4 July 2025

Ultima Markets–The Adjustments for US Shares

From 14th, Jul 2025

|

Product |

Previous Leverage |

Leverage after updating |

|---|---|---|

|

US share CFDs |

33:1 |

20:1 |

• The margin requirements for the above products will increase/decrease with the leverage adjustment. The margin level may be affected; please pay attention to your trading strategy and account risk.

• Due to the inherent uncertainty in the market, please refer to the MT4 software as the primary source for executing trades and monitoring market conditions.

• During both the update and adjustment period, as well as after the update, positions in clients’ portfolios can continue to be held without any impact.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

1 July 2025

Ultima Markets The Rollover Schedule of Futures in July

The Rollover Schedule of Futures in July

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

VIX |

Volatility |

2025-07-15 |

Jul-25 |

Aug-25 |

CL-OIL |

Crude Oil West Texas Future |

2025-07-17 |

Aug-25 |

Sep-25 |

FRA40ft |

France 40 Index Future |

2025-07-17 |

Jul-25 |

Aug-25 |

UKOUSDft |

Brent Oil Future |

2025-07-22 |

Sep-25 |

Oct-25 |

HK50ft |

Hong Kong 50 Future |

2025-07-29 |

Jul-25 |

Aug-25 |

CHINA50ft |

CHINA50 Future |

2025-07-29 |

Jul-25 |

Aug-25 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules based on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

27 June 2025

Ultima Markets The trading sessions of holiday in July

| Holiday | Date | Adjustment Actions GMT+3 | Adjustment Products |

| Special Administrative Region Establishment Day |

2025.07.01 | Market Closed | HK50, HK50ft, HKTECH, CHINAH |

| Independence Day | 2025.07.03 | Early close 20:00 | US shares |

| Early close 20:15 | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, VIX |

||

| Early close 23:00 | UK100, UK100ft, GER40, GER40ft, EU50 | ||

| Independence Day | 2025.07.04 | Market Closed | Cotton, OJ, Cocoa, Coffee, Sugar, Soybean, Wheat, USDBRL, USDCLP, USDCOP, USDINR, USDTWD, USDIDR, USDKRW, US shares |

| Early close 18:30 | VIX | ||

| Early close 19:00 | XPDUSD, XPTUSD | ||

| Early close 19:45 | GOLD, SILVER, UKOUSD, UKOUSDft, USOUSD, CL-OIL |

||

| Early close 20:00 | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, USDX, NG, GAS, Copper, USNote10Y |

||

| Early close 20:30 | Gasoil | ||

| Early close 23:00 | EU50, FRA40, SPI200, CHINA50, CHINA50ft, TWINDEX, SGP20 |

||

| Independence Day | 2025.07.07 | Late open 03:00 | UKOUSD, UKOUSDft |

| Late open 15:00 | Cotton | ||

| Our Lady of Mount Carmel | 2025.07.16 | Market Closed | USDCLP |

| Swiss National Day | 2025.08.01 | Market Closed | SWI20 |

Friendly Reminder

- • The mentioned times are based on DST system time GMT+3.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

27 June 2025

Ultima Markets Notification of Server Upgrade

|

Date |

Trading sessions |

Trade status |

Maintenance sessions |

|---|---|---|---|

2025/06/28 (Sat.) |

02:00 – 04:59 (GMT+3) |

Break |

05:00 – 12:00 (GMT+3) |

2025/06/29 (Sun.) |

00:00 – 23:59 (GMT+3) |

Normal |

/ |

•During the upgrade process, the client portal and UM App will be temporarily unavailable. Our official website will remain available, but clients will not be able to sign up.

• Any client portal and UM App functions that contain account data adjustments might be temporarily unavailable.

• During the upgrade process, the features of MetaTrader software & application, including but not limited to logging in, quoting and opening/closing positions, will be temporarily unavailable.

