Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

US NFP Adds Hawkish Pressure on December Fed Policy Path

The Federal Reserve’s policy path has taken on a more hawkish tone following the release of the latest delayed Nonfarm Payroll (NFP) data. Global markets reacted sharply: U.S. equities fell, with major indexes losing ground—particularly in the technology sector, which bore the brunt of the sell-off. Cryptocurrencies also tanked, reflecting heightened risk aversion and investor concern over tighter monetary policy.

Investor sentiment is on edge as markets reassess the likelihood of further Fed rate cuts and implications for growth-sensitive assets. The NFP data has amplified uncertainty, forcing traders to balance cooling growth against persistent inflation pressures.

In this analysis, we break down the latest FOMC meeting, examine how the recent NFP data has influenced market expectations, and explore the implications for global markets in the weeks ahead.

What the Latest FOMC Minutes Reveal

Looking back at the October FOMC meeting, the minutes show that the Committee lowered the federal funds rate target range by 25 basis points to 4.00%–4.25%, signaling a modest shift toward a more accommodative stance. Yet, the accompanying commentary and forward guidance remained cautiously hawkish.

Key Highlights

- Rate Cut: 25 bps, framed as a “risk-management” move rather than a response to outright economic weakness.

- Economic Activity: Growth has slowed in the first half of the year, with job gains moderating.

- Labor Market: The Fed acknowledged higher downside risks to employment.

- Inflation: Price pressures remain elevated, with some signs of re-acceleration.

- Forward Guidance: Policy will remain data-dependent, with no commitment to a preset path of cuts.

The Fed’s action and stance reflect a careful balancing act: easing financial conditions to support a softening labor market while remaining vigilant against persistent inflation. Several Fed officials have emphasized concerns that inflation progress has stalled, even as hiring demand has eased, though not collapsed.

In other words, The Fed faces a delicate dilemma: rate cuts may provide little support to a moderately soft labor market while risking a rebound in inflation.

NFP Adds a Hawkish Layer to Fed Policy Path

Before the NFP release, markets had already been scaling back expectations for a December rate cut. Following the FOMC minutes and hawkish-leaning commentary from several Fed officials, investor sentiment was tilting toward caution.

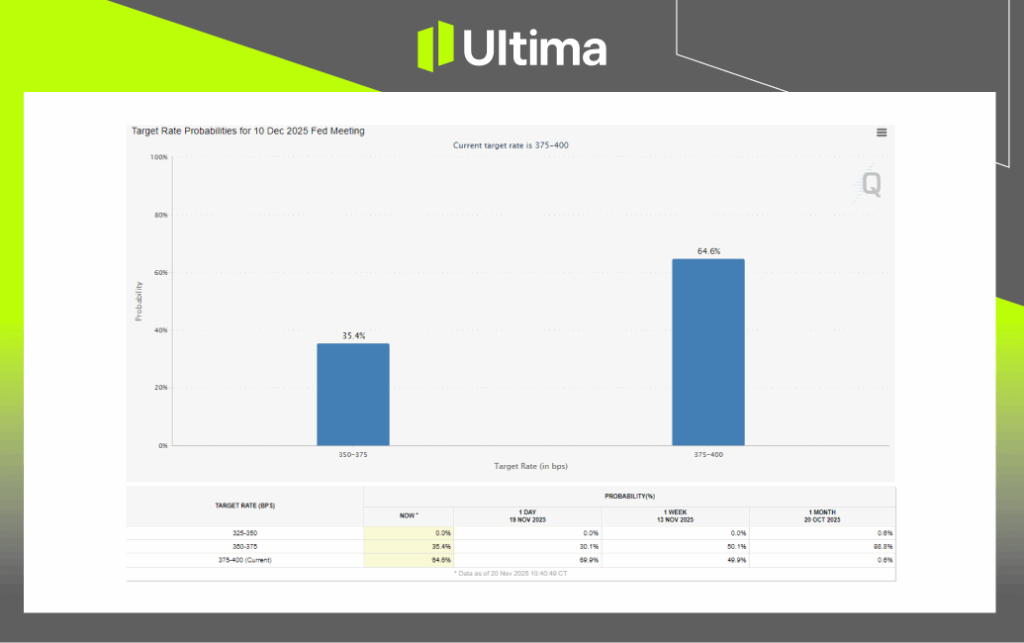

According to CME FedWatch tools, the market had reduced the probability of a December cut to 40%, down sharply from nearly certain odds of 98.8% a month ago. After the release of the Nonfarm Payroll report, these odds fell further to 35.4%, reflecting the strong labor market data.

December Rate Probabilities | Source: CME Group

Nonfarm Payrolls Data Highlights

- Jobs Added: The U.S. economy added 119,000 jobs in September, significantly beating the consensus forecast of 50,000, signaling underlying labor market resilience.

- Unemployment Rate: Unexpectedly ticked up to 4.4%, showing some softening in labor participation.

- Revisions: Prior months’ figures were revised lower, confirming a gradual cooling trend that the Fed has emphasized.

