Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomGold Shines, Stocks Stagnate as Trade Risks Rise and Fed Softens

Daily Market Insights – October 10, 2025, Brought to you by Ultima Markets

Fed Policy & U.S.–China Trade Tensions as Key Drivers

The global financial narrative today is being shaped by two dominant forces: escalating U.S.–China trade tensions and a highly dovish outlook from the Federal Reserve. These developments are setting the tone across asset classes, driving both risk aversion and policy-driven market positioning.

Macro Focus: U.S.–China Trade Escalation Deepens

U.S.–China trade tensions intensified further as both sides began imposing reciprocal port fees on shipping firms — with Beijing specifically targeting U.S.-flagged vessels. This marks another escalation front, despite President Trump’s recent comments that “all will be good,” which offered little reassurance to markets.

The latest escalation also includes export controls on rare earths and critical minerals by China, prompting sharp criticism from U.S. Treasury Secretary Scott Bessent, who accused Beijing of trying to “pull everybody else down.”

The risk of further retaliation is rising. Global risk assets may remain under pressure, particularly if trade measures begin affecting supply chains, critical minerals, and industrial activity, all of which could slow growth momentum.

Federal Reserve: Dovish Tilt Amid Labor Market Weakness

Another major macro driver came from Fed Chair Jerome Powell’s remarks on October 14. Powell warned that the sharp slowdown in U.S. hiring poses increasing risks to the economy. He noted that rising downside risks to employment have shifted the Fed’s policy assessment, signaling that the central bank is likely to cut rates at least twice more before year-end.

This reinforces the market view of a more dovish Fed stance, especially in the face of ongoing U.S. government shutdown delays in official data releases, which further cloud the economic outlook.

Markets are now reacting to this dual narrative—on one hand, escalating trade tensions, and on the other, a softer U.S. monetary policy outlook.

Market Impact Overview

- Gold: Safe-haven demand is surging on trade war fears, while a dovish Fed and lower interest rates make non-yielding gold even more attractive to investors.

- U.S. Dollar: The greenback remains supported by defensive flows but could face pressure if rate-cut expectations deepen.

- U.S. Equities: Tech and growth stocks came under renewed pressure from trade war fears. If tensions escalate, U.S. and global equity markets could face more sustained headwinds.

US Dollar: Mixed Forces at Play

The U.S. dollar is currently caught between defensive flows — stemming from trade, monetary policy, and political uncertainty — and the risk of renewed weakness if the macro-outlook deteriorates further.

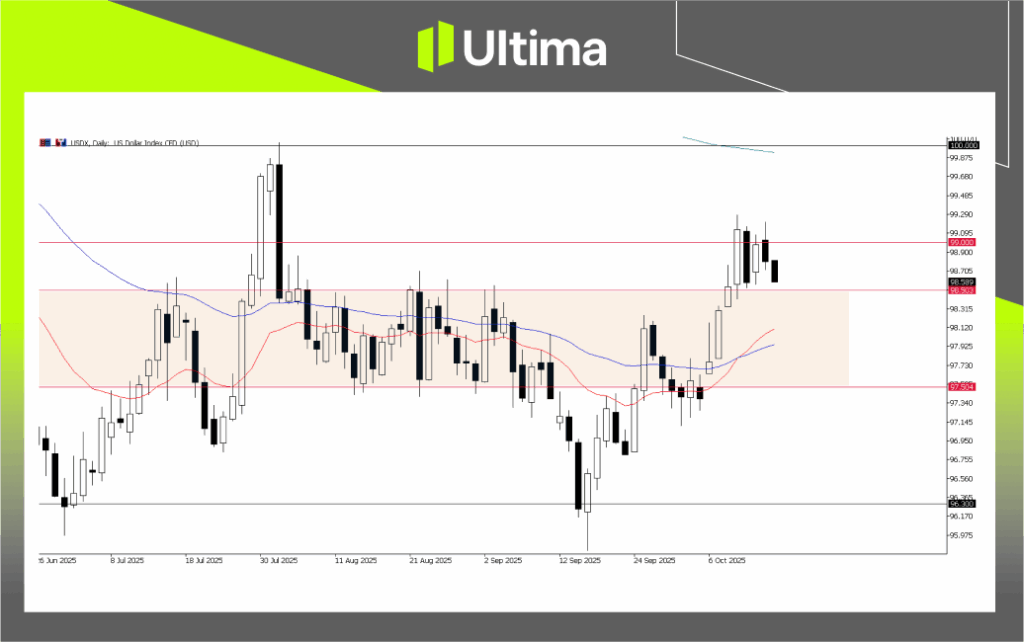

USDX, Daily Chart | Source: Ultima Market MT5

From a technical perspective, the U.S. Dollar Index failed to sustain a breakout above the 99.00 level but remains supported above the key 98.50 zone. This area is crucial for maintaining the recent bullish reversal structure.

- A sustained hold above 98.50 could keep the dollar supported in the near term.

- A decisive break below this level, however, would expose the dollar to further downside pressure, potentially extending the recent pullback and reviving the broader downtrend bias.

U.S. Stocks: Trade Tensions Cap Gains

U.S. equities opened the week with a mixed tone as dovish signals from the Federal Reserve helped stabilize sentiment, but lingering U.S.–China trade tensions continued to cap upside momentum.

Investors remain focused on the potential impact of the 100% U.S. tariffs on Chinese goods, scheduled to take effect on November 1, and whether upcoming diplomatic talks can help ease market pressure and restore confidence.