• There might be a gap between the original price and the price after maintenance. The gap between Pending Orders, Stop Loss and Take Profit will be filled at the market price once the maintenance is completed.

• To ensure access to the most accurate and up-to-date information regarding market opening times and order execution, kindly update your trading platform to the latest version.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

20 June 2025

Leverage Adjustments During Major Economic News Releases

Dear Valued Client:

To ensure a more stable trading environment during major news events, Ultima Markets will implement the following temporary leverage adjustments during specific news releases, effective from June 23, 2025:

USD-Related News:

– Leverage for Forex, Gold & Silver, and Indices will be adjusted to 200:1.

– Oil leverage will remain unchanged.

Crude Oil-Related News:

– Leverage for Oil will be adjusted to 200:1.

News Related to Other Countries:

– Leverage for Forex pairs will be adjusted to 200:1.

Please be reminded that:

– Gold and indices will only be affected by USD-related news

– Market volatility risks still exist. We strongly advise maintaining prudent risk management, including appropriate position sizing.

We are committed to providing a secure and efficient trading experience.

Should you have any questions or require further assistance, please do not hesitate to contact our support team.

Thank you for your trust and support in Ultima Markets.

Best regards,

Ultima Markets

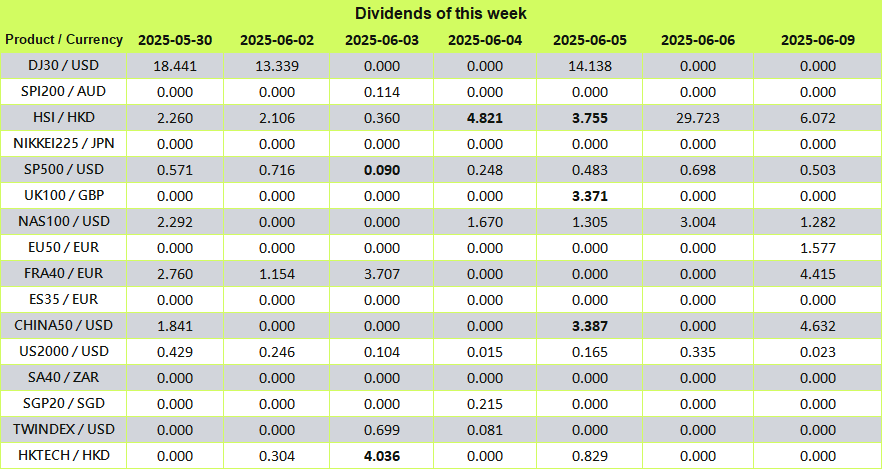

Ultima Markets Index Dividend Adjustment Notice

Filters:

No Results

Please try a different search term.

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

1 July 2025

Ultima Markets The Rollover Schedule of Futures in July

The Rollover Schedule of Futures in July

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

VIX |

Volatility |

2025-07-15 |

Jul-25 |

Aug-25 |

CL-OIL |

Crude Oil West Texas Future |

2025-07-17 |

Aug-25 |

Sep-25 |

FRA40ft |

France 40 Index Future |

2025-07-17 |

Jul-25 |

Aug-25 |

UKOUSDft |

Brent Oil Future |

2025-07-22 |

Sep-25 |

Oct-25 |

HK50ft |

Hong Kong 50 Future |

2025-07-29 |

Jul-25 |

Aug-25 |

CHINA50ft |

CHINA50 Future |

2025-07-29 |

Jul-25 |

Aug-25 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules based on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

