Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomCentral Bank Super Week: How Fed and BoJ Set Tone for Year-End Markets?

The week is undoubtedly focused on the “super week” of central banks, with major central banks continuing to announce their latest monetary policy decisions. Among them, the Federal Reserve and the Bank of Japan are the main highlights, as they are generally expected to be on different trajectories, marking a distinct phase of global monetary policy.

With both maintaining one of the widest interest rate differentials among major central banks — the Fed’s rate at 3.75%–4.00%, while the BoJ holds at 0.5% — any policy adjustment from either side will have a significant impact on global financial markets, particularly in the currency market.

In the following analysis, we will take a closer look at what to expect in the coming months leading up to the December meeting, and how these developments could shape overall market sentiment in coming weeks.

Central Banks: Where Do They Stand?

For a quick overview, here’s a summary of the October central bank decisions so far:

- Federal Reserve (Fed): The Fed cut its key rate by 25 bps to 3.75%–4.00%, but signaled a cautious and data-dependent approach to further easing — disappointing those expecting more aggressive follow-up cuts.

- Bank of Canada (BoC): The BoC reduced its overnight rate by 25 bps to 2.25%, citing weakness from external trade uncertainty, while indicating a potential pause in its cutting cycle after this move.

- European Central Bank (ECB): The ECB held all key rates steady, confirming a pause in its easing cycle and expressing confidence that inflation is approaching its 2% target despite ongoing geopolitical risks.

- Bank of Japan (BoJ): The BoJ kept its policy rate unchanged at 0.5%, reaffirming its commitment to a slow, gradual, and data-dependent path toward monetary normalization.

These decisions reinforce the current divergence among major central banks:

- The Fed and BoC are both in easing cycles, but the BoC appears more focused on supporting a domestic economy weakened by external trade headwinds.

- The ECB remains in a holding pattern, waiting for further confirmation before shifting policy.

- The BoJ continues to stand as the outlier, inching toward tightening from its long-standing ultra-loose stance — setting up a key long-term differential shift.

Still, the focus clearly remains on the Federal Reserve and the Bank of Japan, as their policy directions will be pivotal in determining global capital flow, risk sentiment, and FX volatility heading into year-end.

Dollar Bulls, Yen Bear Still Way to Go

This divergence naturally leads to the USD/JPY story, where market expectations surrounding the Fed’s easing pace and the BoJ’s normalization timeline are already being reflected in price action. The key question now is: while the Fed is easing but could delay, the BoJ is normalizing (tightening) — but when?

USDJPY, Daily Chart | Source: Ultima Markets MT5

Technically, once USD/JPY broke above 150, it confirmed a firm uptrend. Following the October meeting, USD/JPY surged past 153.00, indicating that another leg higher toward the January 2025 high appears increasingly inevitable.

As we move into the final quarter of the year, several fundamental and market drivers will determine whether USD/JPY can sustain its bullish momentum or face a corrective pullback. The following are the main factors could drive the market.

Federal Reserve (Fed): Data-Dependency and the December Cut

The Federal Reserve’s 25-basis-point cut in October confirmed the continuation of its easing cycle. However, Chair Powell’s cautious rhetoric — emphasizing that a further cut in December is “far from” a foregone conclusion — has introduced significant uncertainty, prompting markets to scale back expectations for an immediate follow-up cut and instead shift their focus to upcoming economic data.

