Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomMarkets Await Fed Decision, Trade Optimism Supports Sentiment

Daily Market Insights – October 28, 2025 | Brought to you by Ultima Markets

Dollar Priced for Dovish Fed Expectation

Market activity remains relatively muted on Tuesday as investors await the Federal Reserve’s interest rate decision tomorrow, October 29.

The market has fully priced in a 25-basis-point rate cut, following last Friday’s cooler-than-expected U.S. CPI report, where Core CPI undershot forecasts. With the rate cut already anticipated, attention will shift entirely to the tone of the Fed’s statement and forward guidance.

- The Question: Will the Fed confirm the market’s expectation for a third cut in December or more in 2026, or will they use a cautious statement to signal a pause after October?

- Impact: A statement that is more dovish than expected will weaken the USD and lift equities. A statement that is more cautious (less commitment to December) will cause a sharp market reversal.

USDX, H2 Chart | Source: Ultima Market MT5

The U.S. dollar continues to trade under pressure as markets price in a more dovish Federal Reserve stance. The Dollar Index (USDX) has now slipped below the 98.50 support zone.

A clear break below this level would likely open the door for further downside, especially if the Fed delivers a more dovish-than-expected tone in tomorrow’s policy statement.

U.S. Trade Outlook & President Trump’s Asia Tour

The broader market backdrop this week continues to be shaped by a major diplomatic breakthrough in U.S.–China trade relations, alongside President Trump’s Asia tour aimed at consolidating regional economic and strategic ties.

1. U.S.-China Trade Deal Framework

High-level talks between U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, which concluded in Kuala Lumpur, yielded a crucial preliminary consensus.

- Tariff Threat Averted: The most critical outcome is that the threat of the U.S. imposing 100% tariffs on Chinese imports starting November 1st is now “effectively off the table.”

- Rare Earth Deferral: China has agreed to delay or defer expanded export controls on rare earth minerals for approximately a year while the issues are re-examined. This eases immediate supply chain fears.

This “very substantial framework” is designed to set the stage for Presidents Trump and Xi Jinping to finalize a comprehensive deal during their meeting later this week. The market has embraced this progress, triggering a surge in global risk assets.

2. President Trump’s Asia Tour Agenda

President Trump’s week-long Asia tour coincides with a series of multilateral and bilateral meetings aimed at reinforcing U.S. influence and securing strategic trade and investment deals.

Trump met with Malaysian Prime Minister Dato’ Seri Anwar Ibrahim, focusing on expanding cooperation in trade, investment, and regional security. Today, Trump arrived in Tokyo for a bilateral meeting with Japan’s new Prime Minister Sanae Takaichi. Discussions center on strengthening the U.S.–Japan defense alliance and finalizing Japan’s $550 billion investment plan in the United States.

The tour will culminate at the APEC Summit (Oct 30 – Nov 1), where the Trump–Xi meeting is widely expected to formalize the trade framework, marking a potential turning point for global trade stability.

Analyst View: The success of the Malaysia talks significantly reduces the “tail risk” hanging over the market, allowing the current risk-on rally to extend, especially in the technology and growth sectors. However, the market will remain sensitive to any language from Japan or South Korea that suggests new trade friction or disagreement on defense spending, although today’s or the week’s focus is largely positive.

Gold: Corrective Move Extended

After slumping dramatically on Monday, dropping below the $4000 in the prior session, Gold is attempting to stabilize today. The risk-on trade and trade optimism are its biggest enemies.

Its direction today will be determined by whether the safe-haven selling pressure has finally exhausted itself ahead of the Fed.

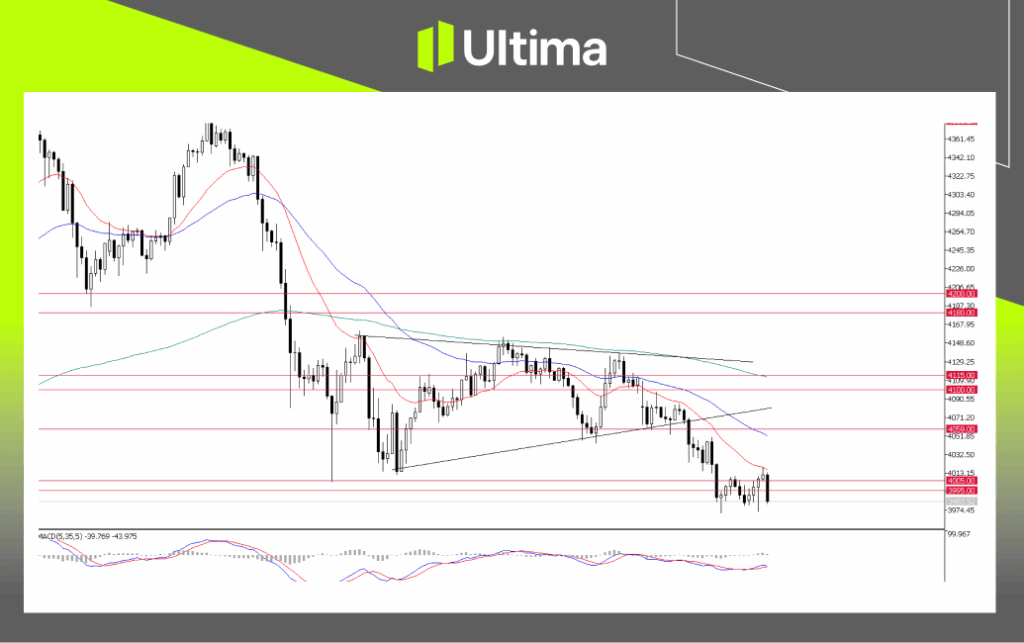

XAU/USD, H4 Chart | Source: Ultima Market MT5

Technically, gold broke below a converging triangle pattern yesterday, signaling that bearish momentum remains intact. Despite hovering near the $4,000 mark, failure to reclaim this level could expose further downside.

Given the current macro backdrop and prevailing momentum, gold may continue trading below $4000 ahead of the Fed decision.

Daily Takeaway

Markets are in a holding pattern ahead of Wednesday’s FOMC decision, with sentiment broadly supported by easing U.S.–China trade tensions and optimism from President Trump’s Asia tour.

he U.S. dollar remains under pressure as traders price in a dovish outcome, while gold struggles to find footing below the $4,000 mark amid fading safe-haven demand.

Today’s quiet session is likely to be defined by position adjustments rather than new catalysts, as investors brace for potential volatility driven by the Fed’s tone and guidance tomorrow.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server