Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteBank of England Holds Rates at 4%, Slows QT Pace

The Bank of England (BoE) voted 7–2 to keep the Bank Rate unchanged at 4.00% in its September meeting. Two members preferred an immediate 25bps cut to 3.75%, highlighting growing divisions within the Monetary Policy Committee (MPC).

Alongside the rate decision, the BoE announced a slower pace of quantitative tightening (QT), reducing its annual gilt holdings rundown from £100 billion to £70 billion.

The composition of sales will shift, with fewer long-dated gilts and more short- and medium-term maturities, aimed at easing recent volatility in bond markets.

BoE Statement Highlights

- Inflation: CPI stood at 3.8% in August, expected to tick higher in September before resuming its decline. The Bank warned that inflation risks remain tilted to the upside, particularly through wage and price-setting dynamics.

- Growth & Labour Market: Economic activity remains weak, unemployment is edging higher, and wage growth is easing gradually—signals of emerging slack in the economy.

- Policy Guidance: The BoE stressed that monetary policy is “not on a pre-set path”, reaffirming that any cuts will be gradual and careful, contingent on sustained disinflation.

Governor Andrew Bailey’s Comments

Governor Andrew Bailey reinforced a cautious stance, saying the UK is “not out of the woods yet” on inflation. He noted that while markets have understood cuts will come slowly, the timing and pace remain uncertain.

On QT, Bailey acknowledged the need to avoid unnecessary disruption in long-dated gilt markets, justifying the decision to rebalance sales toward shorter maturities.

Market & GBPUSD Reaction

Sterling dipped further after the announcement, with investors interpreting the slower QT and dissenting rate-cut votes as a dovish shift. However, sticky inflation and Bailey’s cautious tone limited downside pressure.

- Supportive Factors: Elevated inflation and a cautious BoE keep rate-cut expectations restrained, lending some support to GBP.

- Downside Risks: Signs of weak growth, labour market slack, and internal dissent could fuel expectations of earlier easing, undermining sterling over the medium term.

Technical Outlook on GBPUSD

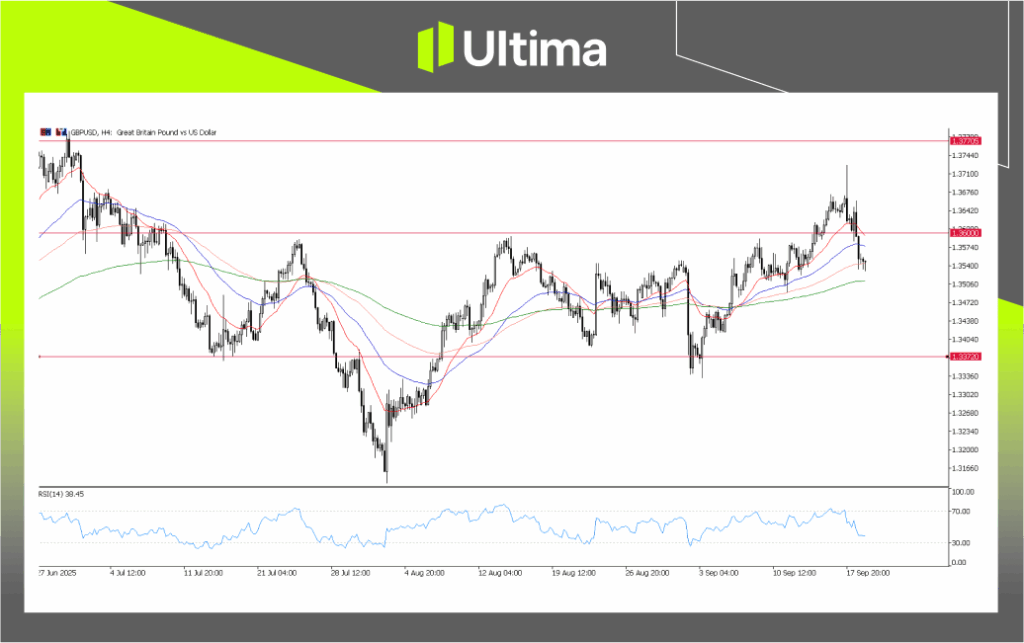

GBPUSD, H4 Chart Analysis | Source: Ultima Market MT5

The GBPUSD extended its downside following the BoE decision, with the pair failing to hold above the 1.3600 key level, signalling weakening momentum.

From a technical perspective, if GBPUSD continues to trade below 1.3600, the pair is likely to remain pressured toward the downside or locked in range-bound trading in the near term.

The next decisive move will largely depend on upcoming inflation and labour market data, which are set to shape sentiment and policy expectations.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server