Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomTrump Targets 50% Copper Tariff, Sparking 18% Price Surge

Abstract: President Trump’s announcement of tariffs up to 50% on copper imports, far exceeding market expectations of 25%, triggered a 13% surge in New York copper futures, marking the largest single-day gain since 1968 and a record closing high. The tariffs are expected to directly benefit COMEX copper prices while driving up the stock prices of U.S. copper producers like Freeport-McMoRan, which rallied over 8.8% at one point.

Ultima Markets offers trading services on its MT5 platform for New York copper futures (ticker: Copper-C) and CFDs on U.S. copper stocks (like FCX), allowing investors to engage with this historic market opportunity by trading copper price volatility and related equities.

Original Content Attribution: Ultima Markets

Senior Analyst: Elon Gu

U.S. President Donald Trump has threatened to impose tariffs of up to 50% on copper imports, a move aimed at reshaping supply chains for the key industrial metal that also risks upending the global copper market, driving up domestic inflation, and adding a new layer of uncertainty to the global economy.

On Tuesday, Trump unveiled the tariff plan, which far exceeded market expectations and sent U.S. copper futures prices spiking 13%—the largest single-day gain since 1968 and a new record closing high. U.S. Commerce Secretary Lutenick stated that the new tariffs could take effect as early as August 1, representing another round of trade barriers on key industrial goods, following those on steel, aluminum, and automobiles.

This move does not just affect copper. Trump also threatened high tariffs on imported pharmaceuticals and semiconductors. Ultima Markets notes that this signals a potential further expansion of his protectionist trade policies, presenting new challenges for investors and markets.

Unexpected Tariffs and Market Shock

The 50% copper tariff announced by the Trump administration, a rate roughly double the 25% widely anticipated by the market, caught investors off guard.

The legal basis for this tariff is Section 232 of the Trade Expansion Act of 1962, which authorizes the president to impose restrictions on imported goods for national security reasons.

According to White House documents, the U.S. Department of Commerce has been investigating potential threats to copper supply for several months. The investigation, originally slated to last up to 270 days and extend to the end of November, concluded earlier than expected. Although the tariff plan has been announced, specific implementation details, such as whether it applies to all copper products and if exemptions will exist, remain unclear.

The market reaction was swift and dramatic. New York spot copper prices (ticker on Ultima Markets MT5: Copper-C) surged as much as 18% from their lows.

(1-Hour Chart of Copper Prices, Source: Ultima Markets MT5)

As one of the leading U.S. copper producers, shares of Freeport-McMoRan also rallied on the news, rising over 8.8% at one point before closing with a 2.5% gain. CFDs on this stock are also available for direct trading on Ultima Markets’ MT5 platform under the ticker FCX.

(1 Hour Chart of Freeport-McMoRan, Source: Ultima Markets MT5)

The U.S. Copper Supply Chain’s Reliance on Imports

Copper is a cornerstone of modern industry, widely used in construction, automobiles, mobile phones, and computer chips. Its demand has surged recently due to the energy transition and the boom in data center construction. However, the United States is highly dependent on imports for this critical metal.

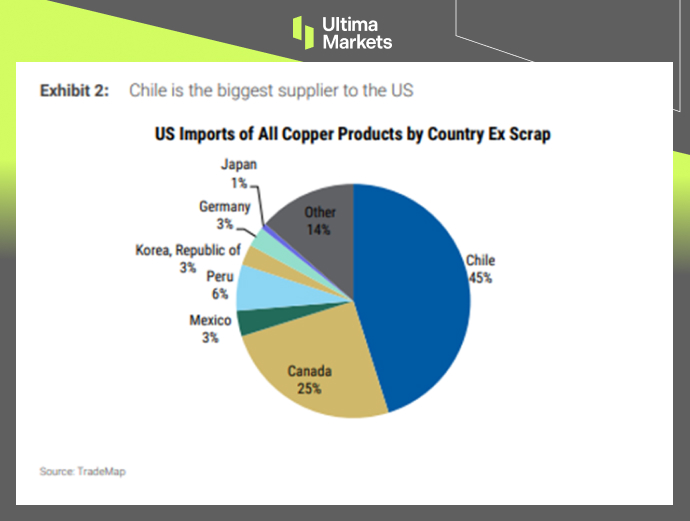

According to the U.S. Geological Survey, net copper imports accounted for 53% of the nation’s total demand last year. The main suppliers were Chile (45%), Canada (25%), Peru (6%), and Mexico (3%).

Despite possessing ample copper reserves, the White House admitted in a February statement that “our smelting and refining capacity significantly lags behind our global competitors.”

Globally, China’s dominance in the copper supply chain is growing. According to Wood Mackenzie, China accounted for nearly half of the $55 billion in new global copper mine investments between 2019 and 2024. Furthermore, since 2000, 75% of the world’s new smelting capacity has come from China. The Trump administration’s objective with this move is precisely to ensure the U.S. has a more resilient domestic supply chain.

Elon Gu, a senior analyst at Ultima Markets, noted, “We saw the potential impact of U.S. trade protectionism on commodities back in March, when prices for U.S. COMEX-related commodities were higher than LME prices. This creates a potential driver for higher global commodity prices.”

Because COMEX reflects the duty-paid price for physical delivery in the U.S., the tariffs will directly increase import costs, thus benefiting COMEX copper prices.

However, this impact may be buffered in the short term. The U.S. has been stockpiling copper since the Section 232 investigation began. According to reports, the U.S. has imported an “additional” 400,000 metric tons of refined copper, equivalent to about six months of imports. These inventories can be consumed first, delaying the full pass-through of the tariffs to prices. Drawing from the experience with aluminum tariffs, price transmission also takes time.

Meanwhile, LME copper prices could face downward pressure. Previous tariff expectations led to a “rush to import” in the U.S., which at one point drained inventories in other parts of the world and supported LME prices.

Once the tariffs take effect, U.S. import demand will drop sharply as consumers prioritize using cheaper, already onshore inventory. This would divert copper originally bound for the U.S. to other markets, potentially leading to looser supply conditions outside the U.S. and thus depressing LME copper prices.

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server