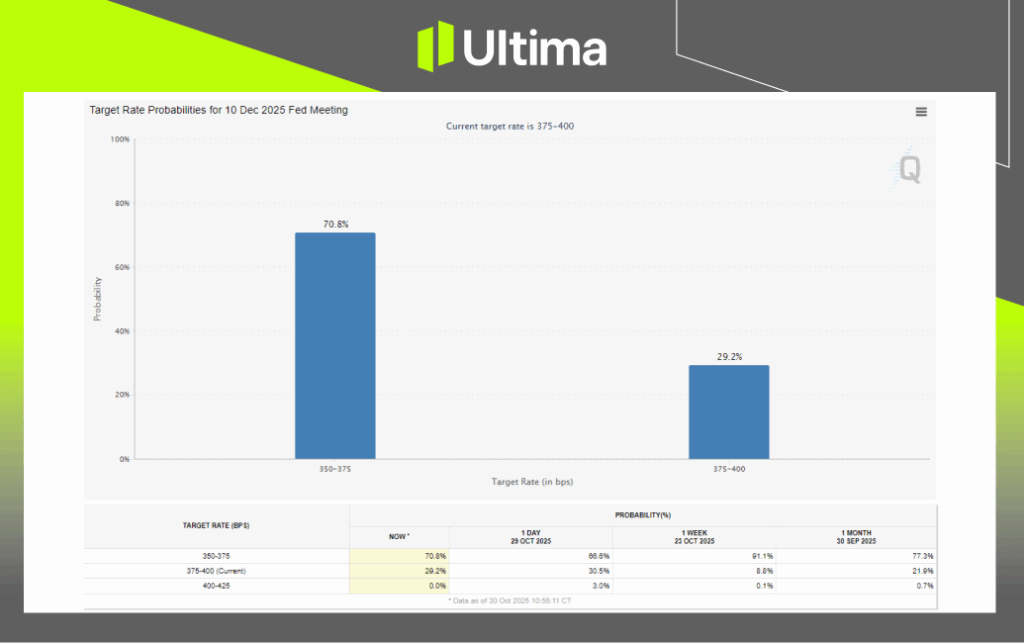

Fed Cut Probabilities in December Meeting | Source: CME Group

According to the CME FedWatch Tool, the probability of a December rate cut to 3.50%–3.75% has fallen sharply from 91.1% prior to the October meeting to 70.8%.

This shift reflects growing uncertainty over the Fed’s policy path and has bolstered the U.S. dollar against the yen. However, whether the greenback can sustain its rally will depend entirely on how upcoming economic data influences the FOMC’s internal divergence in the lead-up to the December meeting.

Key Drivers

- Labor Market: Worsening labor conditions (e.g., higher unemployment, rising jobless claims) increases the likelihood of a December cut (Dovish). This could weaken the dollar

- Inflation Data: if Core PCE/CPI data continuing to move stably toward the 2% target supports further easing without risking an inflation rebound, another factor that could weaken the dollar.

Expected Path

The market has currently dialled back aggressive rate cut expectations following Powell’s comments but still leans toward further easing. So, in near-term, the dollar may still regain the momentum on current landscape, but it still largely depends on the upcoming data from the U.S.

Undoubtedly, the upcoming data will definitely dominate the trajectory of the US Dollar.

- If the data pointed toward a ease in labor market and the inflation data, this could reingite the market expectation on Fed cuts, and undoubtedly this would almost certainly push the dollar lower

- If the data suggest US economy remain resilent this would work other way.

Simply put, the final outcome will rely on how the data path the way to December meeting.

Bank of Japan (BoJ): Slow Normalization and the Yen’s Fate

The Bank of Japan (BoJ) kept its policy rate unchanged at 0.5% in October, showing its commitment to a slow and cautious approach to policy normalization. Although the overall tone was slightly hawkish, Governor Kazuo Ueda said the bank still needs more time to assess domestic inflation, wage growth, and external factors before making any new moves.

Markets viewed this as “cautious hawkishness” — signaling future tightening intentions, but no immediate action. With no major policy changes from previous statements, the BoJ clearly remains in a wait-and-see mode.

While some investors still expect a possible rate hike in December, the chances are very low. For now, the BoJ seems more focused on laying the groundwork for a potential move in early 2026, rather than taking action in the near term.

Key Drivers

- Inflation Persistence: Core CPI staying firmly above 2% continues to increase pressure from hawkish board members for earlier policy tightening.

- Wage Growth Momentum: Strong preliminary signs from the upcoming Shunto (spring wage negotiations) strengthen the case for a rate hike next year.

- External Risks: The BoJ continues to monitor the effects of U.S. trade tariffs and global demand slowdowns on Japan’s exports and corporate sentiment.