30 May 2025

Ultima Markets The Rollover Schedule of Futures in June

The Rollover Schedule of Futures in June

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

EUB5Y |

Euro – BOBL Futures |

2025-06-03 |

Jun-25 |

Sep-25 |

EUB30Y |

Euro – BUXL Futures |

2025-06-04 |

Jun-25 |

Sep-25 |

EUB2Y |

Euro – Schatz Futures |

2025-06-04 |

Jun-25 |

Sep-25 |

EUB10Y |

Euro – Bund Futures |

2025-06-05 |

Jun-25 |

Sep-25 |

JPN225ft |

Japan 225 Index Future |

2025-06-11 |

Jun-25 |

Sep-25 |

VIX |

Volatility |

2025-06-11 |

Jun-25 |

Jul-25 |

EURIBOR3M |

EURIBOR Futures |

2025-06-12 |

Jun-25 |

Sep-25 |

CL-OIL |

Crude Oil West Texas Future |

2025-06-12 |

Jul-25 |

Aug-25 |

USDX |

US dollar index |

2025-06-13 |

Jun-25 |

Sep-25 |

DJ30ft |

DJ30 Future |

2025-06-17 |

Jun-25 |

Sep-25 |

UK100ft |

UK100 Index Future |

2025-06-17 |

Jun-25 |

Sep-25 |

NAS100ft |

NAS100 Future |

2025-06-18 |

Jun-25 |

Sep-25 |

SP500ft |

SP500 Future |

2025-06-18 |

Jun-25 |

Sep-25 |

FRA40ft |

France 40 Index Future |

2025-06-19 |

Jun-25 |

Jul-25 |

GER40ft |

Germany 40 Future |

2025-06-19 |

Jun-25 |

Sep-25 |

CHINA50ft |

CHINA50 Future |

2025-06-24 |

Jun-25 |

Jul-25 |

HK50ft |

Hong Kong 50 Future |

2025-06-26 |

Jun-25 |

Jul-25 |

UKOUSDft |

Brent Oil Future |

2025-06-26 |

Aug-25 |

Sep-25 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules based on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

30 April 2025

Ultima Markets-The Rollover Schedule of Futures in May

The Rollover Schedule of Futures in May

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

FRA40ft |

France 40 Index Future |

2025-05-14 |

May-25 |

Jun-25 |

CL-OIL |

Crude Oil West Texas Future |

2025-05-15 |

Jun-25 |

Jul-25 |

VIX |

Volatility |

2025-05-16 |

May-25 |

Jun-25 |

UKOUSDft |

Brent Oil Future |

2025-05-23 |

Jul-25 |

Aug-25 |

HK50ft |

Hong Kong 50 Future |

2025-05-27 |

May-25 |

Jun-25 |

CHINA50ft |

CHINA50 Future |

2025-05-27 |

May-25 |

Jun-25 |

LongGilt |

UK Long Gilt Futures |

2025-05-28 |

Jun-25 |

Sep-25 |

USNote10Y |

US 10 YR T-Note Futures Decimalised |

2025-05-28 |

Jun-25 |

Sep-25 |

EUB10Y |

Euro – Bund Futures |

2025-06-03 |

Jun-25 |

Sep-25 |

EUB5Y |

Euro – BOBL Futures |

2025-06-03 |

Jun-25 |

Sep-25 |

EUB30Y |

Euro – BUXL Futures |

2025-06-04 |

Jun-25 |

Sep-25 |

EUB2Y |

Euro – Schatz Futures |

2025-06-04 |

Jun-25 |

Sep-25 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules based on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

3 April 2025

Ultima Markets – The Rollover Schedule of Futures in April

The Rollover Schedule of Futures in April

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

VIX |

Volatility |

2025-04-11 |

Apr-25 |

May-25 |

CL-OIL |

Crude Oil West Texas Future |

2025-04-16 |

May-25 |

Jun-25 |

FRA40ft |

France 40 Index Future |

2025-04-17 |

Apr-25 |

May-25 |

UKOUSDft |

Brent Oil Future |

2025-04-24 |

Jun-25 |

Jul-25 |

CHINA50ft |

CHINA50 Future |

2025-04-24 |

Apr-25 |

May-25 |

HK50ft |

Hong Kong 50 Future |

2025-04-28 |

Apr-25 |

May-25 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules based on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

