Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Fed on “Firm Hold”: Dollar Rebounds, Gold Hits $5,500

Ultima Markets Daily Market Insights – January 29, 2026

The Federal Reserve has officially drawn a line in the sand. Defying intense political pressure for an immediate cut, the FOMC voted to HOLD interest rates steady (3.50% – 3.75%) last night. Chair Powell’s message was clear: the economy is “solid,” and he is in “no rush” to ease further.

This “Hawkish Hold” has triggered the deeply oversold US Dollar to stage a mild rebound; however, Gold remains remarkably resilient, defying the typical negative correlation.

Fed January Meeting Update: “Hold” Fine Print

The Fed held rates steady at 3.50% – 3.75% as widely expected. Meanwhile, the policy statement and Powell’s press conference signaled a “Firm Hold,” indicating the Fed is unlikely to cut anytime soon.

- Upgrade on Growth: The statement upgraded its description of the US economy from “expanding at a moderate pace” to “expanding at a solid pace.”

- Labor Market “Stabilization”: In a major shift, the Fed removed the phrase warning of “rising downside risks to employment.” Instead, they noted that the unemployment data has shown “signs of stabilization.”

- Inflation Warning: The statement reiterated that inflation remains “somewhat elevated” and that the committee remains “highly attentive to inflation risks.”

- The Dissenters: The vote was 10-2. Governors Waller and Miran voted against the hold, preferring a 25bps cut immediately.

While there is internal division with two dissenters, the core majority of board members is firmly in the “wait-and-see” camp, overpowering the doves for now.

During the press conference, Powell also mentioned that we may not see a cut until June, despite inflation risks tilting to the downside. The stance remains strictly data-dependent.

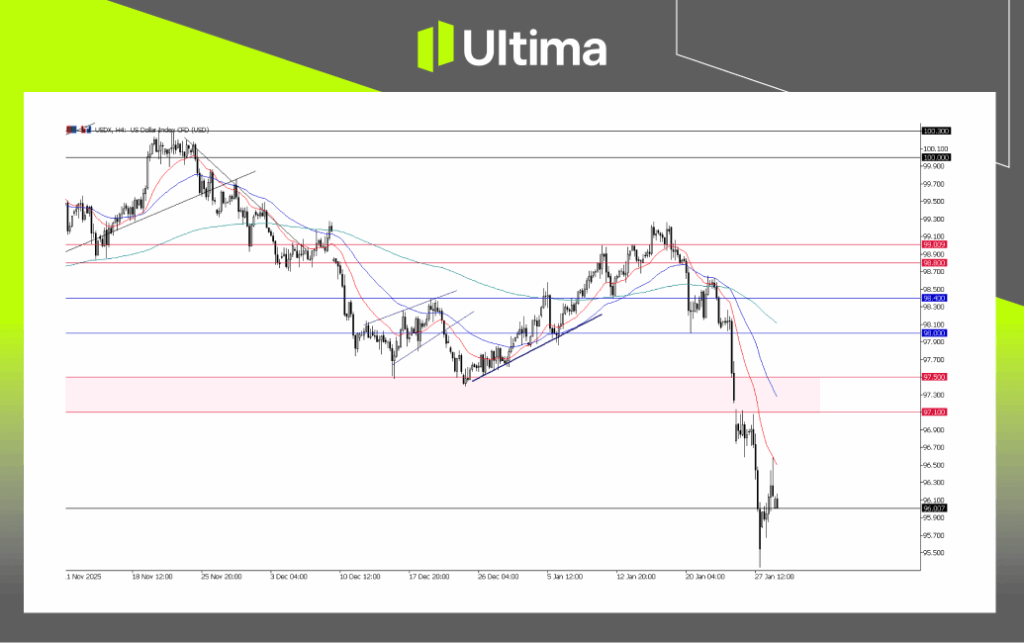

US Dollar Outlook: The “Short Squeeze” Rebound

The US Dollar is staging a sharp rebound post-FOMC, regaining the 96.00 handle; however, the sustainability of this rebound is yet to be proven.

With the “March Rate Cut” effectively off the table (priced out), this provides the catalyst needed for a Dollar rebound after recently reaching oversold conditions.

