Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteUS CPI Steady at 2.7%, Core Inflation Climbs to Six-Month High

U.S. consumer inflation held steady but showing a mixed signal according to latest CPI release, with the headline CPI rising 2.7% year-over-year, matching June’s reading and slightly under the 2.8% forecast. Month-on-month, prices increased 0.2%, consistent with expectations.

However, core inflation—which excludes food and energy—jumped to 3.1%, up from 2.9%, marking the largest annual increase since February. Monthly core CPI also rose 0.3%, the fastest pace in six months, driven by sharp increases in services such as airline fares, medical care, dental services, and housing.

Drivers Behind the Numbers

- Services inflation remains elevated, especially in sectors like lodging, healthcare, and air transport.

- Energy prices declined: gasoline dropped 2.2% in July and is down 9.5% year-over-year.

- Food inflation was flat overall—grocery costs edged down, while restaurant prices rose 0.3%. Annual food inflation stands at 2.9%.

Market and Policy Implications

Wall Street reacted positively—major indices like the S&P 500, Nasdaq, and Dow posted gains—as the data hinted that inflation remains manageable, potentially justifying a Federal Reserve rate cut in September.

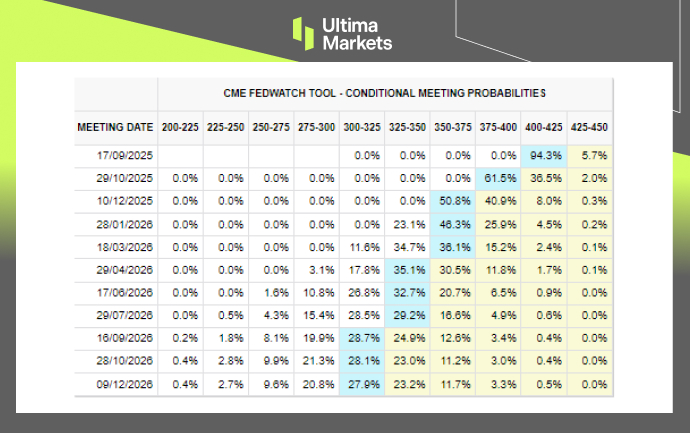

Swaps markets now price in more than 90% chance of a 25-basis-point cut, and seeing potentially up to three cuts in 2025, according to the CME FedWatch data.

Fed Meeting Probabilities | Source: CME Group

This “soft inflation, but not too soft” scenario eased stagflation fears and bolstered risk sentiment. However, core inflation may remain a concern, especially if the Producer Price Index set to be released this Thursday further heightens worries.

The core inflation staying elevated could reflect the newly implemented tariffs are starting to trickle into prices, particularly in durable goods like furniture and tires, although the full impact is yet to materialize.

Market Reaction: US Dollar Slips, Eyes on Key Support

Following the CPI release, the Nasdaq and S&P 500 indices surged to fresh record highs. In contrast, the US Dollar weakened further as markets increased pricing for additional Fed easing.

US Dollar Index (USDX), Daily Chart | Source: Ultima Market MT5

The US Dollar Index fell below the 98-mark but continues to hold above its recent low near 97.80. A decisive break below this level could open the door for further downside in the greenback.

What Comes Next?

With the CPI providing temporary relief to market sentiment, attention now turns to the producer side, where data could offer clearer insight into how tariffs are feeding into US inflation.

If the PPI comes in cooler, it could further support equity markets and put additional pressure on the US Dollar. Conversely, a hotter reading may reverse those moves, as markets could scale back expectations for Fed rate cuts.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server