Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

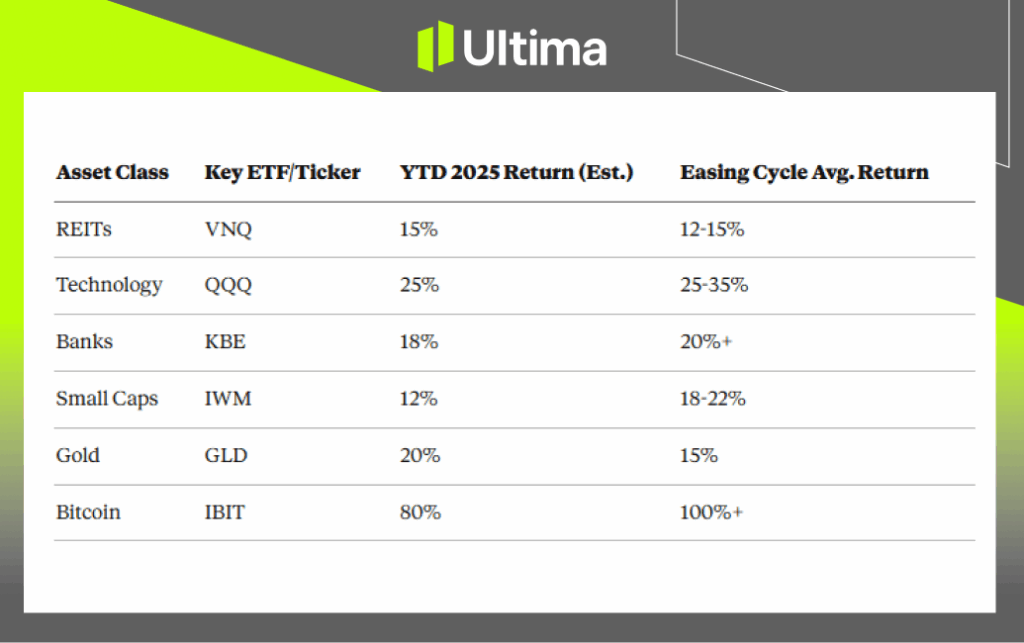

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWinners in the Fed’s Easing Era: Stocks, Sectors, and Assets Set to Surge

The Federal Reserve’s pivot toward monetary easing—marked by rate cuts beginning in September 2024 and projected to continue through 2026—creates a favorable environment for risk assets. Lower interest rates reduce borrowing costs, enhance corporate profitability, and support higher asset valuations, mirroring the bull markets that followed 2008 and ran from 2019-2021. Investors should focus on cyclical sectors, growth stocks, and yield-oriented assets that typically outperform when the 10-year Treasury yield falls below 4%.

Real Estate: REITs Rebound as Rates Decline

Real estate investment trusts (REITs) rank among the primary beneficiaries of monetary easing. Elevated rates since 2022 compressed REIT valuations by increasing discount rates on future cash flows. With mortgage rates declining from 7% peaks toward 6%, both residential and commercial properties are regaining investor appeal.

The Vanguard Real Estate ETF (VNQ), which tracks a broad REIT index, declined 25% in 2022 but has rallied 15% year-to-date in 2025 following initial rate cuts. Individual holdings demonstrate even stronger performance: Prologis (PLD), the industrial warehouse leader supporting e-commerce logistics, trades at a forward P/E of 22 while offering a 4% dividend yield. Its lease agreements with Amazon and FedEx provide contractual rent escalations, supporting projected FFO growth of 8-10% in 2025. Apartment-focused REITs like Equity Residential (EQR) benefit from sustained rental demand as millennials face persistent affordability challenges in the housing market. Historical data from NAREIT indicates that REITs have delivered 12-15% annualized returns during the first two years of Federal Reserve easing cycles.

Technology and Growth Stocks: Low-Cost Capital Accelerates Innovation

Technology companies and growth-oriented equities typically surge when financing conditions ease. Lower rates reduce the cost of equity capital for emerging innovators while compressing discount rates applied to future high-growth earnings.

