Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomU.S. Dollar Breaks Down as PPI Confirms Dovish Pivot

Daily Market Insights – November 26, 2025, Brought to you by Ultima Markets.

Today’s market narrative is defined by the breakdown of the U.S. Dollar. The soft inflation data released yesterday has validated the Fed’s dovish pivot, effectively locking in a December rate cut and triggering a decisive break in key technical levels.

PPI Data: The “All Clear” Signal for a December Cut

With the CPI report cancelled due to the shutdown, yesterday’s September Producer Price Index (PPI) became the market’s primary inflation proxy—and it delivered a clear dovish signal that strengthened expectations for a December cut.

Key PPI Data:

- PPI MoM: +0.2% — softer than the +0.3% forecast, signalling easing headline inflation.

- PPI YoY: +2.7% — confirms producer-level inflation is cooling toward the Fed’s comfort zone.

- Core PPI MoM (Ex-Food & Energy): +0.1% — below the +0.2% expectation, showing underlying inflation is weakening.

- Core PPI YoY: +2.6% — lower than previous readings, indicating meaningful relief in persistent price pressures.

This soft print confirms that inflation pressures at the wholesale level are cooling. It validates the Fed’s recent signals that policy is already sufficiently restrictive and that the committee can afford to ease off the brakes to prevent unnecessary labor-market damage.

Fed Expectations: December Cut Now the Base Case

The PPI release was the final piece needed to solidify the policy outlook. The market has shifted from hoping for a cut to pricing in a cut with high conviction.

According to CME FedWatch, the probability of a 25-bp rate cut in December has surged to nearly 90%.

The “higher-for-longer” narrative has faded sharply. The market now views a December cut as not only possible—but likely—setting the stage for fresh pressure on the U.S. Dollar and renewed support for risk assets going into next two week before the Fed December meeting.

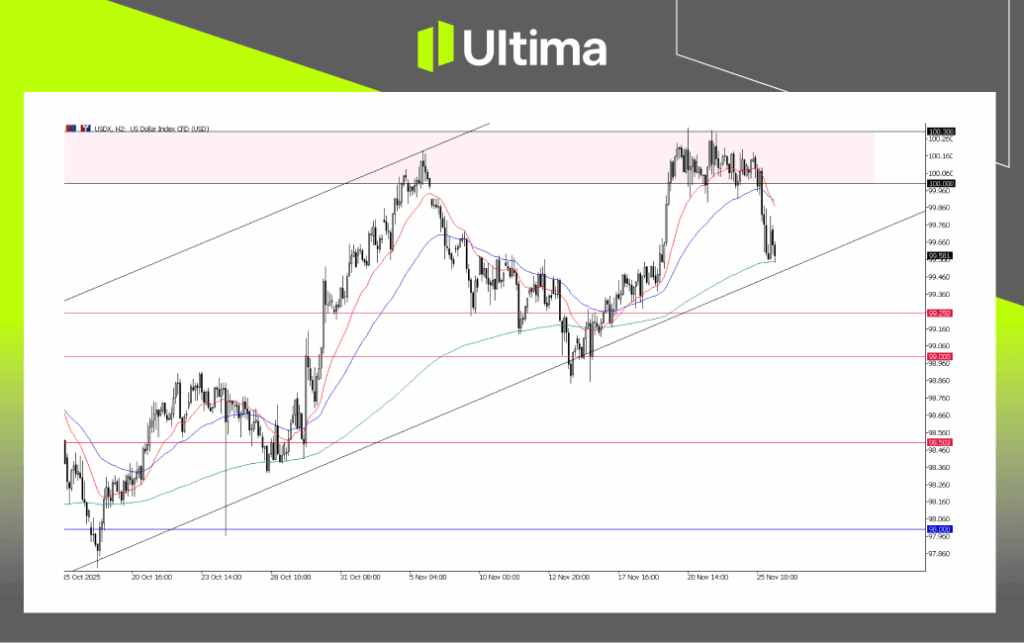

U.S. Dollar (DXY): Breakdown Below 100 Signals a Shift in Trend

The most significant market development is unfolding in the U.S. Dollar. Following the softer PPI data, the Dollar Index has decisively broken below the psychological 100.00 level, closing beneath this critical support for the first time since last week.

USDX, H2 Chart | Ultima Market MT5

This breakdown marks a clear shift from the previous “bullish consolidation” phase to a short-term bearish trend. With the 100.00 support now breached, the next major technical target sits in the 99.20–99.00 zone.

The dollar has effectively moved into a “sell-the-rally” environment. Any intraday rebounds toward the 100.00 level are likely to attract selling interest as markets reposition for lower U.S. yields and increased odds of a December rate cut.

Gold Outlook: The Bullish Reversal & Continuation

Gold is the primary beneficiary of the Dollar’s weakness and the cemented rate cut expectations.

From a macro perspective, yesterday’s soft PPI data reaffirmed that inflation is cooling, significantly boosting expectations for imminent Fed easing. Lower interest rates reduce the opportunity cost of holding non-yielding assets like Gold, while a weaker Dollar enhances global purchasing power. This combination forms a solid fundamental tailwind for further upside.

XAU/USD, H2 Chart | Ultima Market MT5

Technically, Gold has executed a clean bullish reversal, holding firmly above the $4,100 support zone and extending higher. The immediate target for buyers is the $4,150 resistance area, which—if broken—may flip into new support.

If the metal continues to stabilise above current levels, a fresh bullish leg could unfold, opening the path toward a retest of the $4,200 region.

Key Data Missing: Focus Shifts Elsewhere

The PCE Price Index and Q3 GDP revision have been officially delayed until December due to the impact of earlier government shutdown. Markets must now turn to alternative data for near-term guidance.

Primary Focus Today: Jobless Claims & Durable Goods

- Weekly Jobless Claims (released early due to the holiday): A notable rise in claims would reinforce the Fed’s dovish pivot by highlighting ongoing labor-market risks.

- Durable Goods Orders (October): A strong reading would ease recession concerns and potentially support the Dollar; A weak figure could weigh on the Dollar and further strengthen expectations of a December rate cut.

The “Fed Pivot” trade remains in focus. The decisive break of Dollar Index’s 100.00 provides a clear technical signal, but attention now shifts to pre-holiday data—notably Weekly Jobless Claims. Investors will assess whether the labor market shows enough weakness to justify the anticipated December rate cut, which will guide the near-term trajectory for the Dollar, Gold, and equities.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server