Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Fed Keeps Interest Rates Steady What You Need to Know

Fed Keeps Interest Rates Steady: What You Need to Know

The Federal Reserve decided this week to hit the pause button on interest rates, keeping them in the 3.5% to 3.75% range. After cutting rates three times in a row, they’re taking a breather to see how things play out. Here’s what’s happening and why it matters.

The Big Picture: Economy Looking Pretty Good

Fed Chair Jerome Powell had some encouraging news: the U.S. economy is on solid footing as we head into 2026. Sure, we’re not seeing explosive job growth, but things have stabilized, and the economy kept growing at a steady clip last year.

Think of it this way – the economy isn’t sprinting, but it’s maintaining a healthy jog. That’s actually pretty good news.

Inflation: Still a Bit Stubborn, But Heading the Right Way

Here’s where things get a little sticky. Inflation is still running hotter than the Fed would like – hovering around 3% when they’re aiming for 2%. But before you panic, there’s a twist to this story.

Powell explained that much of this higher inflation is coming from tariffs pushing up the prices of goods. Meanwhile, the cost of services (think haircuts, restaurant meals, that sort of thing) is actually cooling down nicely. The Fed expects these tariff-related price bumps to peak and then fade away, assuming no major new tariffs get added to the mix.

What’s Next: A Wait-and-See Approach

The Fed isn’t in any rush to make big moves right now. Powell was pretty clear about this: with the economy doing well and unemployment stable (even if inflation is a touch high), they’re going to let the data tell them what to do next.

Here’s the interesting part – Powell said most Fed officials don’t even think current policy is particularly “tight” anymore. Translation: they’ve already done a lot of the heavy lifting with those three rate cuts, and now they’re in a good position to watch and wait.

Room to Maneuver

The good news? If things shift, the Fed has options. Powell indicated they could ease policy further if prices start coming down as expected. They’re not locked into any particular path – they’ll decide meeting by meeting based on what’s actually happening in the economy.

The Independence Question

Powell took some time to defend the Fed’s independence from political pressure – a hot topic these days. He emphasized that keeping monetary policy separate from political influence isn’t about protecting Fed officials; it’s about serving the public better.

His message was simple: central bank independence works, and losing it would be a mistake that’s hard to undo. He’s confident it will remain intact.

The Dollar Drama

When reporters asked about the recent wild swings in the dollar’s value, Powell politely declined to comment. That’s the Treasury Department’s turf, he said, not the Fed’s. Fair enough.

What Does This All Mean?

Bottom line: The Fed sees an economy that’s doing reasonably well, inflation that’s gradually improving (despite some bumps from tariffs), and a job market that’s holding steady. They’ve shifted from aggressively cutting rates to a more cautious stance.

For now, they’re comfortable waiting to see how things develop before making their next move. It’s not the most exciting decision, but sometimes boring is exactly what you want from your central bank.

Inside the Fed: Not Everyone Agreed

While the decision to pause might seem unanimous from the outside, there was actually some interesting debate happening inside the room. The vote was 10 to 2, meaning two Fed officials thought differently.

Who are these decision-makers? The Federal Open Market Committee (FOMC) is the group responsible for setting interest rates. It includes Fed governors from Washington and presidents from regional Federal Reserve banks across the country. Not all of them get to vote at every meeting, but they all weigh in on the discussion.

The Dissenters: A Different View

Two members voted against holding rates steady: Federal Reserve Governor Christopher Waller and Stephen Miran. These folks wanted another rate cut instead of hitting pause. Their dissent is particularly noteworthy because Waller has been mentioned as a potential candidate to succeed Powell when his term expires in May.

Think about that timing for a second – if the current Fed chair expects tariff impacts to fade by mid-year but they don’t, the new chair could be walking into their first meeting in June facing some really tough decisions. As Powell put it, there are “countless combinations” of economic conditions that could force their hand.

Broad Consensus, But With Nuance

Despite those two dissenting votes, Powell emphasized that there was actually strong agreement across the committee to pause rate cuts. Even members who don’t have voting rights at this particular meeting supported the decision.

That said, Powell was honest about the fact that some members did advocate for continuing with rate cuts. It’s not a black-and-white situation – there’s a spectrum of opinions, which is actually healthy for good policy making.

