Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteGold Signals Hesitation, Oil Slips Toward Key Support

Daily Market Insights – October 3, 2025, brought to you by Ultima Markets.

The U.S. dollar staged a modest rebound yesterday after four consecutive days of losses. However, the upside momentum may prove temporary, as the Non-Farm Payrolls (NFP) report is likely not being released today due to the ongoing government shutdown.

In the absence of official data, markets turned to ADP employment and other private labor indicators for guidance. These showed clear signs of slowing job growth, reinforcing the view that the U.S. labor market is cooling. As a result, while the dollar found short-term support, lingering weakness in employment suggests the rebound may be limited.

Bank of Japan: Ueda Cautions on Global Risks

In his latest remarks, Bank of Japan Governor Kazuo Ueda acknowledged that inflation is trending toward the 2% target, but emphasized that rate hikes will remain conditional and gradual. He also warned that global uncertainty could weigh on wages and complicate the policy outlook.

Markets interpreted his tone as cautious, which weighed on the yen. Deputy Governor Shinichi Uchida, however, struck a more positive note, highlighting improved business sentiment while reaffirming that policy will stay data-driven.

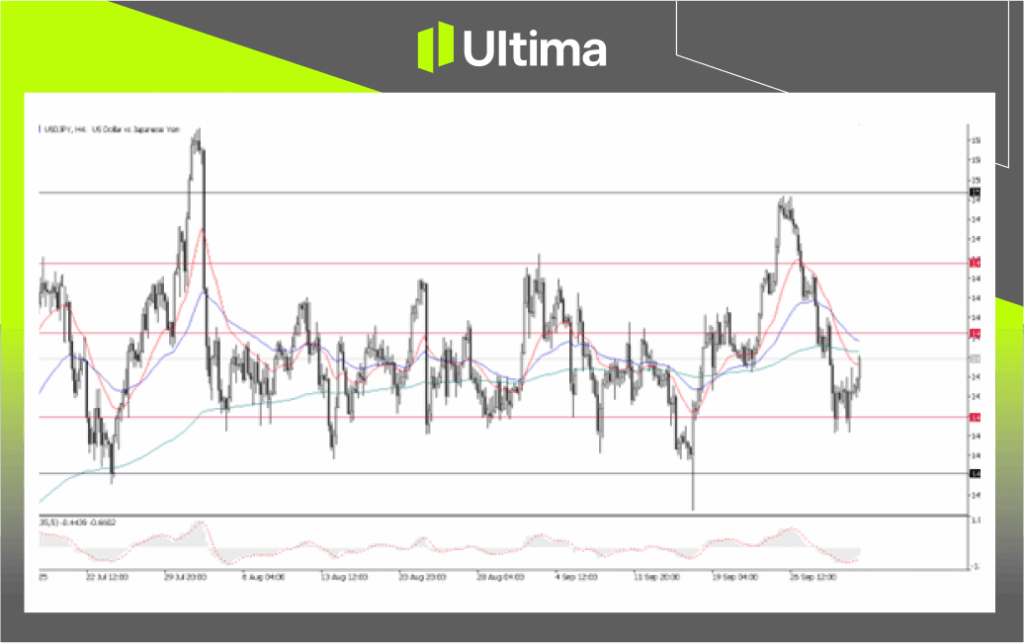

USD/JPY, H4 Chart Analysis | Source: Ultima Market MT5

The cautious stance has kept USD/JPY elevated above the 146.80 support after retreating from near the 150 level over the past four days.

With the BOJ signaling mixed views and the U.S. lacking major data releases, the pair may remain in extended consolidation, likely trading within a range for the near term.

Gold Holds Near Highs but Faces Pullback Risk

Gold extended gains to touch $3,895/oz again yesterday before pulling back, partly pressured by the dollar’s rebound. While the broader momentum remains favorable, the pullback formed a second consecutive upper wick on the daily chart — a sign of buyer hesitation and rising risk of a short-term correction.