27 February 2025

Ultima Markets – The Rollover Schedule of Futures in March

The Rollover Schedule of Futures in March

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

EUB5Y |

Euro – BOBL Futures |

2025-03-04 |

Mar-25 |

Jun-25 |

EUB10Y |

Euro – Bund Futures |

2025-03-04 |

Mar-25 |

Jun-25 |

JPN225ft |

Japan 225 Index Future |

2025-03-12 |

Mar-25 |

Jun-25 |

EURIBOR3M |

EURIBOR Futures |

2025-03-12 |

Mar-25 |

Jun-25 |

VIX |

Volatility |

2025-03-13 |

Mar-25 |

Apr-25 |

CL-OIL |

Crude Oil West Texas Future |

2025-03-14 |

Apr-25 |

May-25 |

USDX |

US dollar index |

2025-03-14 |

Mar-25 |

Jun-25 |

DJ30ft |

DJ30 Future |

2025-03-18 |

Mar-25 |

Jun-25 |

UK100ft |

UK100 Index Future |

2025-03-18 |

Mar-25 |

Jun-25 |

GER40ft |

Germany 40 Future |

2025-03-19 |

Mar-25 |

Jun-25 |

SP500ft |

SP500 Future |

2025-03-19 |

Mar-25 |

Jun-25 |

NAS100ft |

NAS100 Future |

2025-03-20 |

Mar-25 |

Jun-25 |

FRA40ft |

France 40 Index Future |

2025-03-20 |

Mar-25 |

Apr-25 |

CHINA50ft |

CHINA50 Future |

2025-03-25 |

Mar-25 |

Apr-25 |

HK50ft |

Hong Kong 50 Future |

2025-03-26 |

Mar-25 |

Apr-25 |

UKOUSDft |

Brent Oil Future |

2025-03-27 |

May-25 |

Jun-25 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules based on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

27 June 2025

Ultima Markets The trading sessions of holiday in July

| Holiday | Date | Adjustment Actions GMT+3 | Adjustment Products |

| Special Administrative Region Establishment Day |

2025.07.01 | Market Closed | HK50, HK50ft, HKTECH, CHINAH |

| Independence Day | 2025.07.03 | Early close 20:00 | US shares |

| Early close 20:15 | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, VIX |

||

| Early close 23:00 | UK100, UK100ft, GER40, GER40ft, EU50 | ||

| Independence Day | 2025.07.04 | Market Closed | Cotton, OJ, Cocoa, Coffee, Sugar, Soybean, Wheat, USDBRL, USDCLP, USDCOP, USDINR, USDTWD, USDIDR, USDKRW, US shares |

| Early close 18:30 | VIX | ||

| Early close 19:00 | XPDUSD, XPTUSD | ||

| Early close 19:45 | GOLD, SILVER, UKOUSD, UKOUSDft, USOUSD, CL-OIL |

||

| Early close 20:00 | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, USDX, NG, GAS, Copper, USNote10Y |

||

| Early close 20:30 | Gasoil | ||

| Early close 23:00 | EU50, FRA40, SPI200, CHINA50, CHINA50ft, TWINDEX, SGP20 |

||

| Independence Day | 2025.07.07 | Late open 03:00 | UKOUSD, UKOUSDft |

| Late open 15:00 | Cotton | ||

| Our Lady of Mount Carmel | 2025.07.16 | Market Closed | USDCLP |

| Swiss National Day | 2025.08.01 | Market Closed | SWI20 |

Friendly Reminder

- • The mentioned times are based on DST system time GMT+3.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

