Tag Archives: Interest Rate

Tech Rally Propels S&P 500 and Nasdaq to New Peaks Despite Fed’s Rate Pause

In June 2024, for the seventh consecutive meeting, the Federal Reserve decided to maintain the federal funds target range at 5.25%-5.50%, aligning with predictions. The Fed’s policymakers anticipate that until there is greater confidence in inflation sustainably approaching 2%, a reduction in rates will not be deemed appropriate. The current dot plot indicates that policymakers […]

RBNZ Maintains Interest Rates, Surprising Markets with Hawkish Stance, Boosting NZD

The Reserve Bank of New Zealand (RBNZ) maintained the official cash rate (OCR) at 5.5% during its May meeting, marking the seventh consecutive hold, and signaled a more hawkish outlook than anticipated. Subsequently, the New Zealand dollar surged past $0.612. The RBNZ stated that the current restrictive policy stance is necessary for a longer duration […]

Is This the End of the Federal Reserve’s Hiking Cycle?

Federal Reserve Holds Rates Steady, Signals End of Hiking Cycle The Federal Reserve’s recent decision to maintain the federal funds rate has sparked discussions about the trajectory of economic indicators and the potential for future rate cuts. In this article, we delve into the key aspects of the Federal Reserve’s December meeting, examining economic projections, […]

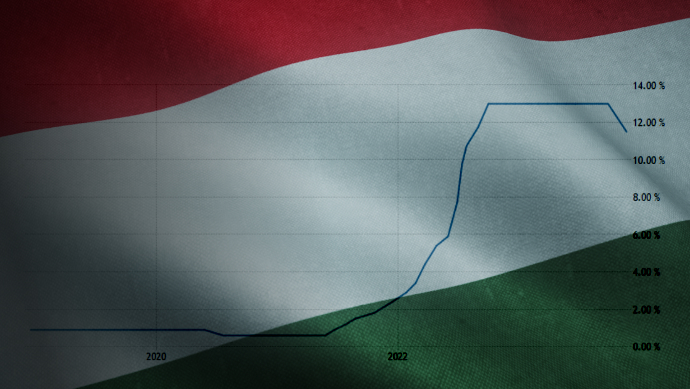

NBH Slash Benchmark Interest Rate Amid Economic Pressures

Hungary’s Recent Benchmark Interest Rate Cut and Economic Dynamics In a decisive move on November 21, the National Bank of Hungary (NBH) implemented a 75 basis points reduction in the benchmark interest rate, bringing it to 11.5%. This strategic decision, made amidst pressure for further rate cuts from the government, reflects the delicate balance between […]