Despite the small uptick in unemployment, the strong payroll growth, combined with the Fed’s hawkish tone, has drastically reduced expectations for a pre-Christmas rate cut. The data suggests the Fed has little immediate reason to accelerate easing, keeping the market on edge over the policy trajectory heading into year-end.

Market Reaction: Win for Dollar, Lose for Equities

Following the NFP release, the U.S. dollar strengthened sharply as markets repriced expectations for the Fed, reflecting the reduced likelihood of a December rate cut. Equities declined, with major indexes falling, and technology stocks underperforming due to their heightened sensitivity to interest rate expectations.

At the same time, cryptocurrencies suffered significant losses as investors shifted away from high-risk assets in favor of safer positions.

The combined impact highlights a market that is now highly sensitive to Fed messaging and economic data, with traders closely monitoring labor and inflation indicators for cues on the central bank’s next policy move.

What Could It Mean for US Stock Market?

With interest rates expected to stay “higher-for-longer,” equities face pressure. But this is not the only factor: despite elevated rates for some time, why now?

Answer to that: the added pressure comes from concerns over AI and tech sector overvaluation.

Recent market sentiment has focused on the AI/tech sector, and the US stock market has rallied strongly since the March sell-off during the trade war escalation.

Now, with elevated rate expectations, AI/tech valuation concerns, and a broad risk-asset sell-off, selling pressure has intensified. This points to one conclusion: US equities may have entered a corrective phase in the current market landscape.

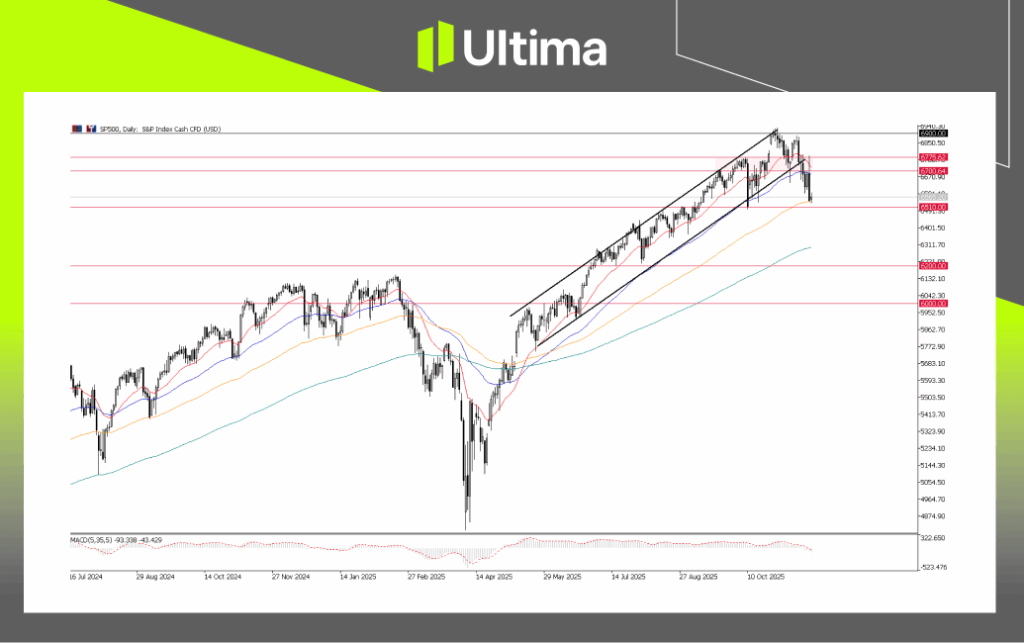

S&P500, Daily Chart | Source: Ultima Market MT5

This is reflected in the technical outlook of the S&P 500 index, where the near seven-month uptrend channel appears to have been broken, suggesting a corrective move is in place. Based on this market landscape and technical outlook, the S&P 500 and broader US stock market are likely in a corrective phase.

Is this a bearish market? Not yet. But any further uncertainty or worsening data in the coming weeks could continue to pressure risk assets.

Elevated Uncertainty Across Fed Outlook, US Economy, and Equities

The latest FOMC minutes, coupled with the strong NFP report, have intensified concerns around the Fed’s policy outlook, adding hawkish pressure and reducing the likelihood of a pre-Christmas rate cut. The data highlight a US economy that is showing resilience in the labor market but also signs of gradual cooling, creating a delicate balancing act for policymakers.

At the same time, the US stock market faces increasing pressure, with elevated interest rate expectations, AI/tech valuation concerns, and broader risk-off sentiment contributing to a potential corrective phase.

Market participants remain on edge, watching closely for upcoming economic data to gauge whether the Fed will maintain its current stance or shift more aggressively.

And the Key Market Implications for other asset-market into end of 2025? Here is a quick wrap up:

- US Dollar: May maintain bullish momentum as the reduced likelihood of immediate Fed cuts supports the currency.

- Gold: Safe-haven demand is present due to heightened risk sentiment, but higher yield expectations keep gold temporarily from being the first choice for capital inflows.

- Cryptocurrency: As a highly sensitive risk asset, crypto may continue to experience pressure. Historically, recovery after sharp sell-offs can take time, suggesting that crypto markets may remain under stress before fully rebounding from the current bear phase.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server