Oracle Stock Falters Post 2Q Results: Mixed Performance

Oracle Stock: Unveiling 2Q Results and Future Projections

Oracle Corporation (ORCL.US) recently reported its fiscal 2Q results, revealing both triumphs and setbacks. The company’s revenue of $12.94 billion, a 5% YoY increase, fell short of the expected $13.05 billion. However, earnings per share outperformed expectations at $1.34 (adjusted), compared to the predicted $1.32.

Segment Breakdown

Delving into specific business segments, cloud services, and license support revenue rose by 12% to $9.64 billion, albeit slightly below the expected $9.71 billion.

Cloud and on-premises license revenue experienced an 18% decline to $1.18 billion, just under the anticipated $1.21 billion.

Services revenue also missed expectations at $1.37 billion versus the consensus of $1.40 billion.

Positive Highlights

On a positive note, cloud infrastructure revenue witnessed a significant 52% surge, reaching $1.6 billion. Oracle secured notable clients during this period, including Elon Musk’s AI startup xAI, Halliburton, and Samsung. However, Oracle faced challenges as xAI sought more AI chips than Oracle could provide due to industry-wide GPU shortages.

Strategic Moves

In a strategic move, Oracle announced Microsoft as a new cloud customer, planning to roll out 20 Azure-connected data centers over the next few months, according to co-founder Larry Ellison. Despite the setbacks, Ellison remains optimistic about Oracle’s future, projecting the Oracle Cloud Infrastructure’s growth rate to exceed 50% annually for the next few years.

Future Guidance

The 3Q guidance provided by Oracle fell short of analyst predictions. The company forecasted adjusted net income per share between $1.35-$1.39 and 6-8% revenue growth. Analysts had anticipated $1.37 adjusted EPS and $13.34 billion in revenue, reflecting a 7.6% revenue increase.

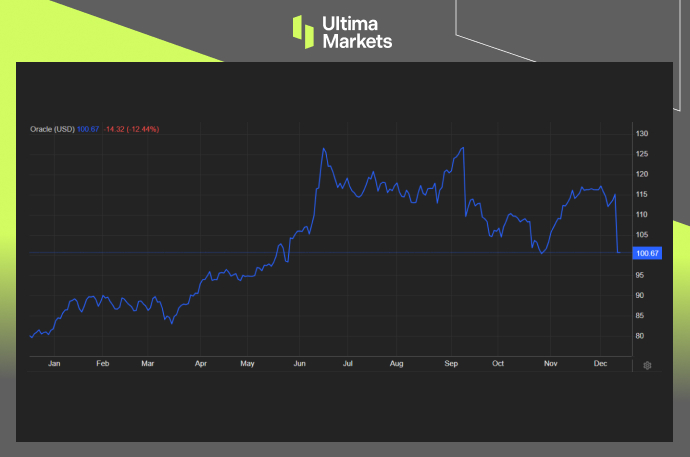

(Oracle Stock Performance One-year Chart)

Acquisitions and Market Performance

Despite the post-earnings share decline, Oracle stock has still achieved an impressive 41% gain in 2023, outperforming the S&P 500’s 20% return. Oracle’s NetSuite division also made a strategic move, acquiring the Australian field service software company Next Technik.

Frequently Asked Questions

Q: What is Oracle’s 3Q guidance?

A: Oracle’s 3Q guidance includes adjusted net income per share between $1.35-$1.39 and 6-8% revenue growth.

Q: How did Oracle’s cloud infrastructure revenue perform in 2Q?

A: Oracle’s cloud infrastructure revenue experienced a substantial 52% surge, reaching $1.6 billion.

Q: Which companies did Oracle secure as clients during the quarter?

A: Oracle secured major clients, including Elon Musk’s AI startup xAI, Halliburton, and Samsung.

Bottom Line

Despite challenges in certain segments, Oracle remains optimistic about its future growth. Strategic acquisitions, new partnerships, and a robust cloud infrastructure contribute to Oracle’s resilience in the dynamic tech landscape.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server