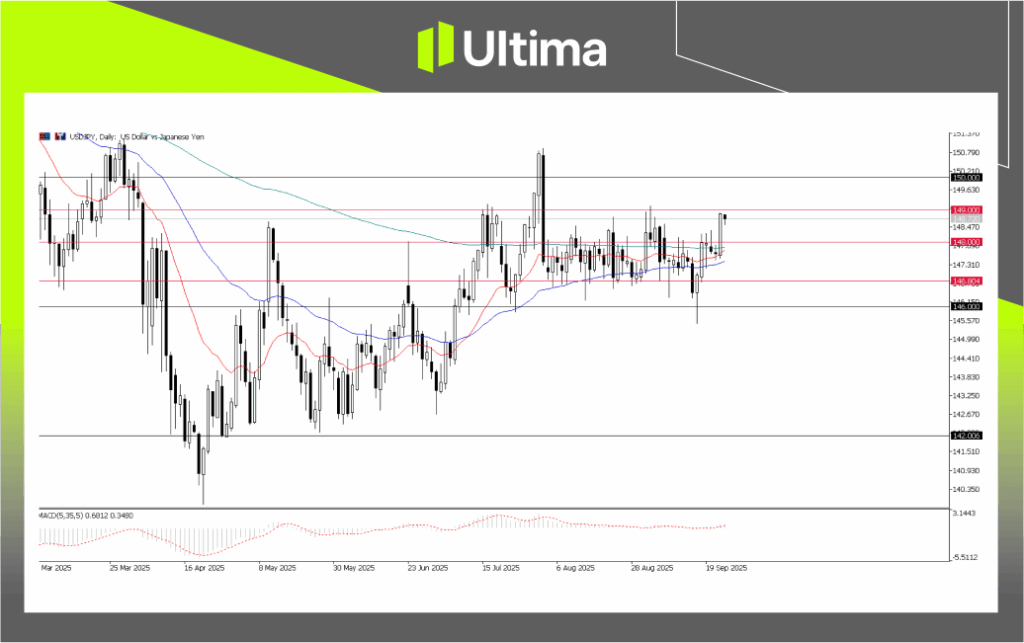

USDJPY, Daily Chart | Source: Ultima Market MT5

On the technical front, USD/JPY has broken out of its 146–148 range, but remains capped below the 149.00 resistance level. A decisive break above this threshold could open room for further upside momentum, while failure to clear it may keep the pair in consolidation.

With the BOJ tilting toward a more hawkish stance, any divergence between incoming Japanese and U.S. data could still lend support to the yen.

However, a clear breakout above 149.00 or a breakdown below 146.00 will be key signals for renewed directional momentum in USD/JPY.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server