Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

U.S. Foreign & Trade Policy in Focus

U.S. Foreign & Trade Policy in Focus: Market Impact & Key Developments

This week, market attention remains on U.S. foreign and domestic policy, particularly the Russia-Ukraine peace talks and international trade relations. On Thursday, President Trump’s public address and meetings propelled the U.S. dollar higher after three consecutive weeks of losses.

Trade Policy Escalates to Global Concerns

On Thursday, Trump reaffirmed that tariffs on Mexican and Canadian imports will take effect on March 4th as originally planned. With just five days remaining until implementation, concerns over global trade tensions have reignited.

Earlier, Trump also announced plans to impose tariffs on the European Union (EU) and signed a memorandum introducing the “Fair and Reciprocal Plan.” This initiative aims to align U.S. tariffs with those imposed by other nations on American goods. The policy specifically targets key U.S. trade partners, including the EU, Japan, and India, seeking to address perceived trade imbalances.

Meanwhile, the UK appears to have “avoided” the tariff threat. Trump suggested that the UK might be exempt from these tariffs, praising Prime Minister Keir Starmer’s “strong lobbying” efforts during their meeting yesterday.

Dollar Surges as Major Currencies Sell-off

The U.S. dollar surged on Thursday as the euro and Canadian dollar weakened, while global trade concerns triggered a sell-off in risk-sensitive currencies like the Australian dollar.

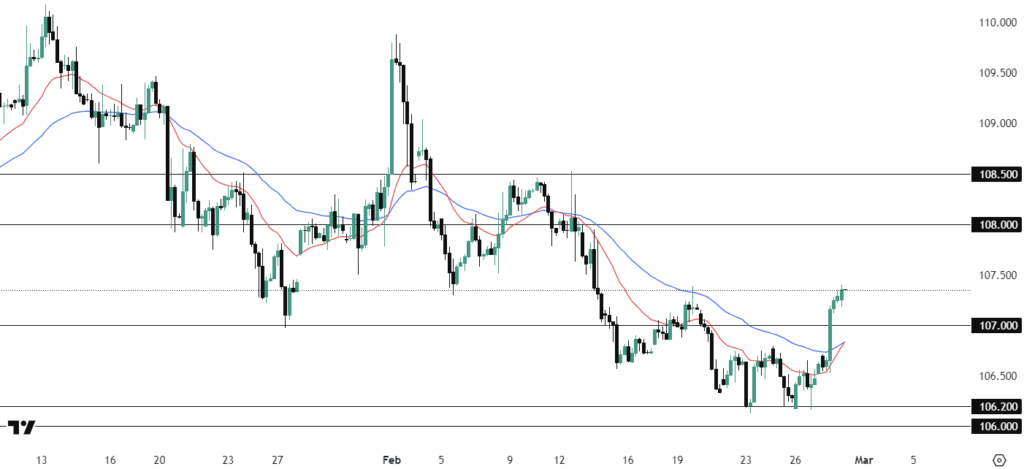

(US Dollar Index, 4H Chart Analysis; Source: Trading View)

The DXY found strong support near 106.15, forming a triple-bottom pattern earlier this week, which fuelled the dollar’s rally. Currently, the index is trading around 107.00. If this level holds, further upside momentum in the U.S. dollar remains possible, supported by prevailing market conditions.

Russian-Ukraine Peace Talks Positive

Trump also discussed on the ongoing situation in Ukraine on meeting with UK Prime Minister Starmer yesterday, and expressed confidence in Russian President Putin’s commitment to a peace deal.

Russia reiterated its key demands, including:

- Recognition of its annexation of certain Ukrainian territories.

- Ukraine’s commitment to not seeking NATO membership.

- Opposition to the deployment of NATO peacekeeping forces in Ukraine.

President Vladimir Putin acknowledged that European countries will eventually need to be involved in the peace process.

Markets are closely monitoring the upcoming high-level meeting, which is expected to include European leaders and potentially direct negotiations between U.S. President Donald Trump, Putin, and Ukrainian President Volodymyr Zelensky. These discussions could have a significant impact on geopolitical stability.

Gold Enters a Corrective Moves

Although no concrete peace deal has been reached yet, the positive developments in the Ukraine peace talks have weakened demand for safe-haven assets, leading to a pullback in gold from its record highs.

(XAU/USD, 4-H Chart Analysis; Source: Trading View)

Gold has broken below the key 2880 support level, signaling a potential continuation of its corrective move toward the next major support at 2840.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server