Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

UK Inflation Plunges in November: Surprising Dip

UK Inflation Takes a Dive in November

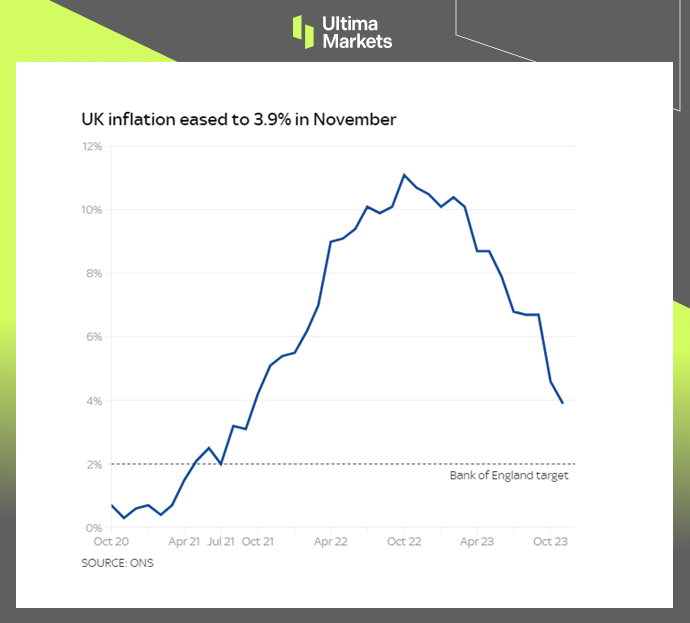

In a noteworthy turn of events, the UK’s inflation rate took a dip to 3.9% in November, as reported by the Office for National Statistics. This marks a substantial decrease from the 4.6% recorded in the previous month.

The slowdown is attributed to decelerating price hikes in various sectors such as transport, recreation, culture, and food. Notably, fuel prices played a pivotal role in exerting downward pressure on the overall inflation rate.

(UK Inflation Rate)

Factors Driving the Decline

Economists, anticipating a modest decrease to 4.4%, were surprised by the more significant drop. The decline is reflected in various input costs, with raw materials falling by 2.6%, transport costs dropping by 1.4%, and factory gate prices experiencing a slight dip of 0.2%.

Despite this reduction, the inflation rate of 3.9% still exceeds the Bank of England’s target of 2%. Policymakers are cautious about prematurely discussing interest rate cuts, as the hikes implemented earlier this year have already elevated borrowing costs to curb inflation.

Significance of the Numbers

Even though inflation has reached a 2-year low, it remains almost double the Bank of England’s target. Core inflation, which excludes volatile categories like food and energy, has also moderated from 5.7% to 5.1%.

This is a crucial metric monitored by the Monetary Policy Committee when determining interest rates. Notably, the UK’s inflation rate now aligns with that of other G7 economies of similar size, matching France’s rate and surpassing those of Germany and the United States.

UK Chancellor’s Perspective

Chancellor Jeremy Hunt views these data points as indicative of progress in alleviating inflationary pressures. He highlights that this development, combined with the recent business tax cuts, supports healthy and sustainable economic growth.

However, he acknowledges the ongoing challenges faced by many households due to the cost of living crisis. Addressing these challenges remains a priority to ensure the well-being of the population.

Frequently Asked Questions

Q: How much did the inflation rate decrease in November?

A: The inflation rate in the UK decreased to 3.9% in November, down from 4.6% in the previous month.

Q: What are the sectors contributing to the slowdown in inflation?

A: Decelerating price hikes in areas such as transport, recreation, culture, and food, with a significant impact from lower fuel prices.

Q: Does the current inflation rate meet the Bank of England’s target?

A: No, the inflation rate of 3.9% is nearly double the Bank of England’s target of 2%.

Bottom Line

Stay informed with breaking news and in-depth analysis on UK inflation. Explore datasets and statistics on inflation rate provided by Trading Economics. For a comprehensive understanding, use the inflation calculator from the Bank of England.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server