Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteSOLUSD Analysis: Is This a Healthy Pullback or the Start of a Deeper Correction?

16 September 2025

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the SOLUSD for September 16, 2025.

Technical Analysis of SOLUSD

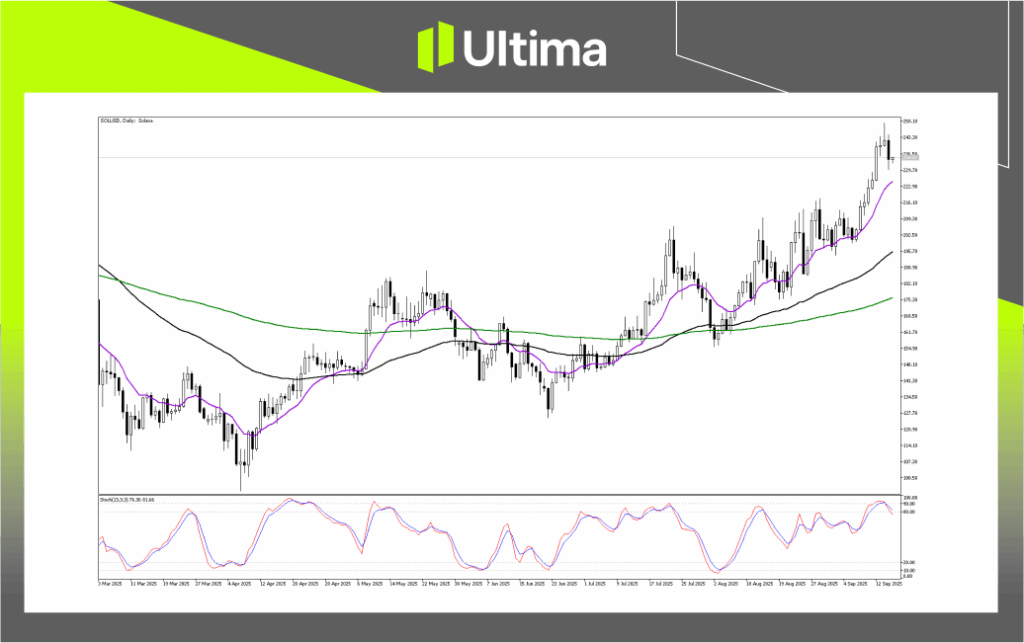

SOLUSD Daily Chart Insight

- The overall trajectory remains positive over the long haul, but near-term prospects warrant a more measured approach. Following an exceptionally robust upward movement that pushed prices to approximately 250.00, the market is now displaying indicators of a retreat or sideways movement. Recent candlestick formations have turned negative, reflecting increased selling activity following the dramatic climb. Additionally, the Stochastic indicator positioned below the chart has entered oversold conditions (exceeding 80) and demonstrates a negative divergence where the blue signal line drops beneath the red baseline, implying that buying momentum is diminishing and a corrective phase appears probable.

- Key support area: The price currently tests immediate support at 222.90, which aligns with the purple moving average that provided dynamic support during the recent rally. If this level breaks, secondary support spans 209.30-202.50, representing a prior consolidation zone and a recent swing low. The critical support sits at 188.90, coinciding with the black moving average, which must hold to maintain the overall bullish structure.