The “Neutral” Debate

Here’s where it gets interesting: Powell and most of his colleagues believe the current interest rate level is “broadly neutral.” What does that mean? Essentially, they think rates aren’t really restraining the economy anymore – they’re not pushing down on the brakes, but they’re not pressing the gas pedal either.

This is a significant shift in thinking. Not long ago, the Fed saw these rates as restrictive, meant to cool down an overheating inflation. Now, many members think they’ve reached a more balanced point. This helps explain why they’re comfortable pausing: if policy isn’t tight anymore, there’s less urgency to keep cutting.

Looking Ahead: Succession Questions

The political backdrop adds another layer of complexity. Powell is facing pressure from the Trump administration, including a criminal investigation and questions about whether he’ll stay on after his term ends. When asked about this, Powell kept it professional, declining to comment but offering advice to whoever comes next: “Don’t get involved in electoral politics.”

His message to his successor was clear: maintaining the Fed’s accountability to Congress while staying free from political interference should be the top priority. It’s a reminder that these aren’t just technocrats playing with numbers – they’re navigating real political pressures while trying to do what’s best for the economy.

The Bottom Line on Fed Dynamics

The 10-to-2 vote shows that while there’s strong consensus, there’s also healthy debate. Some members see more room to ease policy, while the majority thinks it’s smart to wait and see. As the economic picture evolves – particularly around inflation and whether the job market weakens – these internal debates will shape what the Fed does next.

For now, they’re monitoring the data closely and ready to adjust when needed. Whether that means more cuts, holding steady for longer, or even reversing course will depend on how the economy unfolds in the coming months.

Remaining FOMC meetings in 2026

March 17-18

April 28-29

June 16-17

July 28-29

September 15-16

October 27-28

December 8-9

FedWatch

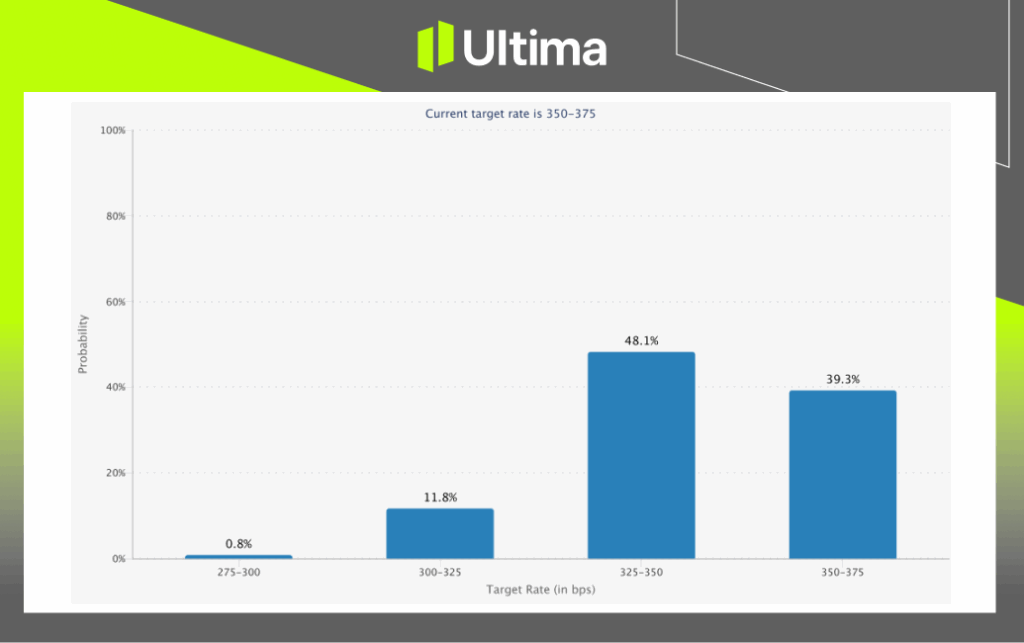

FedWatch uses CME Group’s 30-day federal funds futures prices to predict the probability of Federal Reserve interest rate changes, reflecting market expectations for the effective federal funds rate.

Market expectations currently assign a 48.1% probability to a 0.25% rate cut in June.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server