Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Bitcoin Plunges Below $100,000 on Risk-Aversion Sentiment

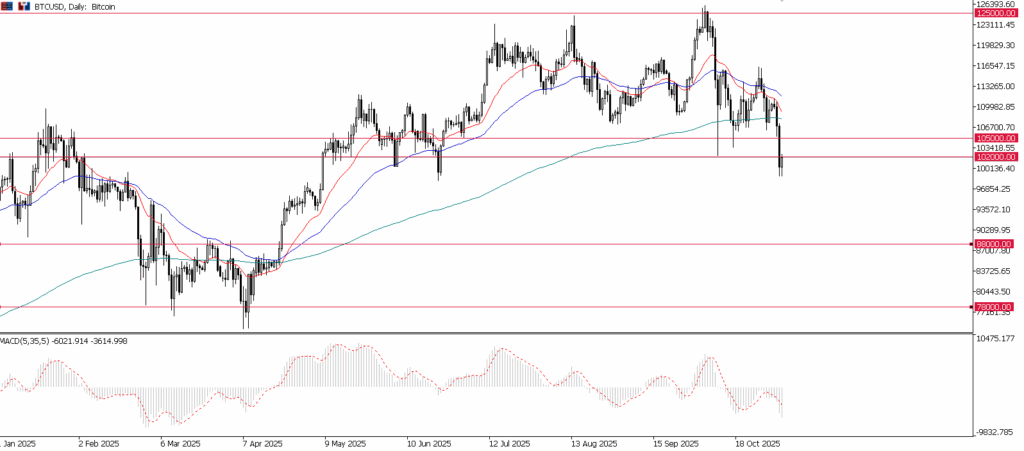

The cryptocurrency market is reeling today after Bitcoin (BTC) suffered one of its most severe pullbacks of the year, plunging below the critical psychological support level of $100,000 for the first time since June.

The move marks a definitive technical shift, with Bitcoin entering a short-term “bear market” territory, having fallen more than 20% from its early-October record high above $126,000.

Bitcoin hit a five-month low, briefly touching prices around $99,000 before stabilizing slightly above the $100,000 mark in morning trading.

The immediate cause of the sharpness of the drop was a massive wave of forced selling. Data indicates that over $1.78 billion in leveraged crypto positions were liquidated within 24 hours, with the overwhelming majority coming from long (bullish) bets. This cascade effect accelerated the price drop once key technical support levels were breached.

Impact on Major Altcoins

The decline in Bitcoin triggered a widespread sell-off across the altcoin market, where correlation remains extremely high.

- Ethereum (ETH): The second-largest crypto, Ethereum, was hit particularly hard. Ether slipped as much as 15% in Tuesday’s trading and briefly approached the $3,000 level, its lowest point in nearly four months. Forced liquidations in Ether also reportedly exceeded those in Bitcoin over the past two days, indicating high speculative positioning in ETH.

- High-Correlation Alts: Other major tokens like Solana (SOL), XRP, and BNB posted significant declines, generally tracking Bitcoin’s fall, reflecting the market’s tight correlation to BTC’s movements.

- Total Market Loss: The aggregate global crypto market capitalization has lost hundreds of billions of dollars over the past month.

Global Risk-off Sentiment Drives the Drop

The core driver is a broader global risk-off environment. Traders are pulling back from speculative assets, including technology stocks (which saw deep selling yesterday) and crypto, amid concerns over stretched valuations and uncertainty about the pace of U.S. Federal Reserve interest rate cuts in 2026. A mildly firmer U.S. Dollar (USD) further pressured non-yielding risk assets like Bitcoin.

The failure to hold a key long-term technical level (the 200-day exponential moving average) triggered massive algorithmic selling, pushing the price through the $100,000 psychological floor.

Deeper Correction in Place

Ultima Market Analysts warn that if Bitcoin fails to decisively reclaim and hold the $102,000 – $105,000 resistance zone, the decline could accelerate toward the next major technical support area of $92,000 – $88,000.

BTCUSD, Daily Chart | Ultima Market MT5

“While Bitcoin’s long-term trajectory remains positive, the near-term risk-off sentiment could trigger a period of ‘corrective phase—a healthy pullback—rather than the start of a deep bear market.’”, Ultima Market Analysts noted.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server