Bitcoin Breaks $116K as Crypto Market Rallies on U.S. Policy Support

Bitcoin surged to a fresh all-time high above $116,000 on Friday, with Ethereum climbing past $2,900, as global risk sentiment improved and institutional inflows accelerated. The rally marks a renewed wave of optimism across the crypto space, driven by supportive U.S. policy signals, stronger tech sentiment, and an expanding pool of corporate adopters.

Strategic Support from US Policy Boosts Sentiment

One of the key catalysts behinds the crypto rally has been the Trump administration’s overt endorsement of the digital assets. In recent weeks, the White House has unveiled plans to create a strategic Bitcoin reserve, a move intended to enhance long-term national competitiveness in decentralized finance.

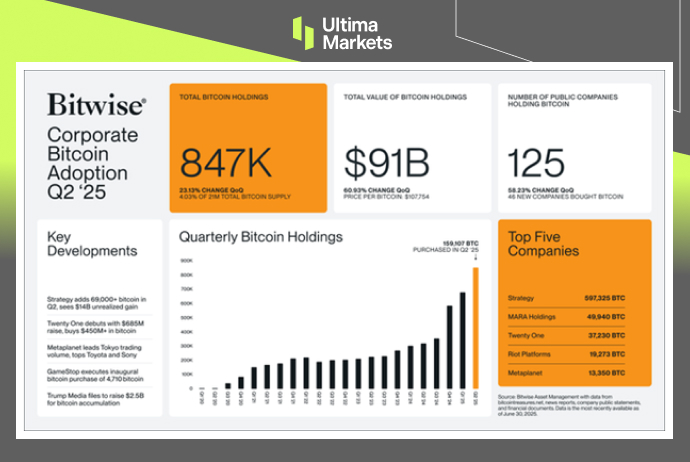

With the policy, Bitcoin reserves held by public companies have surged, with Q2 2025 corporate holdings doubling year-over-year to around 847,000 BTC, according to Bitwise Q2 2025 report.

Corporate Bitcoin Adoption in Q2 2025 | Source: Bitwise

Furthermore, with the optimism around tech stocks, hopes for upcoming Fed rate cuts and a weaker U.S Dollar, risk appetite has lifted demand for crypto as an alternative store of value, further drive the cryptocurrency market higher.

The total crypto market capitalization hovers around $3.45 trillion, with 97 of the top 100 coins trading higher today.

What’s Next for the Crypto Market?

The U.S. Senate is preparing to debate a new wave of digital asset legislation that could significantly impact the regulatory landscape. Key topics include clearer guidelines for crypto taxation, custody rules, and the structure of spot Bitcoin ETFs—potentially unlocking further institutional participation.

Bitcoin’s price action also remains closely correlated with major U.S. equity indices, with a correlation coefficient of approximately 0.87. This growing alignment underscores the asset’s increasing integration into traditional financial markets, suggesting that macroeconomic drivers—such as interest rate expectations and tech sector sentiment—will continue to influence crypto performance in the near term.

Technical Outlook for Bitcoin & Ethereum

From a technical perspective, Bitcoin has decisively broken above its previous all-time high of $112,000, reinforcing bullish momentum.

BTCUSD, Daily Chart Analysis | Source: Ultima Market MT5

“The breakout paves the way for further upside toward the $125,000 psychological level, with $130,000—the next major Fibonacci extension—also in focus,” said Shawn Lee, Senior Market Analyst at Ultima Markets.

ETHUSD, Daily Chart Analysis | Source: Ultima Market MT5

Ethereum is also showing strong upward momentum, trading above $2,800—its key resistance level in the past. A sustained break above this range could open the path toward the upside in near-term. Both assets remain technically supported amid growing institutional demand and risk-on sentiment.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server