Dollar Slips on Weaker Labor Market and Rising Inflation

The U.S. dollar weakened on Thursday as investors assessed data indicating both labor market softness and a slight rise in consumer prices, which suggests that the Federal Reserve may continue cutting interest rates.

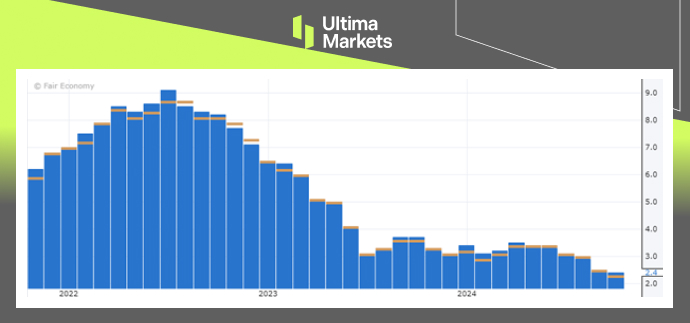

According to data from the Labor Department, the consumer price index (CPI) increased by 0.2% in September. However, on a year-over-year basis through September, the CPI rose 2.4%, marking the smallest annual increase since February 2021. In an interview with the Wall Street Journal on Thursday, Atlanta Federal Reserve Bank President Raphael Bostic expressed comfort with the idea of skipping an interest rate cut at the Fed’s upcoming meeting.

(U.S CPI y/y, Source: Forex Factory)

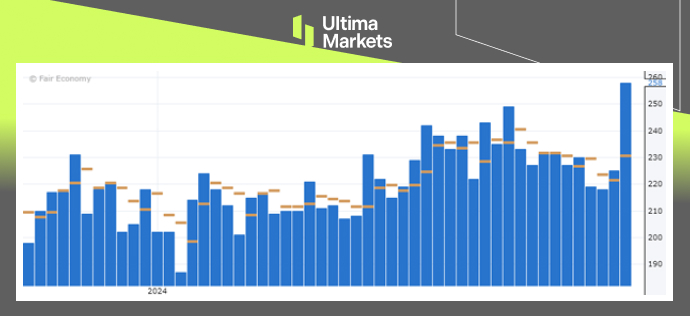

Further data from the Labor Department revealed a surge in unemployment claims last week, partly due to the impact of Hurricane Helene and Boeing furloughs. This spike in claims led to lower bond yields, as it reminded the market of the Fed’s concerns regarding the labor market.

(U.S Unemployment Claims, Source: Forex Factory)

Additionally, traders are now pricing in an 85% likelihood that the Fed will cut rates by 25 basis points at its November 7 policy meeting, with a 15% chance of no change, according to the CME Group’s FedWatch Tool.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server