Among these, external risks have eased as global trade tensions subside, while inflation persistence remains a clear justification for maintaining a tightening bias. Wage growth momentum, as highlighted by Ueda during the post-meeting press conference, has now become the decisive factor for any policy move ahead.

In addition, Japan’s political landscape could introduce further uncertainty. Sanae Takaichi, a prominent contender advocating for looser fiscal policy, may influence market sentiment and add downside pressure on the yen in the near term.

Dollar vs Yen: Yen as the Primary Driver

While the U.S. dollar’s bullish momentum remains uncertain and could reverse if upcoming data point toward softer economic conditions, the recent USD/JPY movement appears increasingly driven by the yen itself. In other words, yen dynamics — rather than pure dollar strength — have become the primary force behind price action against both the dollar and other major currencies.

The yen’s weakness is likely to persist in the absence of strong domestic data or clear forward guidance from the Bank of Japan. Ahead of the December meeting, the yen will likely remain one of the weaker major currencies, regardless of whether the dollar strengthens or softens.

While USD/JPY may enter a short period of consolidation after the recent breakout, other yen pairs — such as EUR/JPY and AUD/JPY — could continue to see strong upside momentum as capital flows favor higher-yielding currencies.

In short, yen weakness is now largely self-driven, rather than a byproduct of dollar strength, even though the dollar still plays a secondary role in the overall trend.

Global Market Implications: Policy Divergence Drives Capital Flows

The widening gap between major central bank policies — with the Fed cautiously easing, the ECB staying on hold, and the BoJ slowly turning hawkish — is not only steering the USD/JPY trend but also shaping global capital flows and cross-asset sentiment. This policy divergence could define the market’s next cycle heading into December’s central bank meetings and potentially set the tone for late 2025.

1. Global Equities Market: Liquidity-Driven Bullish Bias

The combination of monetary policies sets up a fundamentally bullish environment for global equities, driven by liquidity and lower financing costs.

- Underlying Driver: The Federal Reserve’s easing cycle lowers the cost of capital and makes guaranteed returns from bonds less appealing. This encourages capital to flow out of fixed income and into stocks (Risk-On). The Bank of Japan’s ultra-low rate amplifies this by providing a globally cheap source of funding (the Yen carry trade).

- U.S. Equities (S&P 500): Expected to be supported as lower interest rates reduce borrowing costs and justify higher valuations, especially if the U.S. avoids a deep recession.

- Japanese Equities (Nikkei 225): Highly bullish. The persistently weak Yen directly boosts the earnings of Japan’s major exporting companies, attracting heavy foreign investment.

2. FX Market: Carry Trade Dominance

The foreign exchange (FX) market’s direction is overwhelmingly driven by the vast interest rate differential, which favors the carry trade and maintains structural weakness for the Japanese Yen.

- Japanese Yen (JPY) Weakness: The Yen is fundamentally bearish. With the BoJ “unwilling” to raise its rate above 0.5% while other central banks offer much higher yields, the Yen serves as the world’s cheap funding currency. This continuous flow of capital out of the JPY keeps the currency under significant pressure.

- USD/JPY Outlook: The pair maintains a bullish bias (upside), directly supported by the massive rate gap. The primary risk to this trend would be a large, unexpected rate cut from the Fed or a sudden tightening move from the BoJ, both of which are currently low probability events.

- Growth/Carry Currencies (e.g., AUD/JPY, GBP/JPY): These pairs are exhibiting strong, sustained upside momentum. They are the cleanest expression of the global carry trade, as investors borrow the cheap JPY to buy higher-yielding currencies market like the Australian Dollar or Euro.

- U.S. Dollar (USD) Uncertainty: The USD’s momentum is currently mixed. It is supported by the Fed’s cautious posture but faces pressure from its underlying easing cycle. The dollar’s path will remain highly dependent on the upcoming stream of U.S. economic data, particularly employment and inflation.

In the near term, markets remain caught between the Fed’s delayed dovishness and the BoJ’s slow normalization.

Unless either central bank surprises in December, the path of least resistance for capital flows stays out of the yen and into risk assets — reinforcing a soft yen and liquidity-supported equity markets through year-end.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server