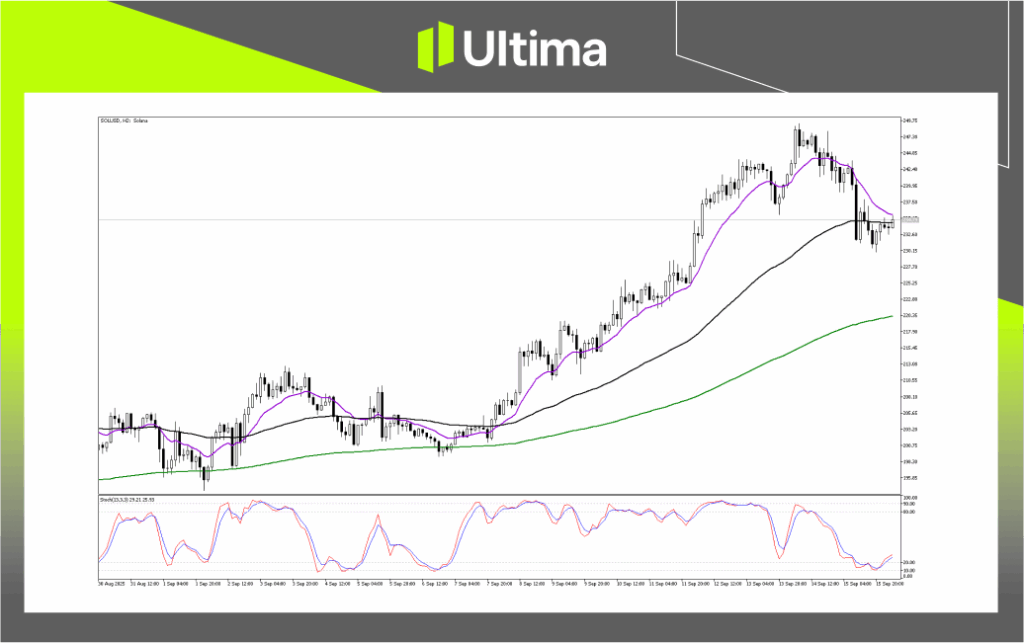

SOLUSD 2-Hour Chart Analysis

- The Stochastic indicator has entered oversold conditions (below 20) and displays potential for an upward reversal as the blue line begins to curve toward the red line. This signals that the current selling pressure is weakening, making a rebound or horizontal consolidation period probable before the market’s next major directional move.

- Breakout scenarios: An optimistic outcome requires the price to first recover above the black moving average near 235.00, followed by a sustained breach of the purple moving average around 237.50, which would indicate the corrective phase has concluded and potentially trigger a move back toward recent peaks at 249.75, with a break above this level confirming continued upward momentum. Conversely, a pessimistic development would emerge from a definitive close beneath the immediate support at 230.15, demonstrating persistent selling activity and opening the path for further decline toward the green moving average at approximately 220.35, where failure to hold would substantially compromise the positive outlook for this timeframe.

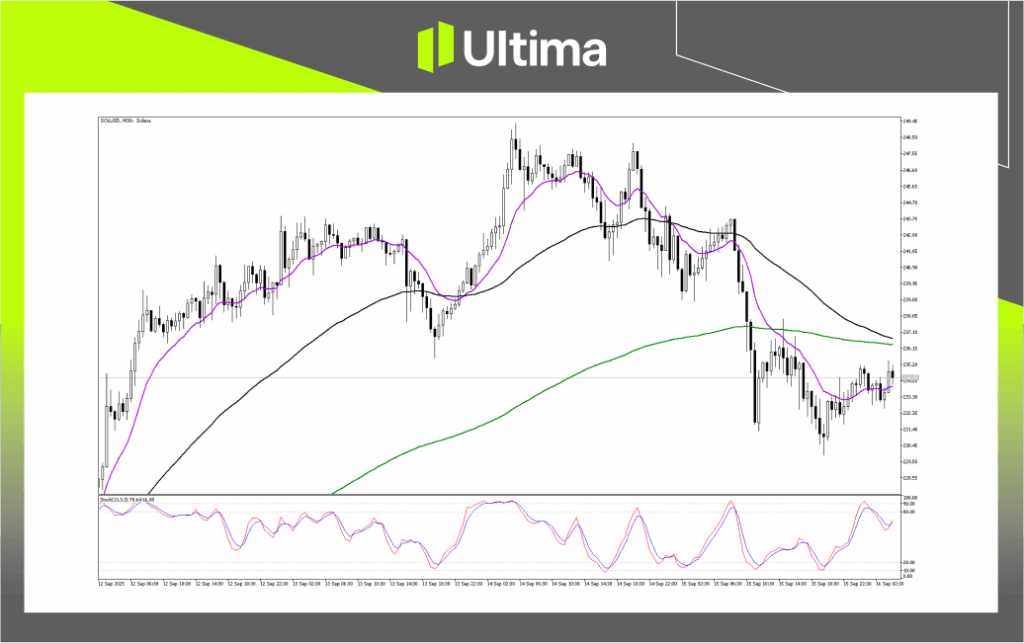

SOLUSD Pivot Indicator

- After the steep decline to approximately 229.50, the market has entered a corrective bounce phase, though this recovery remains capped beneath significant resistance zones, indicating it may represent only a brief pause before potentially resuming the downward movement. The moving averages have repositioned above current price levels and are beginning to trend downward, creating dynamic resistance that will likely limit any upward progress.

- Bullish Breakout (Recovery Scenario): A credible bullish reversal requires the price to achieve a definitive break and close above the key resistance level at 236.15-237.10. Successfully clearing this barrier would eliminate immediate downward pressure and create an opportunity to challenge the subsequent resistance near 240.95.

- Bearish Breakdown (Continuation Scenario): The market currently favors downward movement as the path of least resistance. A decisive break and close beneath the recent low of 229.50 would confirm bearish continuation, validating the negative trend initiated by the sharp decline and likely prompting further selling toward the next significant support zones.

How to Navigate the Forex Market with Ultima Markets

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey. For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets. Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.