U.S. PPI Flat in June, Underlying Inflation Show Mixed Signals

U.S. producer prices were unchanged in June compared to May, with the annual inflation rate also slowing more than expected—underscoring mixed inflation signals as new trade tariffs begin to trickle into production costs.

U.S. PPI Flat in June, But Tariff Impact Surfaces

According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) was unchanged on a month-over-month basis, falling short of expectations for a 0.2% increase. On a year-over-year basis, PPI rose 2.3%, slowing from May’s 2.7%, and marking the smallest annual gain since September 2024.

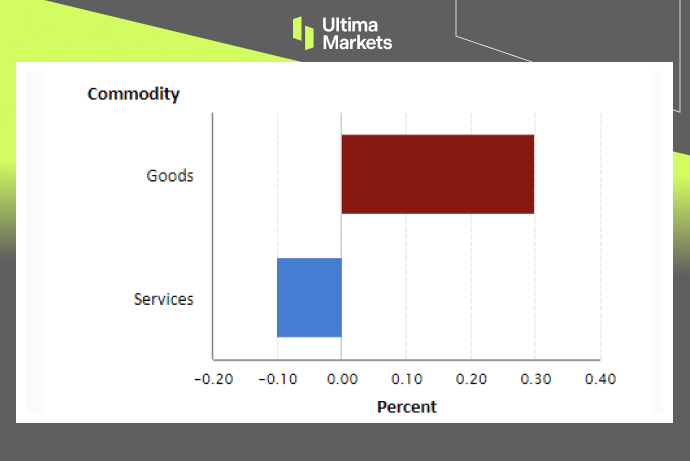

The flat headline number, however, masks underlying shifts. Goods prices rose 0.3%, with notable increases in electrical equipment, household appliances, and industrial materials—categories directly exposed to recent import tariffs.

Meanwhile, service prices declined 0.1%, weighed down by weaker transportation, trade margins, and warehousing costs. The drops in services effectively offset the rise in goods prices.

US June PPI by Components | Source: US Bureau of Labor Statistic

“While the headline number was flat, the underlying dynamics show clear tariff-related cost pressures building in the goods sector,” said Shawn Lee, Senior Market Analyst at Ultima Markets. “It’s likely only the beginning of broader price pass-through as new duties, especially on copper and electronics, take effect in August.”

Fed Policy in Focus Amid Mixed Inflation Prints

June’s PPI data follows a hotter-than-expected Consumer Price Index (CPI) reading, which showed headline inflation rising to 2.7% year-over-year. Taken together, the CPI and PPI paint a complicated picture for the Federal Reserve as it navigates between maintaining price stability and supporting economic growth.

“Sticky inflation in certain components may make it harder for the Fed to justify early rate cuts,” Shawn added.

While easing service inflation offers some relief, the gradual rise in goods prices—driven in part by tariffs—could pose a risk to the Fed’s preferred inflation trajectory.

Market Reaction and What’s Next

Markets reacted cautiously to the release. The U.S. Dollar softened slightly immediately after the data but later recovered its losses. Meanwhile, gold prices briefly spiked to a session high of $3,377, before giving back gains later in the day.

Investor attention now turns to several key events:

- Upcoming remarks from Fed officials, which may provide clues on the policy outlook.

- The G20 Finance Ministers Meeting this weekend, where global leaders are expected to discuss responses to escalating U.S. tariffs.

- Additional inflation data, including July’s PPI and the Fed’s preferred core PCE gauge later this month.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server