The “Magnificent Seven” technology leaders are well-positioned: Nvidia (NVDA), with its dominance in AI chip architecture, could see valuation multiples expand from 40x to 60x as capital expenditure accelerates across the sector. Tesla (TSLA) stands to benefit from reduced EV financing costs and advancing robotaxi initiatives, with analysts projecting 25% revenue growth. Smaller-cap names like Palantir (PLTR) and Snowflake (SNOW) offer concentrated exposure to AI and cloud computing themes, thriving in environments resembling venture capital funding conditions.

The Invesco QQQ Trust (QQQ), heavily weighted toward Nasdaq technology stocks, has delivered returns exceeding 30% in previous easing phases. Sector-focused ETFs like the Technology Select Sector SPDR (XLK) provide balanced exposure, combining established leaders (Apple, Microsoft) with cyclical semiconductor companies. Small-cap technology exposure through the iShares Russell 2000 Growth ETF (IWO)—overlooked during the rate-hiking cycle—appears positioned for significant rotation.

Financials: Banks Capitalize on Favorable Lending Dynamics

Regional banks, somewhat counterintuitively, demonstrate strong performance during easing cycles. Yield curve steepening resulting from rate cuts expands net interest margins (NIMs), as short-term deposit costs decline more rapidly than long-term loan yields.

JPMorgan Chase (JPM) exemplifies this dynamic: management guidance projects 2025 NIMs of 2.8%, up from 2.5%, while investment banking fees accelerate in M&A-conducive low-rate environments. Regional institutions like KeyCorp (KEY) and Zions Bancorp (ZION) trade at discounted valuations (price-to-tangible-book ratios below 1.5x) while offering dividend yields of 4-5% and consensus price targets suggesting 15% upside potential. The SPDR S&P Bank ETF (KBE) provides broad sector exposure and has historically outperformed the S&P 500 by 20% during the first year of easing cycles.

Small Caps and Cyclicals: Rotation from Large-Cap Defensiveness

The Russell 2000 Index (IWM) has underperformed large-cap benchmarks in recent years but historically surges during easing cycles, as lower rates facilitate refinancing for debt-burdened smaller companies. Consumer discretionary stocks (XLY ETF) follow similar patterns: retailers like Home Depot (HD) and Nike (NKE) experience spending rebounds as consumer credit costs decline.

Industrial companies (XLI) also benefit—Caterpillar (CAT), for instance, gains from infrastructure projects financed with low-cost debt. Energy typically lags absent significant oil price increases, while utilities (XLU) provide defensive characteristics with attractive yields (3-4%) and rate-sensitive growth profiles.

Yield Alternatives: Gold, Cryptocurrency, and High-Yield Bonds

Beyond equities, monetary easing pressures the dollar and reduces real yields, supporting alternative stores of value. Gold reached $2,700 per ounce in late 2024 on rate cut expectations; the SPDR Gold Shares (GLD) provides exposure, with gold mining stocks like Newmont (NEM) offering leveraged plays.

Bitcoin and cryptocurrencies have demonstrated particularly strong performance. As “digital gold,” Bitcoin correlates with M2 money supply expansion, surging 150% following 2020 rate cuts. Spot Bitcoin ETFs like the iShares Bitcoin Trust (IBIT) hold over $50 billion in assets under management, with easing cycles historically driving substantial inflows. The Grayscale Bitcoin Trust (GBTC) trades at a narrowing discount to net asset value.

High-yield corporate bonds (HYG ETF) offer yields of 6-7% with declining default risk; junk bonds have returned approximately 15% annually in previous easing environments.

Performance Summary

Risks and Portfolio Positioning

Not all assets benefit equally: utilities may underperform if economic growth accelerates meaningfully, and elevated technology valuations risk correction. Investors should monitor inflation resurgence or persistent labor market strength that could prompt the Fed to pause rate cuts.

Consider positioning through equal-weight ETFs for enhanced diversification, supplemented with targeted exposure to leading names like NVDA through options strategies. A balanced approach might allocate 15-20% of portfolios across VNQ, IWM, and IBIT to capture this opportunity set.

As the easing cycle progresses, these asset classes could propel the S&P 500 beyond 7,000 by 2026. Maintaining flexibility remains essential—Federal Reserve policy shifts reward prepared investors.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server