Yen Firms Slightly as Japanese Ruling Coalition Loses Majority

The Japanese Yen saw a modest recovery on Monday, firming around ¥148.30 per U.S. Dollar, as markets digested the political fallout from Japan’s weekend Upper House election, where the ruling Liberal Democratic Party (LDP) and its coalition partner Komeito lost their majority, deepening the country’s political uncertainty.

The outcome dealt a significant blow to Prime Minister Shigeru Ishiba’s already fragile minority government, raising concerns over potential fiscal loosening and reform paralysis at a time when Japan is already grappling with record-high debt and volatile bond markets.

Rising Fiscal Risk Weighs on JGBs

Market participants are increasingly wary that the weakened coalition could resort to populist stimulus measures—including consumption tax cuts, cash handouts, and expanded fiscal spending—to regain public support.

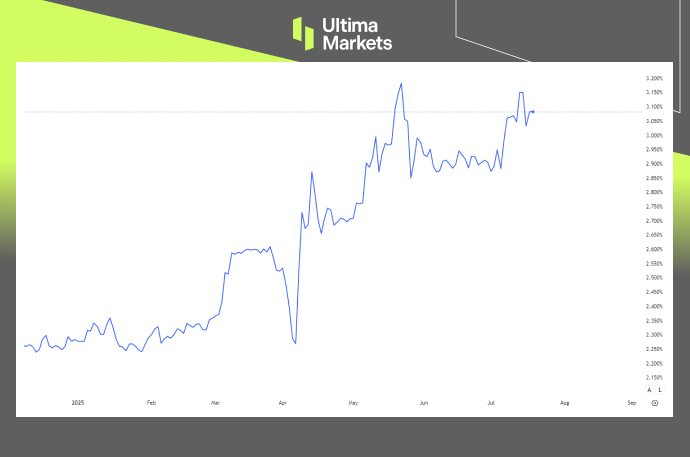

This prospect has led to a sharp rise in long-dated Japanese Government Bond (JGB) yields, with the 30-year yield hitting a fresh multi-month high on Monday.

Japan Government Bonds 30-Y Yields | Source: TradingView

“Surging yields in long-dated JGBs could complicate the Bank of Japan’s monetary stance,” said Shawn Lee, Senior Market Analyst at Ultima Markets. “If the government ramps up fiscal spending to boost its approval ratings, it could further strain the bond market and place downward pressure on the Yen and,” he added.

Tariff Tensions and FX Volatility in Focus

The election results come at a crucial time, with U.S.–Japan tariff negotiations approaching an August 1 deadline. The weakened Yen—down over 5% year-to-date—has drawn scrutiny from U.S. trade officials, especially as President Trump moves to impose a new round of tariffs targeting over 150 countries, including Japan.

At the G20 Finance Ministers meeting, Japanese Finance Minister Kenji Kato reiterated Japan’s commitment to preventing excessive currency volatility, signaling that authorities are monitoring FX markets closely. However, the Ministry of Finance has so far refrained from direct intervention.

Market Outlook: Yen Volatility Ahead

With Japan’s political landscape in flux and key global trade decisions looming, investors are bracing for further volatility. Market attention is now firmly focused on potential BoJ and MoF responses, as well as any policy clues from the new parliamentary balance.

“Unless the political dust settles and policy direction stabilizes, the Yen will likely remain under pressure,”, said Shawn Lee, Ultima Market Analyst

USDJPY: Traders Eyes on 148-150

The USDJPY extended its rally to a fresh four-month high, driven by broad-based Yen weakness. The sharp depreciation in the Yen has drawn renewed attention, particularly from the U.S., where Trump has voiced concerns over Japan’s currency moves

USDJPY, 4-H Chart Analysis | Source: Ultima Market MT5

The pair has decisively broken above the 148.00 level, prompting speculation about potential responses from Japanese authorities.

Market focus now shifts toward the psychologically significant 150.00 level—a threshold that has historically triggered verbal intervention or stealth operations from the Bank of Japan (BoJ) or Ministry of Finance (MoF) to rein in volatility.

Traders remain on high alert as the pair approaches this key resistance, watching closely for any signals of policy response or FX market intervention from Japanese officials.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server