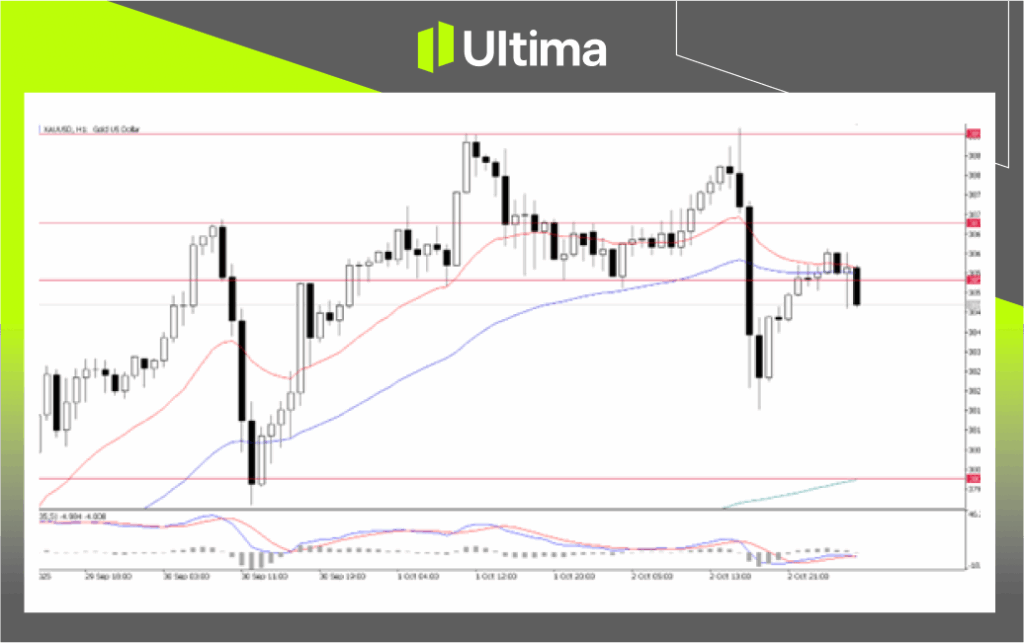

XAU/USD, H4 Chart | Source: Ultima Market MT5

If gold sustains pressure below the $3,855–$3,870 resistance zone, a leg lower could unfold in the near term, forming a technical pullback within the broader uptrend. The key psychological support remains at $3,800.

Oil Faces Supply Pressure

Oil prices were another major focus yesterday, falling to their steepest decline in more than two months. The sell-off was driven by rising OPEC+ supply and weakening demand. Brent crude briefly rebounded on concerns about tighter Russian crude sanctions, but gains were capped.

- OPEC output rose by ~330,000 bpd in September as the group continued to unwind production cuts.

- U.S. inventories also increased, underscoring weak refining activity.

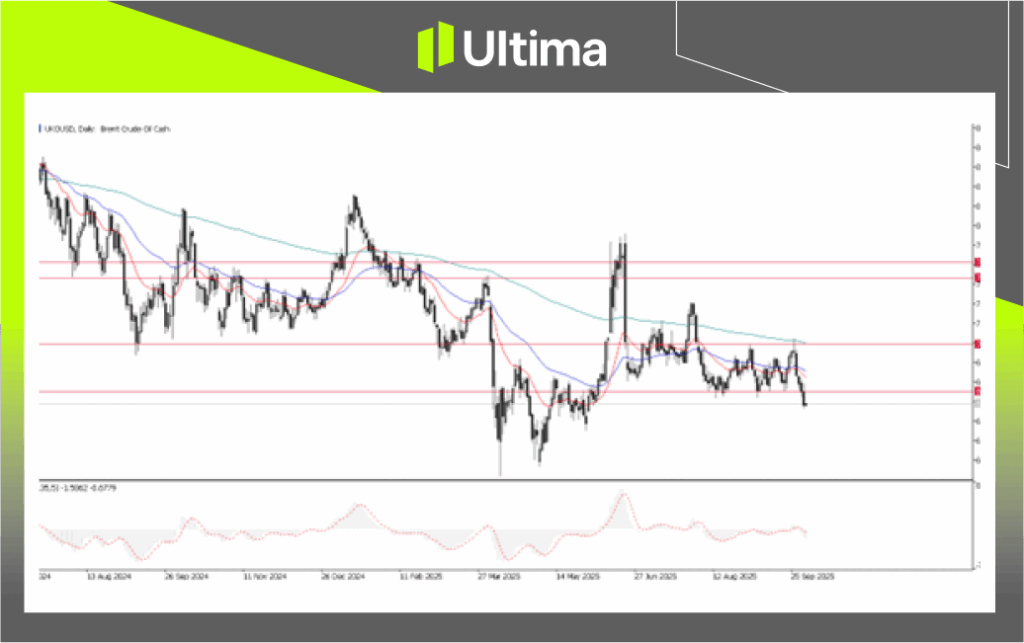

UKOUSD Brent, Daily Chart | Source: Ultima Market MT5

Brent crude has now broken below its recent range of $66–70, which also coincides with a multi-year support zone. This breakdown could invite renewed selling pressure, with downside risk if demand fails to recover or supply remains elevated.

More on Crude oil Technical Analysis.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server