30 May 2025

Ultima Markets The trading sessions of holiday in June

| Holiday | Date | Adjustment Actions GMT+3 | Adjustment Products |

| Ascension Day | 2025.06.02 | Market Closed | USDCOP |

| Presidential Election Day | 2025.06.03 | Market Closed | USDKRW |

| Arafat Day | 2025.06.05 | Normal | / |

| Eid al-Adha | 2025.06.06 | Market Closed | USDIDR,USDKRW |

| The King’s Birthday | 2025.06.09 | Market Closed | SWI20, USDIDR |

| Late Open 10:10 | SPI200 | ||

| Youth Day | 2025.06.16 | Market Closed | SA40 |

| Juneteenth | 2025.06.19 | Market Closed | BVSPX, Cotton, OJ, Cocoa, Coffee, Sugar, Soybean, Wheat, USDBRL, USDCLP, USDCOP, USDINR, USDTWD, USDIDR, USDKRW, US shares |

| Early Closed 17:00 | XPDUSD. XPTUSD | ||

| Early Closed 18:30 | VIX | ||

| Early Closed 20:00 | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, USNote10Y |

||

| Early Closed 20:15 | GOLD, SILVER, UKOUSD, UKOUSDft, USOUSD, CL-OIL |

||

| Early Closed 20:30 | Gasoil | ||

| Early Closed 21:30 | NG, GAS, Copper | ||

| Early Closed 23:00 | UK100, UK100ft, GER40, GER40ft, EU50 |

||

| Juneteenth | 2025.06.20 | Market Closed | USDCLP |

| Late Open 03:00 | UKOUSDft | ||

| Corpus Christi | 2025.06.23 | Market Closed | USDCOP |

| Awal Muharram | 2025.06.26 | Normal | / |

| Muharram | 2025.06.27 | Market Closed | USDIDR |

| Early Closed 19:30 | NETH25 | ||

| Feast of Saint Peter and Saint Paul | 2025.06.30 | Market Closed | USDCOP |

| HK Holiday | 2025.07.01 | Market Closed | HK50, HK50ft, HKTECH, CHINAH |

Friendly Reminder

- • The mentioned times are based on DST system time GMT+3.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

29 April 2025

Ultima Markets – The trading sessions of holiday in May

| Holiday | Date | GTM + 3 | Adjustments (Product / Actions) |

| Labour Day | 2025.05.01 | Market Closed | GER40, GER40ft, EU50, FRA40, FRA40ft, ES35, HK50, HK50ft, SA40, BVSPX, HKTECH, USDBRL, USDCLP, USDCOP, USDINR, USDTWD, USDIDR, EUB10Y, EUB5Y, EUB30Y, EUB2Y, EURIBOR3M |

| Labour Day | 2025.05.02 | Late Open 03:15 | EU50 |

| Late Open 09:00 | FRA40 | ||

| Buddha’s Birthday | 2025.05.05 | Market Closed | UK100, UK100ft, HK50, HK50ft, HKTECH, USDKRW, LongGilt |

| Early May Bank Holiday | 2025.05.06 | Late Open 03:00 | UK100, UK100ft |

| Vesak | 2025.05.12 | Market Closed | USDINR, USDIDR |

| Ascension day | 2025.05.13 | Market Closed | USDCOP, USDIDR |

| Navy day | 2025.05.21 | Market Closed | USDCLP |

| Memorial Day | 2025.05.26 | Market Closed | UK100, UK100ft, Cotton, OJ, Cocoa, Coffee, Sugar, Soybean, Wheat, US shares, LongGilt |

| Early Closed 18:30 | VIX | ||

| Early Closed 20:00 | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, USNote10Y |

||

| Early Closed 20:30 | UKOUSD, UKOUSDft, Gasoil | ||

| Early Closed 21:30 | GOLD, SILVER, XPDUSD, XPTUSD, USOUSD, CL-OIL, NG, GAS, Copper |

||

| Early Closed 23:00 | GER40, GER40ft, EU50 | ||

| Memorial Day | 2025.05.27 | Late Open 03:00 | UK100, UK100ft, UKOUSDft |

| Ascension Day of Jesus Christ | 2025.05.29 | Market Closed | USDIDR |

| Ascension Day of Jesus Christ | 2025.05.30 | Market Closed | USDIDR |

Friendly Reminder

- • The mentioned times are based on DST system time GMT+3.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

