Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteGlobal Equities Lifted by Rate-Cut Optimism, Dollar Edges Lower

Global equity markets advanced on Monday, supported by rising conviction that the Federal Reserve will resume its easing cycle in September. The MSCI Asia-Pacific index edged higher, with Japan’s Nikkei 225 extending fresh record highs. Meanwhile, U.S. futures climbed, pushing the Nasdaq into new record territory.

Fed Cuts Dominate Market Focus

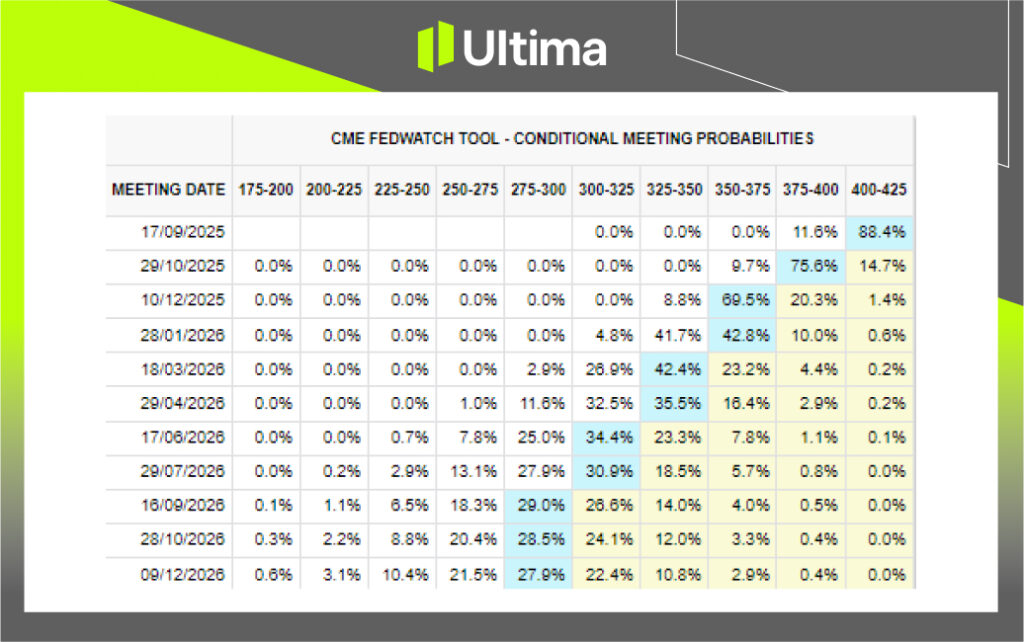

The Fed outlook remains the primary driver of sentiment. Traders are fully pricing in a 25-basis-point cut at next week’s meeting, while a larger 50-point move is viewed as less likely but still possible. According to CME FedWatch, markets are now expecting three cuts in 2025 — expectations that have further bolstered the equity rally.

Chart: CME FedWatch Rate Probabilities | Source: CME Group

However, analysts at Ultima Markets caution that rate-cut optimism may not guarantee sustained gains. Historically, markets tend to recalibrate quickly once the first cut is delivered, as focus shifts to the pace and depth of easing.

Bonds, Dollar, and Fiscal Concerns

Bond markets continue to flash fiscal concerns, with U.S. yields diverging from peers despite the softer policy outlook. This divergence has helped keep the U.S. dollar supported, though the currency remains locked in a broad consolidation range.

Currently, the dollar is fluctuating between 98.50 and 97.50, with recent price action suggesting a potential bearish breakdown. A decisive move outside this range could set the tone for the next trend.

Markets Eye U.S. Inflation Data

Attention now turns to this week’s U.S. inflation reports, which will be the final test ahead of the September 16–17 FOMC meeting. A softer-than-expected CPI reading could reinforce the case for a deeper easing cycle, while sticky inflation would likely force the Fed to tread more cautiously.

Beyond the Fed, investors are also watching corporate earnings momentum and sector rotation, both of which could influence risk appetite into year-end.

Chart: S&P 500, Daily | Source: Ultima Markets MT5

On the S&P 500, the uptrend remains intact. However, a rising wedge pattern is forming, signaling upside with weakening momentum. This suggests markets may turn more cautious while awaiting clearer inflation signals.

Bottom Line

Global markets are leaning into the Fed’s pivot, but the next leg of the rally will hinge on whether inflation confirms the path for sustained easing — and how far policymakers are willing to go in reassuring investors next week.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server