Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteDollar Rebounds as GDP Revised Higher; PCE to Decide Fed Path

The U.S. Bureau of Economic Analysis released its third (final) estimate for Q2 2025, showing GDP grew at an annualized 3.8 % — an upward revision from prior estimates of 3.3 %.

This gain was driven mostly by stronger-than-expected consumer spending, as well as a sharper reduction in imports (which subtract from GDP). Real final sales to private domestic purchasers (i.e. excluding inventories) were also revised upward to 2.9 %, indicating underlying demand remained resilient.

On first glance, this may appear as a signal that the economy is running hotter than some expected — potentially complicating the Fed’s path toward further easing.

Implication for Fed Cut Expectations

The stronger GDP figure pushed back the market expectation for aggressive rate cuts, leading to the surge in US Dollar on Thursday. With growth remains robust, it gives the Fed less cover to ease quickly without stoking inflation risks. Markets seem temper expectations of deep cuts in upcoming meetings.

Still, even with the strong GDP print, the Fed is likely to lean even more on forward data — inflation, labor, PCE — to justify each move. The “data-dependent” mantra now carries more weight in guiding market expectations.

The US treasury yields, especially the shorter maturities, surged as market adjust the probabilities of the cuts downward.

U.S. Dollar Reaction & FX Market

The stronger-than-expected GDP print has provided the U.S. dollar with renewed support, as investors scaled back the probability of aggressive near-term rate cuts.

The greenback may continue to benefit in the short run, though the reaction could remain limited if markets view the GDP surge as partly mechanical — driven by import swings rather than a sustained pickup in domestic activity.

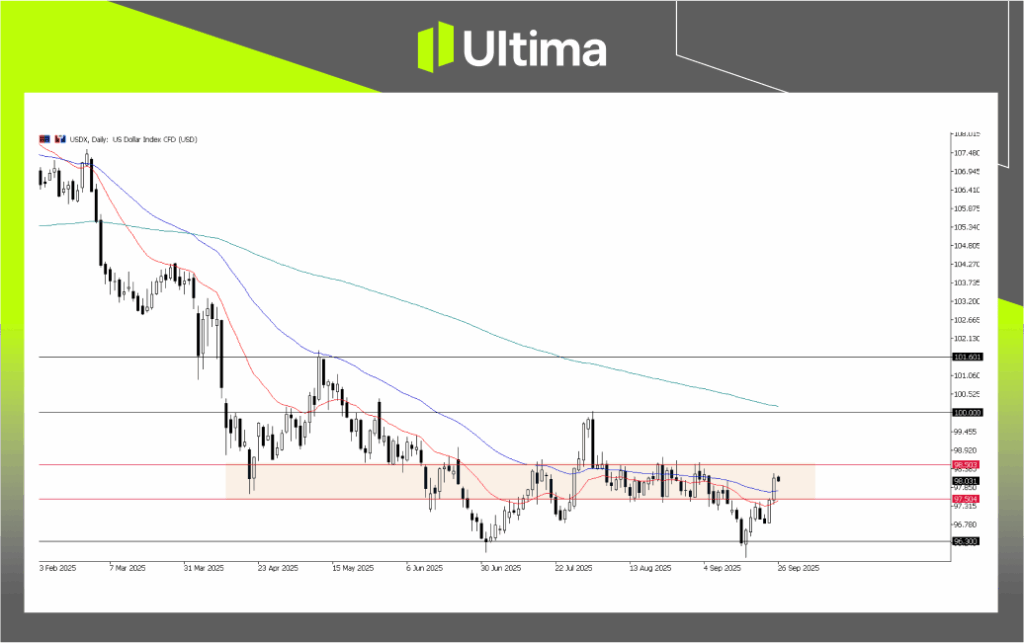

USDX, Day Chart | Source: Ultima Market MT5

From a technical perspective, the dollar has regained momentum, with the DXY reclaiming the 98 level and returning to its key consolidation band between 97.5 and 98.5. This range has acted as a pivotal zone around the dollar’s multi-year low, and the rebound suggests underlying support remains intact.

Overall, the GDP revision strengthens the dollar’s case, particularly if upcoming inflation data confirms sticky price pressures. However, the narrative could quickly shift if inflation cools, as softer data would revive expectations for further Fed easing and weigh on the greenback.

What’s Next: PCE Price Index Takes Center Stage

Looking ahead, all eyes will turn to the PCE Price Index — the Fed’s preferred inflation gauge — set for release soon.

- If PCE prints hotter than expected, it could reinforce concerns that inflation remains sticky, delaying further rate cuts or even prompting a hesitation.

- A softer PCE, especially core (excluding food & energy), could revive confidence in additional easing and weaken the dollar again.

- The market will also compare PCE results versus CPI prints, checking whether core inflation is trending downward or holding firm.

In short: the GDP surprise shifts the burden to inflation data. PCE is now the prime battleground — it may decide whether the Fed leans dovish or stands pat.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server