1 April 2025

Ultima Markets – Trading Session Adjustment for AU Daylight Saving (DST)

| Date | Product | Original Trading Sessions (GMT+3) | Updated Trading Sessions (GMT+3) |

| 2025/04/06 (Sun.) | SPI200 | Mon -Fri: 01:00-08:30, 09:10-24:00 | Mon-Fri: 01:00-09:30, 10:10-24:00 |

Friendly Reminder

- • The mentioned times are based on DST system time GMT+3.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

28 March 2025

Ultima Markets – The trading sessions of holiday in April

| Holiday | Date | Adjustments (Product / Actions) | |

| Lebaran Holiday | 2025.04.01 | Market Closed | USDIDR, USDINR |

| Lebaran Holiday | 2025.04.02 | Market Closed | USDIDR |

| Lebaran Holiday | 2025.04.03 | Market Closed | USDIDR, USDTWD |

| Ching Ming Festival | 2025.04.04 | Market Closed | HK50, HK50ft, HKTECH, USDTWD, USDIDR |

| Lebaran Holiday | 2025.04.07 | Market Closed | USDIDR |

| Mahavir Jayanti | 2025.04.10 | Market Closed | USDINR |

| Mahavir Jayanti | 2025.04.14 | Market Closed | USDINR |

| Day Before Good Friday | 2025.04.17 | Early Closed 17:00 | SPI200 |

| Early Closed 23:00 | UK100, UK100ft, GER40, GER40ft, EU50, FRA40 |

||

| Good Friday | 2025.04.18 | Market Closed | Indices, Shares, Bonds, ETF, Metal, Commodities, USDBRL, USDCLP, USDCOP, USDINR, USDIDR, USDKRW |

| Easter | 2025.04.21 | Market Closed | UK100, UK100ft, GER40, GER40ft, EU50, FRA40, FRA40ft, ES35, HK50, HK50ft, SPI200, SA40, BVSPX, HKTECH, UKOUSD, UKOUSDft, USDBRL,EUB10Y, EUB5Y, EUB30Y,EUB2Y, LongGilt, EURIBOR3M |

| Late Open 14:30 | Cocoa, Coffee, Sugar | ||

| Easter | 2025.04.22 | Late Open 02:50 | SPI200 |

| Late Open 03:15 | EU50 | ||

| Late Open 04:00 | UK100, UK100ft | ||

| Late Open 09:00 | FRA40 | ||

| ANZAC Day | 2025.04.25 | Late Open 10:10 | SPI200 |

| Freedom Day | 2025.04.28 | Market Closed | SA40 |

| Labour Day | 2025.04.30 | Early Closed 23:00 | GER40, GER40ft, EU50, FRA40 |

| Labour Day | 2025.05.01 | Market Closed | GER40, GER40ft, EU50, FRA40, FRA40ft, HK50, HK50ft, HKTECH |

| Labour Day | 2025.05.02 | Late Open 03:15 | EU50 |

| Late Open 09:00 | FRA40 | ||

Friendly Reminder

- • The mentioned times are based on DST system time GMT+3.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

27 June 2025

Ultima Markets Notification of Server Upgrade

|

Date |

Trading sessions |

Trade status |

Maintenance sessions |

|---|---|---|---|

2025/06/28 (Sat.) |

02:00 – 04:59 (GMT+3) |

Break |

05:00 – 12:00 (GMT+3) |

2025/06/29 (Sun.) |

00:00 – 23:59 (GMT+3) |

Normal |

/ |

•During the upgrade process, the client portal and UM App will be temporarily unavailable. Our official website will remain available, but clients will not be able to sign up.

• Any client portal and UM App functions that contain account data adjustments might be temporarily unavailable.

• During the upgrade process, the features of MetaTrader software & application, including but not limited to logging in, quoting and opening/closing positions, will be temporarily unavailable.

