U.S. June Inflation Accelerates as Tariff Concerns Increase

U.S. inflation picked up pace in June, with early signs that recently announced tariffs may be starting to seep into consumer prices—raising questions about the Federal Reserve’s policy path in the second half of the year.

U.S. Consumer Price Index (CPI) – June Data

The headline Consumer Price Index (CPI) rose 0.3% month-over-month, marking the largest monthly increase since January and pushing the annual inflation rate to 2.7%, up from 2.4% in May, according to data released by the Bureau of Labor Statistics on Tuesday.

Core inflation—which excludes volatile food and energy prices—increased 0.2% month-over-month and 2.9% year-over-year. While slightly below consensus forecasts, both figures were higher than May’s readings of 0.1% and 2.8%, respectively.

The latest figures may point to early signs of tariff-related price pressures, particularly in categories such as household appliances and imported electronics—an outcome markets have been bracing for since President Trump announced sweeping new tariffs, including a 50% levy on copper and up to 30% tariffs on imports from Canada and Mexico.

“While the June CPI data may not yet fully reflect the impact of the latest tariffs, inflation expectations are clearly starting to push back against the disinflationary trend we’ve seen in recent months,” said Shawn Lee, Senior Market Analyst at Ultima Markets.

Market Reaction: September Cuts Odd Reduced

Financial markets responded with caution. The U.S. 10-year Treasury yield ticked higher to 4.49%, while the Dollar Index (DXY) saw a significant gain in recent weeks, regain above the 98-mark.

Meanwhile, gold prices in contrast, slipped below $3,340 to its three-day low, largely driven by a dollar rebound.

Equity markets were mixed, with the S&P 500 edge higher but paring gains in later session as investors digested the implications for Federal Reserve policy.

Fed Fund Rate futures now suggest reduced odds of September cut, with traders increasingly expecting the Fed to stay on hold through Q3.

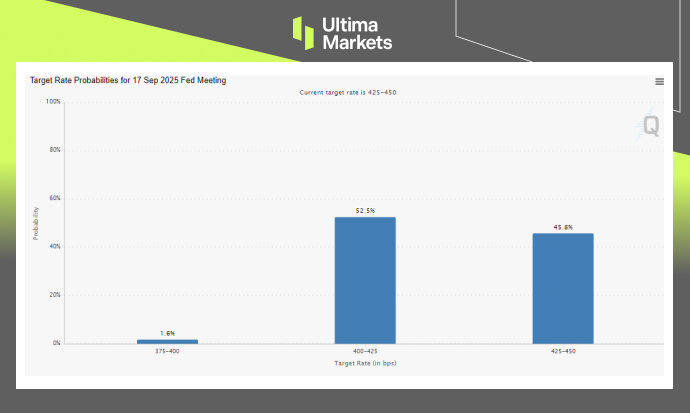

Target Rate Probabilities for September Fed Meeting | Source: CME FedWatch

According to CME FedWatch, probabilities of rate unchanged have increased significantly to 45.8% compare to 28.7% a month ago.

What’s Next?

Attention now turns to the upcoming Producer Price Index (PPI) and commentary from Fed officials later this week. With headline inflation creeping up and core prices remaining sticky, policymakers may find themselves navigating a narrow path between containing inflation and supporting growth.

Meanwhile, markets remain sensitive to any further tariff announcements or signs of retaliation from U.S. trade partners, particularly ahead of the G20 Finance Ministers meeting this weekend.

“If producer prices stay firm and trade tensions persist, the Fed may have to reassess its easing outlook,” said Shawn Lee, Senior Market Analyst at Ultima Markets. “For now, traders should brace for increased volatility in the coming days.”

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server