Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomUS Dollar Holds as Fed Nominee Looms, US Services PMI Slips

The U.S. Dollar traded mostly flat on Tuesday, as markets remained cautious ahead of President Trump’s expected announcement on the next Federal Reserve Board nominee. The U.S. Dollar Index hovered near the 98.50 level, hold flat after recent weakness driven by disappointing labor data and rising expectations for a September rate cut.

Fed Board Nomination in Focus

President Trump confirmed that he plans to announce his nominee to fill the vacancy on the Federal Reserve Board by the end of this week, following the early resignation of Governor Adriana Kugler, effective August 8, 2025.

Kugler’s departure—months ahead of her scheduled term expiration in January 2026—has accelerated the administration’s search for a like-minded appointee. The decision could have broader implications, not only for the unexpired seat but also for the future Fed chair position.

Trump has ruled out Treasury Secretary Scott Bessent for the role, citing Bessent’s desire to remain in his current position. That leaves a shortlist of four candidates under consideration for the Fed chairmanship, two of whom have been publicly identified:

- Kevin Warsh, former Fed governor now aligned with Trump’s policy stance, and

- Kevin Hassett, current director of the National Economic Council and long-time Trump adviser.

Other potential names include Christopher Waller, a sitting Fed governor known for advocating rate cuts. Trump has also suggested that Kugler’s successor could later be promoted to chair the central bank once Jerome Powell’s term ends in May 2026. Powell is expected to remain at least until then, and possibly continue serving on the Board thereafter.

ISM Services PMI: U.S. Service Sector Slows Sharply in July

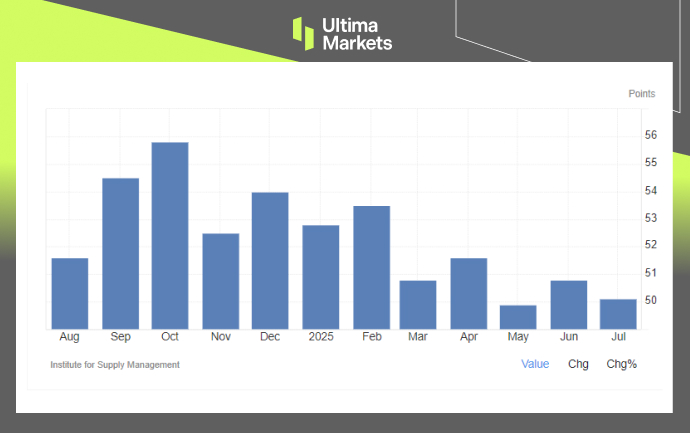

On the data front, the ISM non-manufacturing (services) PMI fell to 50.1% in July, down from 50.8% in June and below the consensus estimate of 51.5%. While the reading still indicates slight expansion, it reflects a significant loss of momentum in the services sector—by far the largest component of the U.S. economy.

US ISM Service PMI | Source: ISM, Chart: TradingEconomics

Key Sub-Index Highlights:

- Business Activity: Slowed to 52.6% (from 54.2%), though still in expansion.

- New Orders: Dropped to 50.3%, indicating cooling demand.

- Employment Index: Contracted further to 46.4%, its second consecutive month below the 50-mark.

- Prices Paid: Surged to 69.9%, the highest since October 2022, signaling persistent inflation pressures.

- New Export Orders / Imports: Fell to 47.9% and 45.9% respectively, reflecting the drag from trade tensions and rising tariffs.

Though technically still in expansionary territory, the data point to a near-stalled services sector, adding to concerns about slowing U.S. economic growth.

“This report shows that while headline figures remain in expansion, the underlying components raise fresh stagflation concerns, with rising costs coinciding with weaker business activity and soft hiring trends,” said Shawn Lee, Senior Analyst at Ultima Markets.

The disappointing services print comes on the heels of last week’s downbeat jobs report and may intensify pressure on the Fed to act in the coming months—particularly if economic softness broadens further.

What’s Next for US Dollar?

Markets have increasingly priced in a strong likelihood of a Federal Reserve rate cut in September. The dual impact of political uncertainty over the Fed’s leadership and softening economic indicators may further weigh on sentiment toward the U.S. Dollar.

However, the Dollar Index’s ability to hold steady near 98.50 suggests that investors remain cautious but are not overreacting. The greenback is likely to stay range-bound in the short term, with any significant move depending on upcoming developments—particularly the Fed nominee announcement and key inflation data.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server