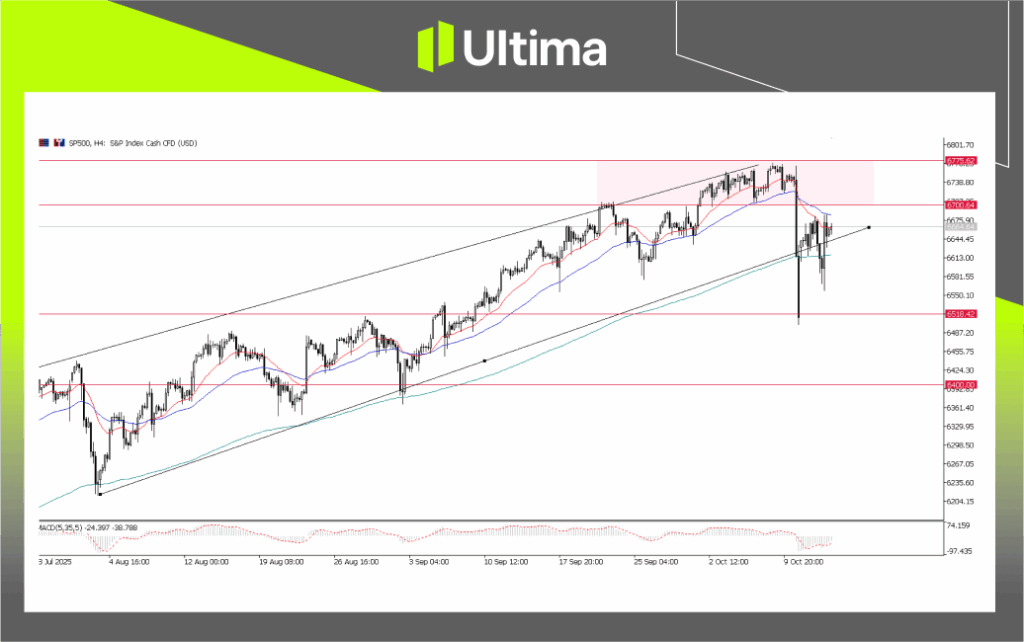

S&P 500, Daily Chart | Source: Ultima Market MT5

From a technical perspective, the S&P 500 is consolidating following last week’s pullback.

- Key level to watch: 6,700 — sustained pressure below this zone may trigger a broader risk-off move, potentially leading to a deeper correction.

- On the upside, a clear break above the recent highs would be needed to reestablish bullish momentum.

With Fed policy expected to turn more accommodative but trade risks rising, U.S. equities are likely to remain range-bound in the near term, with headline-driven volatility dictating day-to-day sentiment. Any escalation in trade tensions could quickly shift flows toward defensive positioning.

Gold: Safe-Haven Rally Continues

Gold pushed to new highs once again, fueled by U.S.–China trade tensions, geopolitical uncertainty, and sustained safe-haven demand.

The $4,100 level remains a critical pivot point (as noted in yesterday’s insights). Holding above this zone continues to reinforce the bullish narrative and keeps upward momentum intact.

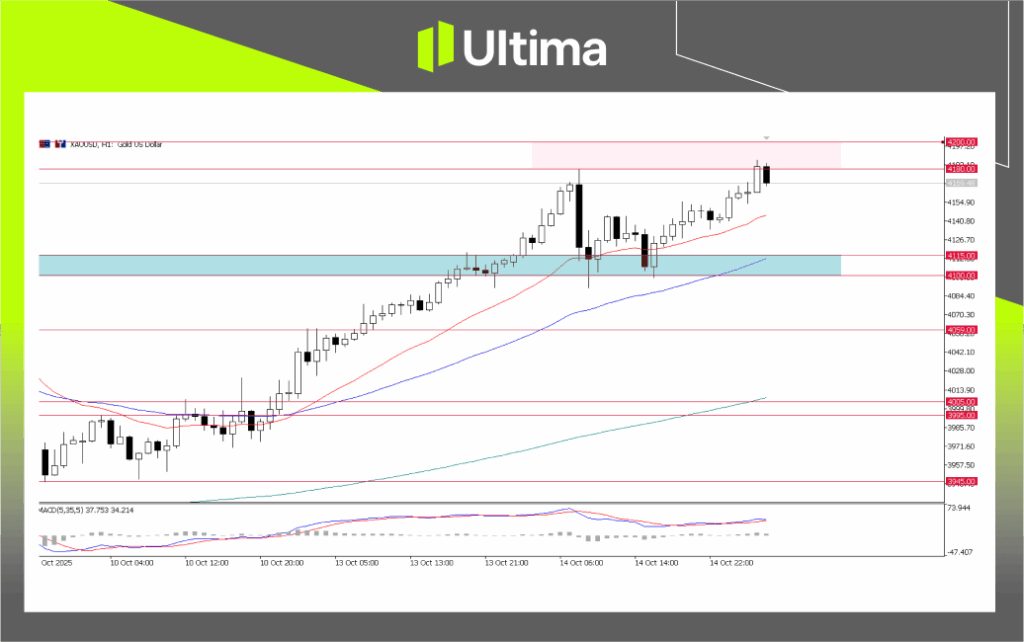

XAU/USD, H1 Chart | Source: Ultima Market MT5

From a technical perspective:

- Immediate resistance sits at $4,180–$4,200, a key psychological zone that could challenge bullish momentum.

- Near-term support remains anchored at $4,100. A firm defense of this level would likely encourage more dip-buying behavior.

- A break above $4,200 could open the door for an extension of the rally, while any failure near resistance could trigger a corrective pullback.

While the macro backdrop favors gold bulls, traders should remain tactically cautious, especially as price approaches major resistance zones where volatility can spike.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server