US Stocks Ended Winning Streak, Risk-Aversion Resurfaces

TOPICSU.S. stock indices snapped their nine-day winning streak on Monday as investors reassessed the implications of former President Trump’s latest tariff announcement. Safe-haven assets like gold also rallied sharply, signaling a potential return of risk-aversion ahead of key policy events this week.

Trade and Monetary Policy Uncertainty

Over the weekend, Trump proposed a 100% tariff on foreign films, which weighed on market sentiment and pressured entertainment stocks such as Netflix and Paramount Global. While the proposed tariff may have limited direct economic impact, it reignited concerns about Trump’s overall trade stance, challenging recent optimism around a more moderate approach.

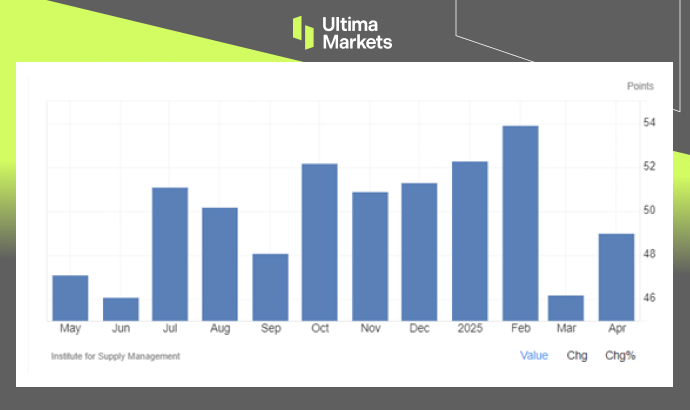

Meanwhile, economic data offered mixed signals. The U.S. ISM Services PMI unexpectedly rose to 51.6 in April from 50.8 in March—marking a rebound from a nine-month low. However, the employment component of the index showed a second consecutive month of contraction, reinforcing caution among investors and casting doubt on the labor market’s underlying strength.

US ISM Services Employment; Source: ISM | Trading Economics

In addition to renewed trade tensions, uncertainty surrounding the upcoming Federal Reserve policy decision has grown—largely due to the lack of progressive move in U.S.-China trade talks.

While both nations have signalled a willingness to engage in talk, significant obstacles remain. Ongoing mutual mistrust and cautious diplomacy continue to cloud the outlook, adding pressure to market expectations ahead of this week’s Fed meeting.

The Fed is widely expected to keep rates unchanged in May, investors are closely watching for clearer guidance on the timing and scale of potential cuts—particularly whether the first move could come in June or July. However, with trade risks resurfacing, market participants are dialling back expectations of imminent easing, anticipating that the Fed may stick to a more hawkish and cautious tone similar to its previous meetings.

“Such a stance could weigh on investor sentiment and pressure U.S. equities, especially given the fragile recovery in risk appetite.”, according to Ultima Market Senior Analyst Shawn.

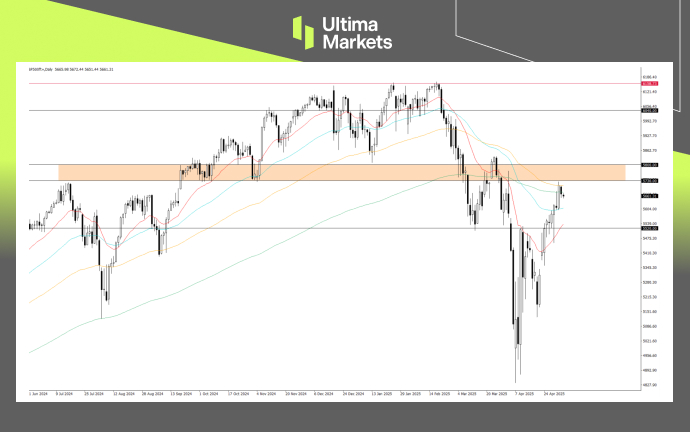

S&P 500 Facing Pressure at 200-Day Moving Average

The U.S. equities benchmark—S&P 500 Index—is currently encountering resistance at a key technical zone, aligning with the 200-day moving average. This level has historically acted as a critical inflection point, and the index’s failure to break above it suggests that bearish sentiment remains intact.

S&P500 (SP500+), Day Chart Analysis; Source: Ultima Market MT5

Given the recent uptick in risk-aversion and ongoing macro uncertainty, the index may face renewed selling pressure. If bearish momentum intensifies, the S&P 500 could see another leg lower, especially if upcoming data or Fed communication dampens investor confidence further.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server