Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

BYD Surpasses Ford in August 2023 Car Sales: Industry Insights

BYD Overtakes Ford in August Car Sales: What Does It Mean for the Auto Industry?

According to TrendForce report, car sales in 37 markets around the world totaled 5.55 million units in August 2023, an increase of nearly 1% from July. The growth momentum came from the launch of new models for the autumn.

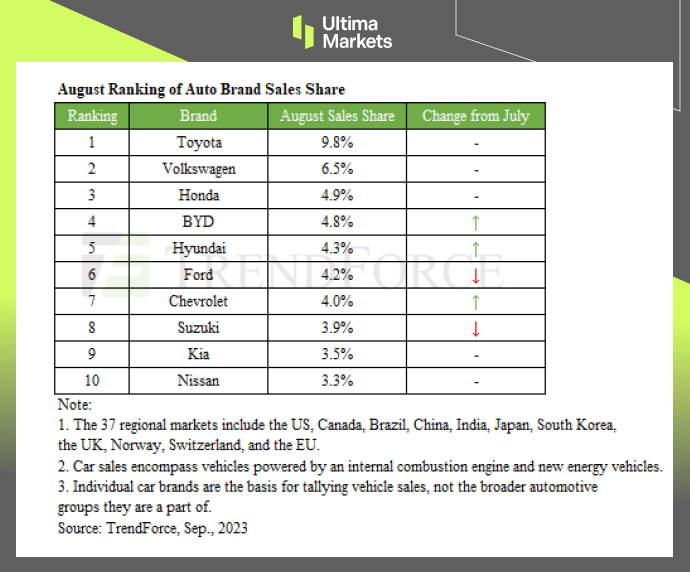

(August Ranking of Auto Brand Sales Share)

The composition of the top ten brands is the same as last month. The top three are Toyota, Volkswagen, and Honda. The Chinese car manufacturer BYD replaced Ford and became the fourth-largest brand in August car sales.

BYD’s Remarkable Growth

BYD has converted all its models to new energy vehicles, so the lukewarm domestic demand in the Chinese market has less impact on it. BYD recorded a MOM growth of 5%, and the market share was only 0.1% behind the third-placed Honda.

However, Japanese car manufacturers also have contributions from markets such as Southeast Asia. Consequently, for BYD to surpass Honda in the global market, the key is its expansion speed in overseas markets.

Ford’s Decline in August Sales

Ford’s ranking fell to sixth place due to lower sales in Europe and the United States compared with the previous month, with sales declining by 6.7% month-on-month.

Challenges and Variables in 2H23

Although the launch of autumn models will help new car sales, there are still many variables in 2H23, including the United Auto Workers (UAW) strike that has not yet ended; OPEC+ allies’ crude oil production cuts, etc.

Strategies for the Fourth Quarter

As the fourth quarter approaches, auto manufacturers will do their best to ensure smooth production, fulfill orders, and stimulate year-end sales, minimizing the impact of reduced order visibility caused by economic changes.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server