• There might be a gap between the original price and the price after maintenance. The gap between Pending Orders, Stop Loss and Take Profit will be filled at the market price once the maintenance is completed.

• To ensure access to the most accurate and up-to-date information regarding market opening times and order execution, kindly update your trading platform to the latest version.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

12 June 2025

Ultima Markets Notification of Server Upgrade

|

Date |

Trading sessions |

Trade status |

Maintenance sessions |

|---|---|---|---|

2025/06/14 (Sat.) |

03:00-23:59 (GMT+3) |

Break |

00:00 – 02:59 (GMT+3) |

2025/06/15 (Sun.) |

00:00-23:59 (GMT+3) |

Normal |

/ |

•During the upgrade process, the client portal and UM App will be temporarily unavailable. Our official website will remain available, but clients will not be able to sign up.

• Any client portal and UM App functions that contain account data adjustments might be temporarily unavailable.

• During the upgrade process, the features of MetaTrader software & application, including but not limited to logging in, quoting and opening/closing positions, will be temporarily unavailable.

• There might be a gap between the original price and the price after maintenance. The gap between Pending Orders, Stop Loss and Take Profit will be filled at the market price once the maintenance is completed.

• To ensure access to the most accurate and up-to-date information regarding market opening times and order execution, kindly update your trading platform to the latest version.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

19 May 2025

Important Notice Regarding Position Records for USC (Cent Account)

|

Dear Client, As part of our ongoing commitment to enhancing your trading experience and ensuring a seamless environment for all our clients, we would like to inform you about an upcoming adjustment related to your USC (Cent Account) on the MT4 platform, effective May 17, 2025. Adjustment Details:

Friendly Reminders:

This adjustment is part of our ongoing efforts to maintain a high standard of service and provide a smooth, efficient trading experience for all our clients. Thank you for your understanding and support. Wishing you all the best. Sincerely, Ultima Markets |

15 May 2025

Ultima Markets – Notification of Server Upgrade

|

Date |

Trading sessions |

Trade status |

Maintenance sessions |

|---|---|---|---|

2025/05/17 (Sat.) |

02:00-23:59 (GMT+3) |

Break |

00:00 – 01:59 (GMT+3) |

2025/05/18 (Sun.) |

00:00-23:59 (GMT+3) |

Normal |

/ |

•During the upgrade process, the client portal and UM App will be temporarily unavailable. Our official website will remain available, but clients will not be able to sign up.

• Any client portal and UM App functions that contain account data adjustments might be temporarily unavailable.

• During the upgrade process, the features of MetaTrader software & application, including but not limited to logging in, quoting and opening/closing positions, will be temporarily unavailable.

• There might be a gap between the original price and the price after maintenance. The gap between Pending Orders, Stop Loss and Take Profit will be filled at the market price once the maintenance is completed.

• To ensure access to the most accurate and up-to-date information regarding market opening times and order execution, kindly update your trading platform to the latest version.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

25 April 2025

Ultima Markets Notification of Server Upgrade

|

Date |

Trading sessions (GMT+3) |

Trade status |

Maintenance sessions (GMT+3) |

|---|---|---|---|

2025/04/26 (Sat.) |

02:00 – 10:29 |

Break |

10:30 – 12:30 |

2025/04/27 (Sun.) |

00:00 – 06:59 |

Break |

07:00 – 11:00 |

•During the upgrade process, the client portal and UM App will be temporarily unavailable. Our official website will remain available, but clients will not be able to sign up.

• Any client portal and UM App functions that contain account data adjustments might be temporarily unavailable.

• During the upgrade process, the features of MetaTrader software & application, including but not limited to logging in, quoting and opening/closing positions, will be temporarily unavailable.

• There might be a gap between the original price and the price after maintenance. The gap between Pending Orders, Stop Loss and Take Profit will be filled at the market price once the maintenance is completed.

• Please refer to MetaTrader for the latest update on the completion and market opening time.

If you have any questions or require assistance, please do not hesitate to contact [email protected].