USDX, H4 Chart | Ultima Markets MT5

However, technically, the price action still lacks the momentum to sustain a major reversal or even just a rebound. For today’s outlook, we need to see the price hold above 96.00 to validate whether the Dollar can maintain its rebound in the near term.

Technical Levels:

- Support:96.00 remains the key level. A break below this would confirm another leg down, while holding above could provide intraday rebound momentum.

- Resistance:97.10 remains the key resistance to validate the broader downtrend.

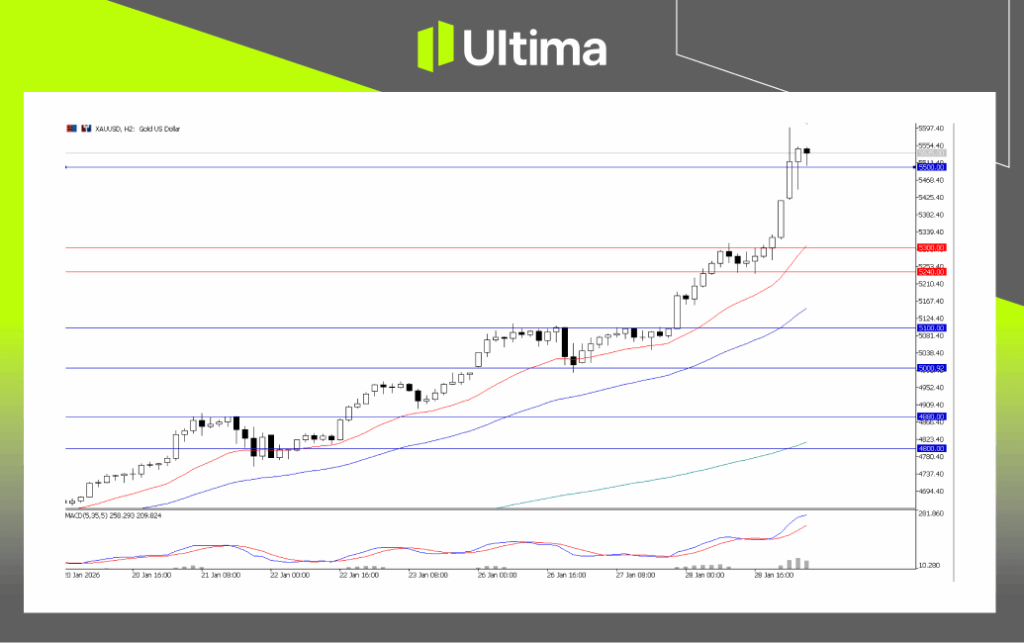

Gold Surpasses $5,500: Can it Hold?

Gold made history overnight and extended its bull run at the Asian session opening today, spiking to a new record high of $5,597.

The Outlook: The backdrop for Gold remains promising with momentum strengthening; however, the outlook is now mixed, especially as Gold enters overbought territory.

Headwind Risk: If the Dollar and Treasury yields continue rebounding, this could pose short-term pressure on Gold, potentially leading to a correction.

XAUUSD, H2 Chart | Ultima Markets MT5

$5,500 is now the psychological pivot for Gold. If we see a daily move below this $5,500 pivot, it could signal a “false breakout” and trigger a wash-out.

Over the broad term, the $5,300 – $5,240 zone remains validated as bull trend support. $5,600 is the next measured move target if the rally resumes.

What to Watch Today

1. US Initial Jobless Claims (8:30 AM ET):

- The Test: Watch closely to see if the labor market is indeed “stabilizing” as the Fed claimed in yesterday’s statement.

- Impact: Any unexpected spike in claims would undermine the Fed’s hawkish stance and could quickly reverse the Dollar’s relief rally.

2. Post-Fed Profit Taking & Volatility:

- Market Behavior: Thursday sessions following a Fed meeting often see choppy “whipsaw” moves as traders square their positions and digest the policy shift.

- Caution: Be wary of false breakouts during the early US session as liquidity normalizes.

3. Gold’s Momentum Test:

- Key Level: The immediate focus is on whether Gold can hold above the $5,500 psychological level.

- Outlook: A successful defense of this zone would keep the “Buy the Dip” narrative intact, signaling that the uptrend remains healthy despite the Dollar’s rebound.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server